The Dearness Allowance Case of West Bengal Government employees is being fought tooth and nail in the Court of Law since 2016 or even earlier. While DA is an integral part of the salary of Government employees to be remitted time to time as the price rise adjustment factor, West Bengal Government remained adamant to treat dearness allowance as ex-gratia payment. While DA is supposed to be remitted at a predictably regular interval based on consumer price index calculation and is supposed to be computed based on a definite mathematical formula as a percentage of the basic salary, West Bengal Govt, from 2012, remitted DA whimsically as if depending on good mood of the employer. Such attitude reflected that of a feudal lord while Govt of a democracy had no legitimate scope to behave in this manner. Government being not an individual but a collective entity comprising all the people of the State including its employees as well, Government’s display of whims and mood swings like a pregnant or peri-menopausal woman appeared to have no legitimacy.

While dearness allowance is purely a ratio related to price index rendering a measure of the cost of living in a particular place, West Bengal government remitted DA in a manner of ex-gratia payment defying the core characteristic of DA. The State remitted it once a year up to 2021 & the amount varied unpredictably and erratically, mathematics whereof was never provided by the State in its long-lasting fight in the Court of Law. The petitioners on behalf of the employees too never asked the Government representatives to provide their mathematical basis of DA remittance. This must be done by the petitioners in the Court. The State of West Bengal needs to present the mathematics behind their DA remittance.

As Government of India publishes monthly price indices, DA component of Government employees’ salary remains fully predictable. Looking at the variation pattern of price index, DA can be exactly plotted along the timeline. Such DA thing, in West Bengal, went arbitrary, maths-less, schizophrenic and infinitely lethargic.

Isn’t Government’s Affordability a Factor?

Depending on affordability of the Government, the State can defer the payment of the price rise adjustment factor called DA for some reasonable time period and for a reasonable cause. For example, the Central Finance Ministry froze the Dearness Allowance (DA) to the Central government employees from January 2020 up to January 2021 due to crisis arising out of Covid Pandemic. Central Government declared to freeze the 3 instalments remittable in January 2020, July 2020 & January 2021. However, it resumed DA payment, as announced in their order, from July 2021. It has to be noted that such freeze was depending on Government’s lack of affordability for a reasonable cause and a reasonable time period which was pre-declared & predictable. Central Government resumed DA payment from July 2021 at the then revised rate subsuming the rates of the 3 unpaid instalments. However, Government cannot remit DA at a lesser rate or a greater rate (if they can’t present the mathematical computation thereof), nor can it defer such payment for extraordinarily long period, as unusual deferment implies non-remittance of the price rise adjustment factor (DA) at the time when that level of price rise was affecting the employees.

West Bengal Government Was Not a Gross DA Defaulter till 2012

Till 2012, West Bengal Government remitted DA predictably at the same rate as given by the Central Government. The State, however, remitted it after a reasonable delay post the Central Government’s remittance of a particular instalment. The State delayed, on an average, by 9 months – 21 months to pay the same instalment to the State employees. From 2008 onwards GOWB was tending to reduce the time lag between Central remittance & its own. However, after January 2012, DA started behaving in a weird manner in West Bengal reflecting, as if, a specific person’s mood. This time onwards DA assumed the face of ex-gratia payment and didn’t retain the characteristic of DA any more. West Bengal Government started defaulting DA payment from after 2012.

What is Price Index? What is All India Consumer Price Index Number AICPIN?

Generally speaking, Price Index is a ratio between the price of some commodity during a particular period and the price of the same commodity at an earlier base period. The all India consumer price index number, AICPIN, for industrial workers is being compiled by the Labour Bureau under the Government of India and is the most well accepted cost of living index in India. One can find list of monthly AICPINs as published by the Labour Bureau of India.

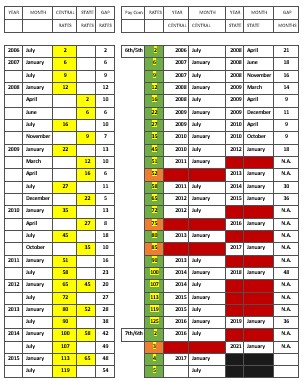

9: Pattern of DA Payment by West Bengal Government

One can observe in the table that till January 2012 West Bengal Government remitted DA at the same rates as that of the Central Government albeit with some delay which couldn’t be marked as unreasonable. Starting from July 2006, GoWB remitted initially after 1 year 9 months of the Centre’s remittance of the same instalment while they gradually reduced the time lag. Coming to 2010, GoWB reduced the time lag to 9 months. After 9 months of the Centre’s payment of DA at the rate of 35% with effect from January 2010, GoWB paid the same 35% DA from October 2010. Though in the meantime from July 2010, the Central Government announced another instalment of 10% DA, thus revising the DA for their employees from 35% to 45%. Going by the norm of a delay of 9 to 10 months, the employees of the Government of West Bengal could expect that instalment from sometimes around April or May 2011. But as 2011 was the election year, GoWB didn’t, understandably, remit any DA instalment at that time. In January 2012, GoWB paid that instalment of 10% DA, thus revising the DA rate from 35% to 45% which was paid by the Central Government in July 2010, again increasing the gap to 1 year 6 months. In January 2013, GOWB first remitted an instalment which didn’t match the Centre’s percentage. Central Government remitted 51% DA in January 2011 while GOWB remitted a 52% in January 2013. The time lag increased to 2 years & the % went erratic. This was the first ever sign of GoWB going rabid with respect to DA remittance. Again, in July 2012, Centre remitted 72%, while GoWB remitted 75% 3 years 6 months later. Whimsical remittance continued & the time lag went on increasing denying the basic characteristic of DA and its indispensability for the employees. As Central Government paid 80% in January 2013, West Bengal Government paid unexplained 85% 4 years later in January 2017. No one, as yet, has asked GoWB their basis for calculating such percentages which differed from those of the Centre. This mathematics is inevitable as DA is invariably a mathematical component, and not a whimsical ex-gratia component, of employees’ salary.

Is It Necessary for West Bengal Government to Remit DA at the Central Rate?

It doesn’t appear so. As DA is based on consumer price index, West Bengal can remit DA as per the State’s own CPIN if such CPINs have been calculated following an accepted mathematical basis and published from time to time so far (the way AICPINs are published by the Labour Bureau all through). However, if state specific CPIN is not available for West Bengal and if the formula to calculate such West Bengal specific CPIN have not been derived, checked & verified, West Bengal DA has to be remitted based on AICPIN. The set West Bengal being a part of the bigger set India, it has to remit DA based on All India CPIN in absence of WBCPIN. However, as DA is 100% related to consumer price index & price index depends on inflation, West Bengal Government employees were supposed to get a rate of DA higher than that of the Central Government employees had WBCPIN remained in existence. This is because rate of inflation in West Bengal has almost consistently been 2.5% higher than the average National rate of inflation. However, even if WBCPIN is made available now, it would be evasive and manipulative of West Bengal Government to challenge the directive of the 5th Pay Commission for GoWB employees to remit DA as per Central rate as it was not available at the time of the recommendation by the 5th Pay Commission in 2009. It is unfortunate that the Finance Secretary West Bengal, in his affidavit to the Calcutta High Court on November 9, 2022 had expected the Hon’ble Court to calculate the dearness allowance payable to GoWB employees based on AICPI. If the Court had to calculate DA, the real reason behind West Bengal Government’s payment of hefty monthly sum to Shri Abhirup Sarkar (brother-in-law of Alapan Bandyopadhyay) as the Chairman of the 6th Pay Commission for GoWB employees remained unclear. Shri Sarkar, for all practical purposes, copied & pasted the report of the 7th Pay Commission for Government of India employees and took 4 years for such copying and pasting while his real job was to calculate the DA for all GoWB employees belonging to different salary slabs based on their basic pays. Who wanted to pay large sum of money for 4 years to Abhirup Sarkar and why did Shri Sarkar agree to accept such monthly sum for copying and pasting remained opaque. Moreover, while the 5th Pay Commission for West Bengal Government employees could submit their report within 5 months 15 days after its formation, the 6th Pay Commission chaired by Abhirup Sarkar took 4 years. Such unusual delay was reflective of either West Bengal Government’s lack of intention to take the report or Shri Abhirup Sarkar’s inefficiency as chairman.

GoWB suppressed truth in the Court of Law. The GoWB memorandum no. 1691-F dated 23.02.2009 (the document where anything about DA was mentioned under ROPA rules 2009), there were 5 points mentioned at the beginning as the reason for setting up such pay commission. The 5th point thereof clearly stated– “to make recommendations on each of the above having regards inter alia to the prevailing pay structure under the Central Government, public sector undertakings & other State Government etc…”. This implies that the very cause of framing the pay commission was to bring in a parity between the pay structures of the Central Government & GoWB. Suppressing this part, the GoWB rather emphasized the ending words of the same point that stated “…the resources of the State Government & the demands thereon on account of the commitment of the State Government to developmental activities.” In this fashion, the GoWB tried their best to interpret before the Hon’ble Court that as West Bengal Government was not left with enough resources after fulfilling their developmental commitments like fairs, games, festivals, etc. (non-committed revenue expenditure in reality), it was not possible for them to remit DA to their employees. This approach of suppressing a part of the fact to express some other to their own advantage speaks volumes about GoWB’s unfortunate and deceitful attitude. GoWB didn’t fail to manipulate and display double standards to fail their own commitment of 2009 and started remitting DA whimsically & insufficiently with the spirit of paying dole to their employees.

What Does Whimsical and Delayed Remittance of DA Signify?

Unusual delay in DA remittance signifies reduction of salary. With price rise, purchase power of basic salary reduces which is kept at the base level by remitting DA. Non-payment of DA means leading employees to compromise with life itself. This is why Calcutta High Court said it was a violation of the fundamental right to life of GoWB employees as per Article 21 of the Constitution of India. GoWB perhaps didn’t want to take away its employees’ right to life, but by not remitting DA, it effectively slow poisoned them.

How would Government Remit DA while It Doesn’t Have Fund?

If Government doesn’t have fund to pay its employees, Government needs to lay them off paying off all their dues including the arrear DA not remitted so long. However, to show that it is in fund crunch, Government needs to exhibit due extent of fiscal discipline. Government’s fiscal policies need to reflect the same crisis while West Bengal Government’s budgetary expenditure reflected otherwise. In spite of being a State of primary deficit, West Bengal Government’s predominant fiscal approach has been distribution of doles & subsidies along with aggressive promotion of financial crimes within the State. West Bengal is witnessing tremendously massive amounts of financial crimes and it would be inexplicable naïveté to presume that such mammoth financial scams within the State could have happened without the active & passive participation of the Government machinery itself. While scams happened in the departments of different Ministers E.g. Education Ministry, Centre’s Grant for Cyclone Amphan Relief and for various other social schemes (eg MNREGA, PMAY) too ended up being embezzled which was impossible without the direct participation of the Government machinery. Cyclone Amphan Relief Fund had been audited by CAG and was described to contain a “very large number of irregularities”. Moreover, West Bengal Government had taken no decisive steps to curb the trans-border smuggling and trafficking crimes of gigantic volumes till such crimes started being investigated by the CBI & the ED. As an economic outcome of so many scams and financial crimes, West Bengal turned into a large cash-based economy resulting in massive inflation & selective distribution of wealth.

It may be relevant to mention here that Niti Aayog’s assessment of sustainable development goals of 2021 had shown Kolkata and West Bengal to be a State of uneven distribution of wealth. While Kolkata secured a score of only 3 out of 100 in Niti Aayog‘s SDG Goal 8 i.e. “Decent Work and Economic Growth”, it secured 27 out of 100 in Goal 2 i. e. “Zero Hunger”. While Kolkata had no jobs & was very far away from collective hunger mitigation, certain individuals in the State had seized and hoarded cash and gold and countless properties in their own unholy grips. People started witnessing such hoards being unearthed by the ED in different places of Kolkata from July 2022 starting right from Partha Chatterjee’s close aide’s place. Such facts clearly indicated selective distribution and accumulation of wealth in Kolkata giving rise to inflation at an artificially high rate. West Bengal’s rate of inflation has almost consistently been 2.5% higher than the National rate of inflation cause whereof is likely to be rooted in West Bengal’s fiscal indiscipline & crime-prone nature. In such a State of huge inflation, West Bengal Government is not remitting DA to Government employees who do not have legal scope to earn from any other sources but have to maintain their responsibilities. Such people, no wonder, are feeling suffocated to live with underpayment. Many such employees, as a result, are resorting to unlawful malpractices and bribery adding further to inflation. As DA is 100% related to consumer price index & price index depends on inflation, West Bengal Government employees are ideally supposed to get a rate of DA higher than that of the Central Government employees as rate of inflation in West Bengal is higher than the average all India rate. However, even if not at a higher rate, they are supposed to get at least at the Central rate to be able to sustain in the cash heavy crime State of West Bengal.

As They Appear to Have Stolen & Embezzled the Fund, How Would West Bengal Government Arrange Fund for DA Remittance Now?

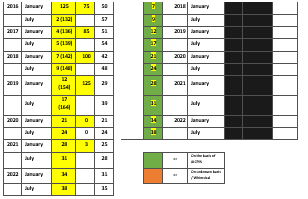

West Bengal’s budgetary planning didn’t reflect fund crunch as West Bengal Government allotted larger and larger amount under “non-committed revenue expenditure head” year after year. Over FY 20-21, the State allotted 36.68% growth in subsidies in FY 21-22 while it allotted another 14.8% growth in FY 22-23 over FY 21-22. Out of the 4 States declared financially ‘bimaru’ by RBI, West Bengal has registered highest growth in subsidies allotment in FY 21-22 over FY 20-21 as well as in FY 22-23 over FY 21-22. This means West Bengal Government didn’t practice fiscal restraint yet cried hoarse about fund crunch.

Had GoWB remitted subsidies i.e. non-committed revenue expenditure at the same rate in FY 21-22, as that of FY 20-21, the State could have remitted arrear DA in last financial year itself. In FY 21-22, GoWB allotted (90327 – 66085) Crores = 24242 Crores extra over FY 20-21. This amount was nearly enough to remit arrear DA to all Government employees. In FY 22-23, GoWB allotted a further amount of (103694 – 90327) Crores = 13366 Crores subsidy over the amount it allotted in FY 21-22. This incremental amount too could have remitted almost half of the arrear DA of the Government employees. This indicates that the giant leap Government of West Bengal had taken in budgeting for its non-committed revenue expenditures in two consecutive financial years was in itself almost enough for arrear DA remittance. Keeping dole distribution withheld for just one year, DA can be paid off. Once paying off the arrear DA, regular DA remittance won’t add more than just around a few thousand crores a financial year in salary & pension head which would be a miniscule amount compared to the doles that GoWB distributes every year, year after year.

Are There Any Other Ways for GoWB to Arrange for Fund?

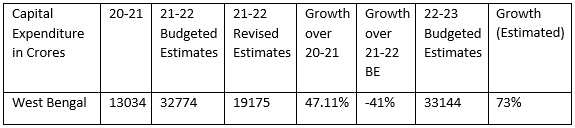

West Bengal Government couldn’t spend even 50% of its budgetary allocation for capital expenditure in FY 21-22, yet taken a 73% growth in this head of accounts in FY 22-23. That fund may be shifted to the committed revenue expenditure head for remitting arrear DA.

If, West Bengal Government budgets to grow optimistically by 50% in FY 22-23 in Capital Outlay Actuals over FY 21-22 RE, it needs to allot 28762 Crores in Capital Outlay and may take the rest (33144-28762) = 4381 Crores for committed revenue expenditure disbursements.

Government has to remit DA because it is GoWB’s legal responsibility. Salary is a priority expenditure while dole distribution is a populist policy of the ruling political party. Government of West Bengal, however, has greater responsibility to act upon the Constitutional dictates protecting the fundamental rights of Government employees than to protect the ruling party’s populist interest. Getting dole, moreover, is no fundamental right of the State populace. While Manoj Pant, Finance Secretary of West Bengal indicated, in his affidavit to Calcutta High Court, that remitting DA would bring about catastrophic consequences to the State, non-remittance of DA for an unreasonably long period had already brought a much greater catastrophe. It is unfortunate & suspicious that Manoj Pant had failed to mark that catastrophe. Or, perhaps Pant meant that it would be a catastrophe if the GoWB had to pay the DA over and above the doles, indicating that GoWB had no way out but to distribute the doles committed by the CM by hook or by crook just to maintain the populist interest of the Supremo of the ruling political party who perhaps prefers to keep her political identity as ruling party Supremo above her constitutional identity as the CM of the State. It may be expected that the Finance Secretary of West Bengal didn’t mean anything such in his sworn affidavit before the Calcutta High Court because in that case it could amount to an official admittance that in the State of West Bengal, political interests are officially prioritized over constitutional obligations, indicating a total breakdown of constitutional machinery. Remitting non-committed revenue expenditure cannot be a commitment of the Government in reality.

As GoWB Has Been Habituated Paying Dole In Lieu of DA Money, How Can They Deprive the Dole Getters Now?

If so, then it is untruthful of GoWB to claim fund crunch. It is priority anomaly in reality & hence, illegal. Dole cannot be remitted at the cost of employees’ salary as that would set a demonic trend of anarchy wherein violating limits of legitimacy would appear normal, thus changing a democracy into a demonocracy. The Constitution of India hasn’t created any room for such unlawful, chaotic practices.

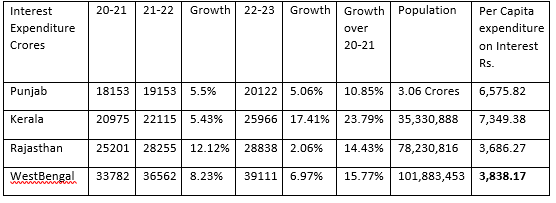

Doesn’t West Bengal Have to Pay Huge Interest on Loan Taken So Far?

Truth is stranger than fiction. Amongst the 4 States declared ‘bimaru’ by RBI, Kerala has to pay the maximum per capita interest followed by Punjab, West Bengal & Rajasthan in descending order. With respect to the State’s huge population of around 10.19 crore, West Bengal’s interest payment is not unusually big with respect to the other 3 loan burdened States of India.

Isn’t West Bengal’s Loan Burden More as It Has to Pay a Huge Sum for Government Employees’ Salary? Do Other States Have to Spend This High in Salary?

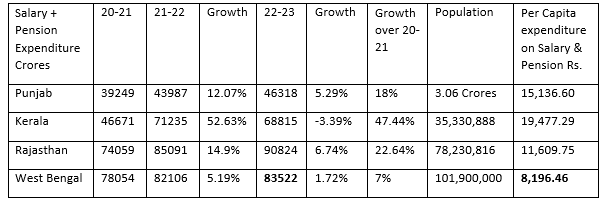

Amongst the 4 ‘bimaru’ States, West Bengal registered the least growth year after year on account of salary & pension while West Bengal’s population is highest amongst the 4. West Bengal also spends the least in terms of per capita expenditure on Salary & Pension leaving its per capita salary expenditure unusually low as compared to West Bengal’s huge population while number of Government employees of a State should be directly proportional to the State’s population density. As a result, it may be observed, West Bengal is failing to perform in several fields, such as tackling the Dengue outbreak in the State.

If West Bengal Government Has to Remit the Balance 35% DA, How Is It Possible that Regular DA Remittance Won’t Add More Than Just Around A Few Thousand Crores A Financial Year In ‘Salary & Pension’ Head?

In FY 22-23, West Bengal Government has allotted 83522 Crores for salary & pensions, and is currently paying DA at a 3% rate while Central Government is remitting DA at a rate of 38%. As per figures, 35% of 83522 is equal to 29232.7 Crores. So, mathematically, West Bengal Government is supposed to require an additional 30 thousand crores to remit DA to West Bengal Government Employees at the rate of 38% every financial year. However, in reality, only a few thousand crores would be truly sufficient for annual DA remittance at 38% rate as out of all employees of GoWB, a large number are civic i.e. casual workers, contractual workers and ‘Karmabandhus.’ These categories of employees do not draw as per Government scale. ‘Karmabandhus’ draw about one third of what the civic workers draw and the civic workers draw around 8-9 thousand a month. This means DA won’t be payable to a large majority of workers who are being paid from the salary head of the account of West Bengal Government and that is why only a few additional thousand crores a year would suffice to remit the right rate of DA. This also means the Government of West Bengal is running with the help of mercenaries and not dedicated people. This explains the fall of law and order and the non-performance of the Government in different fields of operations e.g. Dengue Management.

How Paying DA would be better for the fiscal health of West Bengal?

West Bengal Government didn’t reflect fund crunch in its budgetary planning and created ample scope for fund embezzlement by allotting significantly large amount in doles and subsidies in spite of having a stupendously high loan burden on the public treasury. While West Bengal Government claimed fund crunch by affidavit, it should have registered negative growth or at least stagnation year after year in terms of their budgetary allocation for non-committed expenditures. But that has not happened. They have allocated disproportionately large growth for non-committed revenue expenditures year after year. A fund crunched Government steadily raising non-committed expenses is not economically viable. Moreover, as West Bengal has embezzled the Central Grant for disaster management, MNREGA and Pradhan Mantri Awas Yojna etc., no reason to expect that the State’s disproportionately large sum of non-committed revenue expenditure (i.e. dole distribution) would be spent righteously without defalcation. From West Bengal Government’s antecedents, it may be safely assumed that large budgetary allocation for subsidies too is intended to carry on with the general trend of embezzlement of public money. Such Government needs to adopt the path of fiscal penance & bind themselves tight in fiscal discipline by directing most of their fund to pay off the committed expenditures. This way, the Government would be left with lesser amount to defalcate. At the end of FY 22-23, GoWB would have a loan burden of 5.87 lac crore which, after adding the DA burden, would turn into around a 6.5 lac crore. While Government of West Bengal would have to pay off the loan and the DA, it is better for them to spend more on committed expenditure heads like salary, pension, interest & repayment of loan by restricting itself on populist, non-committed revenue expenditures. This would steadily improve the condition of West Bengal from economic cachexia. To bring the State onto the path of fiscal discipline, DA remittance appears to be a therapeutic measure. Moreover, DA money would not only help employees to live with their due salary but would also percolate down into the economy from the employees’ hands to let the economy roll comparatively healthier.

What Could Be the Ways for West Bengal Government to Increase the State’s Own Revenue to Prevent Future Fund-crunch?

Leading people to drink alcoholic liquor is not a healthy way to raise fund, but Government of West Bengal is attempting such debauchery to collect greater quantum of Excise Duty from increased sales of liquor within the State. As a result, if increased drinking damages health of the State’s populace or causes moral fall, the Government doesn’t look bothered. However, on the other hand, the State can go all out to collect more GST from the business sector as West Bengal is a consuming State with a huge 10.19 crore population. It is no less surprising that containing more than double the population of Odisha (47,099,270), West Bengal’s collection of GST is not even 1.5 times that of Odisha’s. In September 2022, while Odisha has collected 3765 Crores, West Bengal has collected 4804 Crores only which is just 1.28 times that of Odisha’s collection. However, GST being a consumption tax, collection of GST is supposed to be directly proportional to the amount of consumption and amount of consumption is supposed to be directly proportional to the population. West Bengal’s GST collection has scope to be improved much further and GoWB needs to target that, instead of targeting to make common people alcohol addicts. In West Bengal, however, revenue collection has been under-prioritized. While the ruling party men has practiced extortion from businessmen based on their business turnover, State Government had encouraged evasion. As a result, West Bengal businesses have a general trend to operate with huge cash transactions apparently for ease of evasion. The State had nothing to lose as revenue shortfall was programmed to be compensated by the Central Government till March 2022 as per GST law. Such period of compensation, however, has been extended by GST council keeping Covid compromise of the economy in mind. Since 2012, West Bengal Government systematically undermined revenue & resorted to market borrowing ending up building a staggering loan mount on the public treasury. This approach has to be altered. GST Collection needs to be prioritized to arrange for fund.

Comments