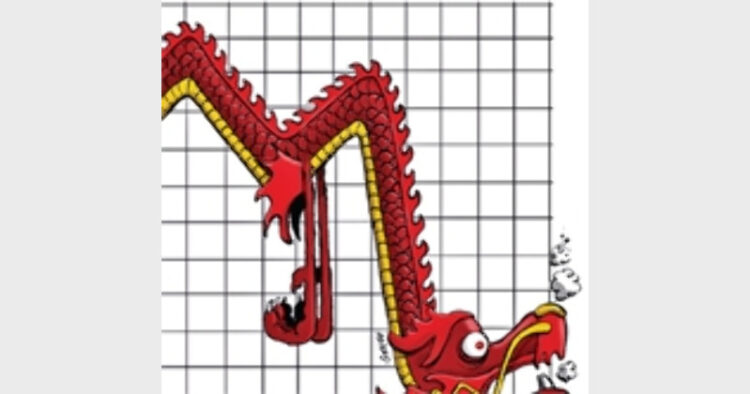

Economy : Panicking Prospects of Made in China

As crisis looms large over Chinese economy, is it beneficial or detrimental for the economy of Bharat?

The black Monday in Chinese economy had made its repercussion felt across the global economies. Steep drop in Chinese stocks led to a worldwide panic about the condition of the world’s second-largest economy.

According to Rajeev Upadhyaya, a Research Scholar in Delhi School of Economics (DSE), “The current situation in China is not as worst as it was in 1997 during Asian crisis but there lies problem with its economic profile. It is an investment based economy that is highly regulated. To finance the investments Chinese firms have borrowed heavily from government agencies as well as from foreign banks and financial institution. Also the domestic consumption has not increased at the same pace at which GDP has grown in last two decades. So there is huge mismatch between the growth in production and consumption. Also previously there had been rumors that Chinese authorities had artificially kept stock prices in economy at higher level which eventually became unsustainable over time. These three things are the basic reasons for the current problem besides its foreign exchange management policy and practices.”

|

For the last two decades, China has outgrown many economies to become second largest economy in the world and achieved this landmark by making its economy an investment driven economy. And for that, it had borrowed huge amount of money from domestic as well as foreign sources. At present Chinese firms have foreign debts to the tune of more than $1 trillion which increasing their default and bankruptcy probabilities in case significant slowdown (that is evident now). Unlike other large developed and developing economies with high GDP growth, the economic prosperity in China has not reached the bottom of pyramid. |

“The speculation related to further devaluation in Chinese currency, weakening of China’s imports and its underperformance led to the economy being slowed down, with prospects of not even achieving the 7 per cent growth rate. Moreover, there is a growing sense of fictitious data and figures being circulated by the Chinese agencies to support the slow but assured economic growth by manipulating the fiscal processes.”, adds Aravind Yelery, Associate Fellow at Institute of Chinese Studies.

However, the Bharatiya economy is sought to be wishy-washy situation with respect to Chinese crackdown. “Bharat may have benefit as well as problems both at the same time. If Bharat went on its economic reform endeavor, it will attract the flying investment from China helping in Make in India and smart city projects. But at the same time some sectors like automobile sector may have to face difficult times.

Also the lower oil and copper prices will help to lower fiscal deficit and inflation. Also electronic goods would be cheaper. But if the problem gravitates, India cannot get away even if the RBI says so. Because, to face with another crisis, the fundamentals of Indian economy are not as strong as it were in 2008.

The export may fall if Chinese problem spread to other countries mainly the US and Europe. Rupee as well as stock market may have tough times if erupts a currency war. There would be many benefits such attracting flying investment to Bharat, lower fiscal deficit and inflation because of lower oil prices, cheaper mobile phones and electronics”, says Upadhayaya while explaining about the effect of Chinese Economy.

However, Aravind Yelery feels there’s little to be optimistic about “The stock markets across the globe operate under speculations. The fear of Chinese devaluating the currency to promote export and further increase the economic performance has led to the fall of some of world’s prominent stock markets, including Bharat. The Indian Rupee is also depreciated further as a direct effect. There will be little to gain directly vis-à-vis China. The gains are comparative, the stock crisis caused plummeting of the commodity prices and the investors are not ready to park their fortunes in Chinese market anymore. At this juncture, Bharat with its transparent policies and newer initiatives may attract these floating investments. The exports from China would get benefitted directly from the devaluation as the prices of domestic products have come down.”

Moreover, the prospects for the world economy are bleak in future. To this, Yelery adds, “The global economy should expect more volatile market in China. While the institutions across globe welcome China loosening its neolithic control over its currency and other fiscal areas, the world economies are also worried with the aftershocks. Because the market and economies work around tendencies and speculations.”

But is there any use of being hopeful easy recovery of Chinese economy? “No. Even when China maintained a high growth rate, the policies and govt. control succumbed to political pressures. Under political pressure, the controlled relaxation of micro policies might see worst fears come true. With the Fourth plenum around and formalizing the 13th plan on its agenda, Chinese would grow more anxious,” concludes Yelery.

Simply, the Chinese economy is and has always been a paper dragon. They don’t consume enough of their own goods to keep the engine turning, and the engine won’t turn at all if they stop exploiting the desperation of their own people for cheap labour.

Divyansh Dev

Comments