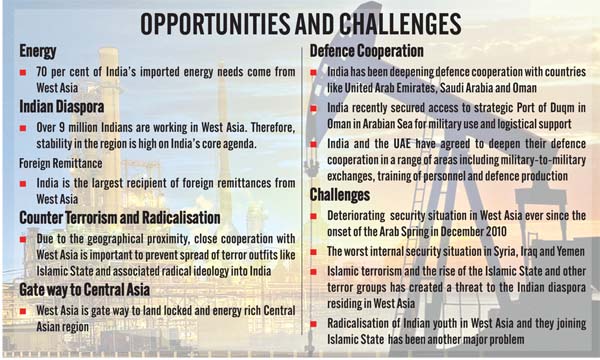

West Asia is India’s extended neighbourhood with deep civilisational connect and historic and P2P roots. Over time, these have been categorised in the 3E matrix, which includes, though not exclusively, Energy Security; Economic Engagement; and Expatriates of Indian origin and their welfare. India’s nearly 9 million diaspora in West Asia, mostly in the six Gulf Cooperation Council (GCC) countries, has been instrumental in developing their host countries while remitting over $50 billion to India, which has been significant and nearly accounts for 1/10th of India’s current foreign exchange reserves. Their welfare is yet another dimension of India’s security imperatives. It was clearly evident during the Covid-19 when several Vande Bharat Mission flights ferried many of our citizens while rendering urgent assistance to the extended neighbourhood in West Asia.

India depends on uninterrupted supplies of crude oil and gas from the region, especially GCC countries to a great extent. It imports nearly 40 per cent of its oil and 70 per cent of its gas requirements from the region, which are essential for the Indian growth and development story.

Diversification of oil economies

Moreover, the safety of trading sea lanes and anti-piracy and counter-terrorism collaboration are absolutely essential for interrupted supplies. Iraq, Saudi Arabia, UAE and Qatar are the major suppliers of oil and gas to India. No wonder, UAE is our third largest trading partner and Saudi Arabia the fourth. However, what needs to be done is to take note of the diversification of the oil economies from hydrocarbons to renewables and enter into a green tech-driven development in accordance with their vision slated from 2025 to 2040. Moreover, going by the geopolitics encompassing the Sino-US strategic competition and shifting pivot of the economic pendulum towards Asia, several GCC countries have crafted their policies termed ‘Act East’ towards Asia, especially China and India, where their markets are. This blends very well with India’s Link West policy. There has been a qualitative change in India’s bilateral relationships with the Gulf majors from transactional to strategic partnerships with energy security at its helm. UAE has committed to investing $ 75 billion in India in diverse sectors.

Invest in downstream projects

Several projects are already in the pipeline. Dubai has remained a major transit hub for Indian trade and is often ranked as 2nd or 3rd largest trading partner. Prime Minister Modi invited ADNOC and Mubadala to invest in downstream projects in India’s hydrocarbon sector also. Strategic oil reserves are a priority for India, and the agreement on oil storage and management between Abu Dhabi National Oil Company and the Indian Strategic Petroleum Reserves Limited signed in January 2017 underscores that crude oil supply from UAE for the Mangalore cavern would be a significant transformational step in building a strategic partnership in the energy sector. More importantly for the first time, Abu Dhabi awarded a major oil concession to an ONGC-led consortium from India in the ADMA-OPCO field in Lower Zakum, being termed an emerging strategic engagement in the energy sector. In order to keep track of various high-level promises and agreements, High-Level Ministerial Taskforce has been created.

As India hosts and chairs G20, PM Modi has invited UAE’s President Sheikh Mohamed bin Zayed al Nahyan as a special guest at the September Summit. India recently signed the Comprehensive Economic Partnership Agreement (CEPA) with UAE as it became a founding partner of the fast-moving I2U2 framework with Israel and the USA as other strategic partners where investment, technology and markets will add a futuristic and mutually beneficial collaborative matrix across energy transition and provision as UAE intends to enhance its production of oil to nearly five million bpd (barrels per day).

India’s oil requirements

Saudi Arabia provides nearly 17 per cent of India’s oil requirements and Crown Prince Mohammed bin Salman had committed to an investment of US$100 bn across the infra-spectrum, including the energy sector, during his visit to India. This has continued even during the pandemic. Saudi Aramco signed an MoU in April 2018 with the Indian consortium (IOC, HPCL & BPCL) to acquire a 50 per cent stake in India’s largest refinery project ‘Ratnagiri Refinery & Petrochemicals Limited’ worth US $ 44 billion. Later, ADNOC too signed an agreement to take a 25 per cent stake of Saudi Aramco’s share in the Ratnagiri Project. However, the project has not been able to take off due to the allocation of land issues which are expected to be resolved soon. Saudi Company Al- Fanar is currently executing a 300 MW power project in Kutch.

Several other Saudi companies have also invested in India through their non-Saudi subsidiaries. But Riyadh is also expecting Indian investments in critical areas in the kingdom. The Russia-Ukraine war has caused a major catastrophe as weaponisation of energy by Russia as a countermeasure to sanctions has added a new dimension to coercive diplomacy. Global South, including major importers like India, are being impacted. India has availed of this opportunity by importing more oil from Russia at major discounts as the GCC producers have enhanced supplies to Europe, which has a major problem of supplies due to sanctions against Russia. However, within OPEC+, they have gone along with Russia and their own commercial national interests by keeping or even reducing production levels stagnant or further reduced to keep the markets stable and their own coffers aflush. Of course, this peeved the Americans, who even threatened Riyadh with ‘consequences’.

Oil supplies from the region have not been without their own complications and geopolitics and geoeconomics. India was importing nearly 11-12 per cent of her requirements from Iran which was virtually reduced to zero due to threats of US-imposed CAATSA sanctions against Tehran. This impacted India’s oil bloc Farzad B in Iran adversely, even though the Chabahar project was spared and is currently being used for the import of oil and other trade with Russia in a significant manner. However, seeing India’s spirited defence of its procurements of oil from Russia under the heaviest ever US and Western sanctions, Iranians have begun to provoke and prod India to start importing oil and gas from them as well in accordance with the strategic autonomy to preserve New Delhi’s national interests. It is a tricky situation indeed.

India’s nearly 9 million diaspora in West Asia, mostly in the six Gulf Cooperation Council (GCC) countries, has been instrumental in developing their host countries while remitting over $50 Billion to India

Perhaps given the frequency of unilateral sanctions, time has come to devise not only innovative payment mechanisms but also SPVs (Special Purpose Vehicles) made immune from such sanctions.

India’s goals for renewable energy

As India has started its own energy transition goals towards renewables to counter climate change and to meet its decarbonisation goals, it has also launched a Hydrogen Mission in which it is looking for collaboration with the regional powers. Recently, an Indian company, ‘Renew Power’ has signed an agreement to establish a facility in Egypt with an investment of US$ 8 billion, which is the largest in the country and the region.

India’s economic growth trajectory, energy mix and consumption patterns will dictate the extent and depth of the energy partnership with the west Asian countries. But, in the medium term and during the Amrit Kaal (next 25 years), the collaboration will continue to intensify with the region, which in many ways is its most important extended neighbourhood. However, a caution point for India will be the Chinese challenge in the region and other geographies, although the Pak factor has significantly subsided.

Comments