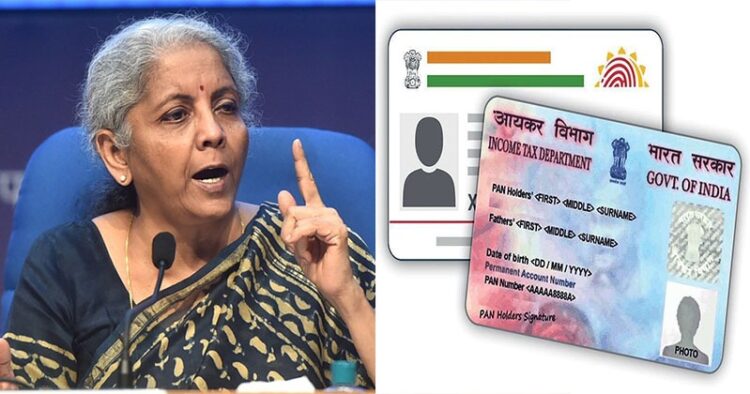

On April 6, Union Finance Minister Nirmala Sitharaman said that charging a fee for not linking a PAN card to an Aadhar card was a good idea. The Aadhar-PAN linking was free till March 31, 2022, after which a late fee of Rs 500 was levied on April 1, 2022. Furthermore, the late fee was increased from Rs 500 to Rs 1000 from July 1, 2022.

The Union Minister said that if even after giving these many opportunities Aadhar card is not linked with the PAN card, then the PAN card will be deactivated after June 30, 2023. She said, “Aadhar and PAN cards must be linked. We spent a lot of time on this. At least now, it needs to be assembled,” during a press conference in New Delhi.

“If this deadline is passed, the penalty amount will increase. According to a statement issued by the Finance Ministry on March 28, any person having a PAN should link it with Aadhar. Or else, we may face many consequences, including an increase in TDS and TCS,” she said.

Last month, the Government of India extended the date for linking PAN card and Aadhar card from March 31 to June 30. The Union Ministry of Finance release said this extension was meant to provide some more time to the taxpayers.

The PAN card not linked with Aadhar will become inoperative from July 1, 2023. “The PAN can be made operative again in 30 days, upon intimation of Aadhaar to the prescribed authority after payment of a fee of Rs 1,000,” the release said.

However, individuals exempted from linking PAN card and Aadhar card will not be liable to face those consequences. The exempted individuals include people residing in Assam, Meghalaya and Jammu and Kashmir and non-resident Indians, individuals who are not a citizen of India and individuals above the age of 80 years. It is pertinent to note that over 51 crore PAN cards have already been linked to Aadhar.

PAN-Aadhar Linking Benefits for Individuals:

- PAN-Aadhar linking would provide the Income Tax department with an audit trail of all transactions.

- Filing ITR would become earlier as it would eliminate the need for submitting receipts to the IT department or e-signature and it will be done using Aadhar e-verification.

- PAN-Aadhar linking will ensure that the PAN card does not become inoperative after the prescribed term expires.

PAN-Aadhar Linking Benefits for the Government:

- PAN-Aadhar linking is useful for tracking tax evaders.

- PAN-Aadhar linking would solve the problems of one individual using multiple PAN cards and therefore reducing the possibility of fraudulent activities.

Comments