The truth behind Hindenburg Research’s report against the Adani Group will unfold with time. As we try to make sense of the accusations and rebuttals, and struggle to cope with the damage it has done to the Indian markets, some interesting facts need highlighting.

- Short seller Hindenburg has a track record of sending stocks of its target companies tumbling. It managed to do the same with Adani Group

- A global anti-Adani campaign was launched as far back as in 2016 with the official Twitter account of #StopAdani campaign

- A website ‘adaniwatch.org’ run by NGO Bob Brown Foundation focuses solely on highlighting

Adani’s “misdeeds” - The report was timed just ahead of Adani’s FPO – which was actually India’s largest ever FPO

- It comes at a time Adani is poised to give China a run for its money in the global infrastructure race

- In July, his Adani Ports unit won a tender to take over Israel’s Haifa Port. This put the company into direct competition with China’s state-owned Shanghai International Port Group. Global analysts had started speculating how the Adani Group can lead India’s alternative to China’s crucial Belt and Road Initiative (BRI)

- Many at the World Economic Forum in Davos described India as a bright spot on the world stage. At the same forum, Adani met several heads of states and business leaders. He made headlines when he said at Davos: “The decoupling of trading giants the United States and China is a huge opportunity for India to become a powerful force in the global supply chain”

- Short-selling activism has been around for long but this is the first time it has struck India in a big way

- Naming Adani gives much-needed opportunity to the Opposition to put the Modi government on the mat in a crucial election year – the scenes in Parliament are a case in point

Information is not just the currency of democracy but also a critical weapon in this era of fifth-generation warfare. In this case, even the ‘Legal Disclaimer’ at the end of rather long Hindenburg report is an eye opener and makes for an interesting read!

So while we sift the truth from the narrative, here are some expert views on the Hindenburg-Adani controversy for you to ponder upon.

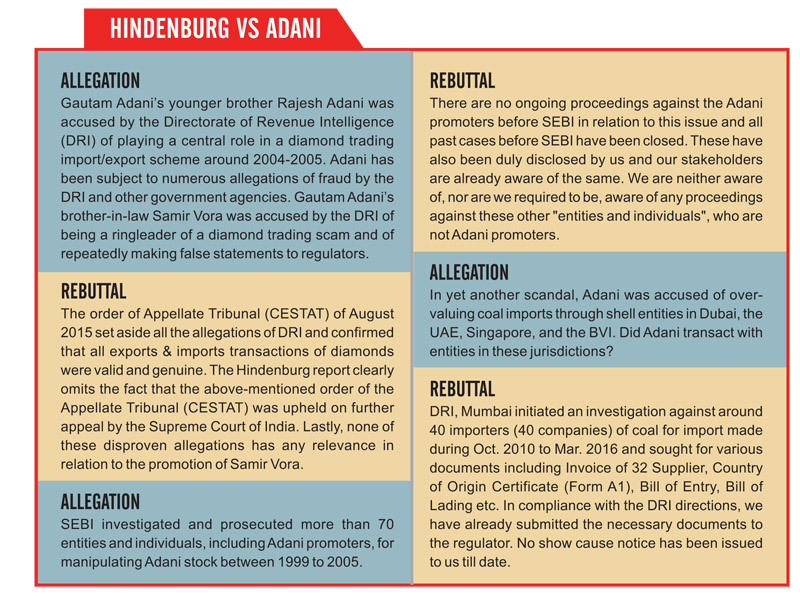

On January 24, 2023, the controversial short seller Nathan Andersen’s Hindenburg Research released a report targeting Adani Group as if the Adani Group were the equivalent, parallel and acronym of the Indian economy. The report was laced with various framed and vague accusations ranging from conspiracy theories (such as linking Adani with arrests and murders of journalists), to stock manipulation, accounting fraud, and concerns over the group’s leverage and valuations.

This report resulted in the Adani Group stocks losing Rs 4 lakh crores of market cap within two days. The Hindenburg report was timed just ahead of Adani’s biggest-ever public issue to sabotage Adani Group’s flagship company – the Adani Enterprises Ltd. The result was that, though the target was the Adani Group, we saw a bloodbath and marked bearish fall in the stock market with many top 500 companies closing in red. The stock indices resorted to hard hit bleeding for two successive days. Along with that, the Indian stock markets lost their eminent position in the top 5 equity markets in the world. In other words, the attack on Adani heavily impacted the overall equity markets and valuations of many other famed companies and banks.

The intent of this report was to create suspicion and cast aspersions on the credibility of Indian companies and in turn, on Indian economy, and thereby stall the fund raising opportunities and options of Indian companies.

Vested interest of a short-seller

Nathan Andersen has the nefarious reputation of vaguely targeting various companies. Hindenburg has already faced castigation in the US courts, as being a defamed and almost a banned agency in USA. In January 2023, a civil judgment by the Court of Southern District of New York allowed DraftKings motion to dismiss a class action stemming from a 2021 short-seller report. The Court found two problems with the Hindenburg report and allegations by Hindenburg against DraftKings. First, the Hindenburg Report was a short-seller report. The Judge stated that given a short seller’s interest in seeing a stock price go down, the “allegations must be considered with caution”. And second were the confidential sources on which the report was based. The inability of the plaintiffs’ attorneys to verify and interview the sources of the report resulted in the Court reprimanding and discounting the report. This background is enough to raise doubts and questions on the credibility of Nathan Andersen and Hindenburg Research’s report.

What is Hindenburg Research?

Hindenburg Research is a short-seller firm that claims to specialise in forensic financial research. A ‘short’ trade is a way to make money if an investment’s price drops. When it releases its ‘research’, if the price of the target company’s stock or bond falls due to negative sentiment created by the report, Hindenburg can profit. Reports suggest Hindenburg has the backing of several investors and its core business operation is to make money through short trade. Its founder Nathan Andersen has targeted various companies earlier too and has faced castigation in the US courts.

Adani FPO

Despite setbacks, FPO worth Rs 20,000 crore by Adani Enterprises was over-subscribed on January 31, with heavy support from non-institutional investors. However, on February 2, 2023, the group decided to withdraw the FPO to insulate investors from potential losses. In a video message, Gautam Adani said the interest of his investors was paramount and everything else secondary.

Bloodbath in Stock Market

After Hindenburg released its report on January 24, Adani Enterprises Ltd’s stock fell from January 24 closing of Rs 3,442 to February 2 closing of Rs 1,565. The Company lost a value of around Rs. 2.4 lakh crore (around $ 25 billion).

Notwithstanding, in India, the Hindenburg report was taken as the epitome of credibility and blatant truth by a section of media and political class. The said report was used to not only target the Adani Group companies, but short sellers in the market had a field day targeting many other renowned and reputed large companies and credible banks. In other words, it ended up taking the form of an assault on Indian markets and Indian economy simultaneously. In fact, it was a precursor to the BBC’s malicious and maligned report on PM Modi two weeks back.

History of attacks on economy

However, if we to go back in history, this is not a lone case. Indian economy and companies have been subject to various kinds of repeated assaults by vested interests in India and abroad. The forms of attacks are different. Starting with environmental activists, it moved to rioters and vandals, and now finally we are seeing sophisticated financial assaults.

This attack by the global bear cartel reminds us of George Soros’ attack on the Bank of England by shorting Pound Sterling in 1992 and earning US$ 1bn by hurting the Bank of England. The Malaysian Government later accused Soros of ruining and hitting Malaysian economy by massive currency speculation in Ringgit in 1997. For the financial markets, this kind of manipulation and malicious targeting of companies, currencies, and in turn economies, is not new. It is for the first time we have experienced the global forces targeting Indian companies and markets.

Not long ago, we have seen attacks of a different nature on Indian companies and Indian economy. First this global lobby used environmentalists to target Anil Agarwal’s Sterlite Industries Ltd’s copper smelter in Tuticorin. Under false accusations of environmental damage and using street force coupled with a compliant secular liberal media, they created an adverse narrative about Sterlite and forced the smelter to be closed. This resulted in India becoming a net importer of copper in 2018-19, for the first time in 18 years, from being a net exporter of copper by exporting 3,35,000 MT of copper in 2017-18. What was the outcome? China, which held huge copper stock, was able to liquidate its stagnated inventory. Imagine the loss to India! Later it was found that the smelter was not creating any pollution. The most shocking revelation was that the whole protest against Sterlite was funded by China using a UK-based NGO named “Foil Vedanta” as a front to target Indian companies and economy.

If that was not enough, we have seen rioters masquerading as anti-farm law activists targeting Reliance JIO’s mobile towers during farmers’ protests. Reason: The Indian Government prohibited Chinese 5G vendors and preferred Reliance. So, farmers were misused and exploited to attack Reliance JIO and its operational assets in Punjab. Even an infant can conclude that the sole intent of the attacks was to stop Reliance JIO from going ahead with its 5G plans, which presented a hard competition for Chinese 5G vendors i.e. Huewei and ZTE.

Later on, India experienced targeted attacks by a select class of environmentalists on Mumbai’s critical infrastructure project i.e. the Mumbai Metro. This project is funded by Japanese agency JICA. By creating a fallacious controversy around Aarey to stop the construction of Metro Car Shed, the environmentalists’ lobby managed to stop a major infrastructure project, and the delay caused a colossal loss of approximately Rs 10,000 crore to the Maharashtra state. Maharashtra’s Deputy Chief Minister Devendra Fadnavis said the agitation to stall the metro car shed project was sponsored. The sponsors were able to rope in politicians like Shiv Sena chief’s son Aditya Thackarey and Bollywood stars to misguide and rally people behind them to stall the project and hurt the economy of the state.

These instances only prove that assaults on the Indian economy have now become very easy in an open and interconnected world. This is part of the fifth generation warfare wherein hostile powers use various oblique tactics to target the Indian economy. Some assets like rioters in farmers’ protests or environmental activists are crude unsophisticated operators, whereas the likes of Hindenburg and George Soros are suave and technically qualified domain experts. India is now growing economically and expanding its wings to get control over critical infrastructure assets overseas. It is also working on undermining the dominance of the US Dollar by promoting UPI and Rupee trade. Besides, India has not succumbed to the coerced pressure of the West (read: the US and the EU) and has been continuing trade with Russia by importing Ural Crude and settling trades in Indian Rupee and other non-Dollar currencies. In such an eventuality, India must be well prepared to confront many more similar attacks.

In the wake of the Adani case, India needs to work on new mechanisms to safeguard its sound economy as also build capabilities to not only defend the markets from attacks, but also booking and bringing such financial criminals to justice. This is extremely important and vital so that we can create a safety net around our economy and markets.

Comments