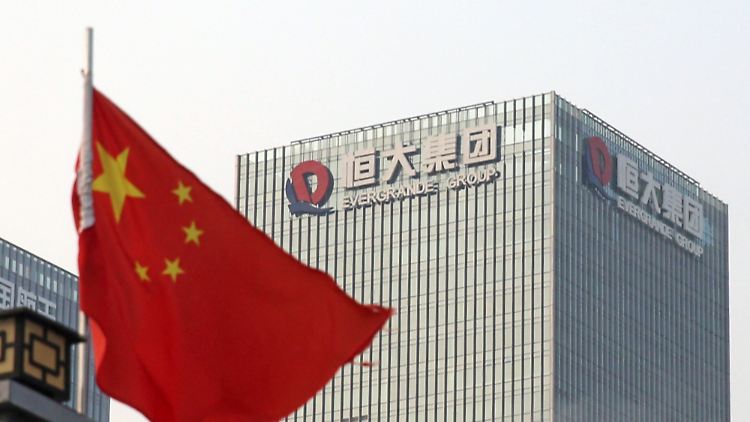

Is China’s economic powerhouse, Evergrande Group, facing a meltdown? The company’s shares took a harrowing nosedive of a whopping 87% as trading resumed, sounding alarm bells about its precarious financial state.

After an eerie silence since March 21, 2022, Evergrande’s trading bell rang with a thud. The numbers were nothing short of shocking – shares tanked to a dismal 22 Hong Kong cents, a far cry from their previous worth of 1.65 Hong Kong dollars per share on March 18, 2022.

Behind this tumultuous trade resumption lies a financial tale of woe. Evergrande revealed a loss of 39.25 billion yuan ($5.38 billion) for the half-year ending in June. Yet, surprisingly, this was an improvement over the catastrophic 86.17 billion yuan loss during the same period a year ago. Notably, revenue bucked the trend, rising from 89.28 billion yuan in June 2022 to a robust 128.81 billion yuan.

Taking a page from the playbook of desperation, Evergrande sought refuge under Chapter 15 bankruptcy protection in a U.S. court back in July. This manoeuvre aimed to shield its U.S. assets from creditors and carve out room for a comeback plan on a different battleground. Digging into the numbers, the company unveiled its liabilities tally, revealing a hefty 2.39 trillion yuan as of this June – a hair’s breadth lower than the 2.44 trillion yuan in the same timeframe last year. Amidst this financial maze, Evergrande’s assets clocked in at 1.74 trillion yuan by June’s end, cash and restricted funds included.

But this isn’t the first time Evergrande’s dance with disaster has made headlines. The company’s defaults in 2021 triggered a spiral that led to an offshore debt restructuring plan last March. As if to underline its financial blues with a bold marker, the company released its overdue earnings report this year – showing a staggering $81 billion loss. The details unveil a grim tale of net losses, with 2021 and 2022 reporting 476 billion yuan and 105.9 billion yuan in the red, respectively. The culprit? A cocktail of property markdowns, land quagmires, financial asset mishaps, and funding woes. A sharp contrast from 2020, when Evergrande basked in a net profit of 8.1 billion yuan before its tumble into default.

In a whirlwind of events, Evergrande’s shares have become a battleground of uncertainty, leaving us to wonder: Is China’s colossal economic player spiralling towards trouble?

Comments