India is not one of those Baltic States where economic governance structures are either weak or non-existent. Neither is India’s run on exotic market instruments, as is the case with a few European economies and the US. Indian economic management is also distinctly different from ‘commanding heights’ oligarchs that control the Communist regime in China.

Since India has its thinking on economic and developmental issues and a population of 1.4 billion, the country may have to chart its course on key issues like cryptocurrencies.

Prime Minister Narendra Modi’s meeting with various stakeholders recently, Finance Minister Nirmala Sitharaman and Reserve Bank of India’s Governor Shaktikantha Das have outlined India’s policy towards cryptocurrency mania that continues to sweep several geographies like a storm.

In the Indian context, it’s not desirable to introduce or legalise cryptocurrencies. Blockchain-based technologies may have other financial sector applications that can definitely be pursued for digitising the Indian economy.

No one has an issue with exploring the full potential of blockchain technologies. But, one cannot make cryptocurrencies legal tender. Neither can cryptocurrencies be treated as an asset that can be held, transferred or traded on market platforms or on the dark web, legally or illegally.

It does not matter the intention of countries like El Salvador to create an exclusive cryptocurrency city. India cannot afford to gamble on cryptocurrencies with which even advanced market-based economies like the US are still to come to terms.

Union Cabinet’s decision after several rounds of stakeholders’ consultations is significant as it seeks to ban all private cryptocurrencies.

Simultaneously, the Narendra Modi Government’s move to introduce a digital rupee beginning next year is a precursor to digitising the US $ 3.08 trillion strong Indian economy. The digital rupee to possibly be introduced by RBI will be backed by sovereign assets and guarantees like any other banking instrument or paper. Several central banks around the world have contemplated digital currencies as legal tender.

Even as the Parliament’s winter session began on November 29, lobbies continued to work behind the scenes to push the Government towards either status quo on cryptocurrencies or their weak regulation. These lobbies must be shown their place.

The Modi Government need not be apologetic or apprehensive about its decision to slap a complete ban on private cryptocurrencies. In a sense, holding cryptos, their transfer and trading become illegal and punishable under the statute. This measure would also insulate the Indian economy and markets from possible destabilisation due to these speculative instruments.

RBI Governor Shaktikanta Das has rightly pointed out that ‘instability and economic gloom that cryptocurrencies would ring in for India. The ban in itself cannot be viewed as the Modi Government being anti-reforms or new-age technologies.

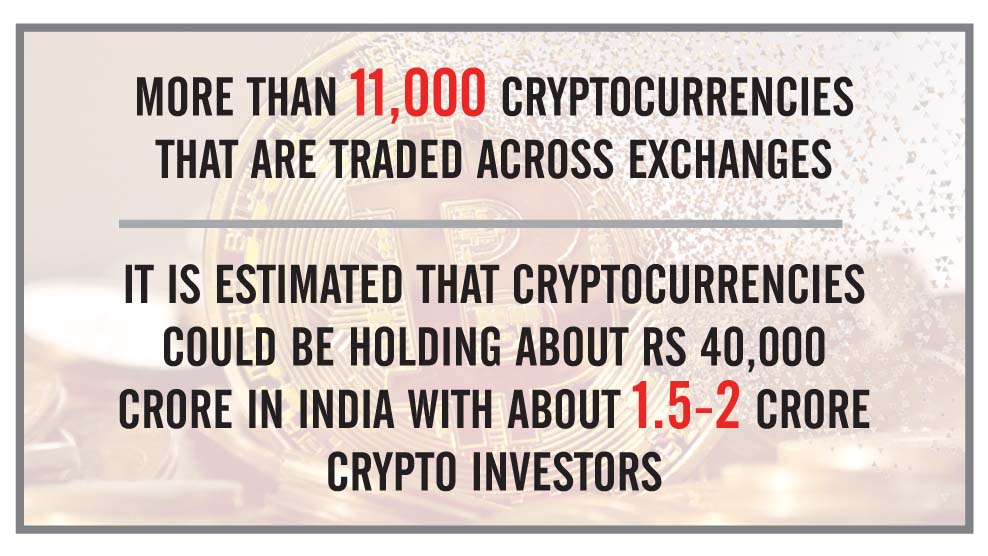

For youngsters, who are high on blockchain-based crypto money trading on unregulated exchanges or the dark web, the decision may be unsettling. Retail investors in India that reportedly are over 15 million with exposures up to the US $ 6 billion on crypto speculations may be better off with a protective cover of the State.

Given that cryptocurrency transactions cannot be brought under either banking regulator RBI or market watchdog, Securities Exchange Board of India (SEBI), the best possible option exercised by the Government is to ban them. Hence, these cryptocurrency–related transactions cannot be taxed as well.

Apart from validity or valuation issues, cryptocurrencies misuse, leading to serious security issues, Prime Minister Modi hinted while chairing a meeting of stakeholders, bankers, and investors recently. For instance, Enforcement Directorate has pointed to about Rs 4000 crore worth of funds routed through cryptotransactions to launder ill-gotten funds by economic offenders. Can we open another channel for tax evaders, corrupt people and traders to legitimise their ill-gotten wealth?

A recent study of Paris-based Financial Action Force (FATF) flagged 56 million illegal transactions on one crypto exchange named Liberty Reserve that US enforcement agencies busted. Liberty Reserve is just one of such exchanges whose numbers run into thousands and enable illegal transactions in billions.

Cryptocurrencies and exchanges by design do not allow for any regulation or enforcement and operate outside of banking channels in most geographies, including India, where banks wisely kept off from such operations.

In the infamous Aryan Khan case, Narcotics Control Bureau (NCB) unravelled that payments made using cryptocurrencies to acquire drugs recovered from a ship owned by Cordelia Cruises. Drug peddlers were paid in bitcoins for the narcotic substances busted from the ship off the Mumbai coast in the aftermath of a rave party.

World over the narcotics drug trade, laundered funds, credit card frauds, identity theft, investment frauds, computer hacking scandals were linked to cryptocurrencies as per the FATF report.

Terror financing by Pakistani outfits, Afghanistan’s Taliban and jihadists apart from Church using cryptocurrencies were reportedly flagged by Government officials in internal discussions. United Nations Centre for Counter-Terrorism (UNCCT) pushed for a workable framework to prevent the use of digital money, including cryptocurrencies, to finance terrorist activities globally.

Cryptocurrency and Regulation of Official Digital Currency Bill 2021 to be piloted by Finance Minister Nirmala Sitharaman in the ongoing winter session of the Parliament may have to take 360 degrees view and ban the cryptocurrencies without exceptions.

The SEBI panel has rightly pointed out that since there are no underlying assets, cryptocurrencies cannot be bracketed as a class of assets like stocks, debt paper, legal tender, real estate or commodities.

Even in most advanced economies like the US, the banking regulators are yet to make comprehensive plans on cryptocurrency, while some States have gone ahead with their set of rules.

Federal Reserve in the US, Federal Deposit Insurance Corporation and Comptroller of Currency may take the entire 2022 to chart a plan for cryptocurrencies.

While China has gone ahead to ban cryptocurrencies beginning with the issue of coins, all mining operations were shut down to safeguard its small investors. In contrast, European Union’s 27-members group have differential regulations on cryptocurrencies and digital coins. European Parliament is struggling and may take a year to frame commonly applicable rules and regulations on cryptocurrencies.

Most astonishingly, there have been a deluge of large advertisements on varied media platforms in India pushing for cryptocurrencies. In these full-page pull-outs, numbers on retail investors are fudged and investment values incorrectly stated.

A strong cryptocurrency lobby globally seems to have been at work. This has even flagged these speculative rogue instruments as anti-liberalisation and those opposed to free markets. This may not be true.

After the global market crisis of 2008-09, saving the economic policymaking from the jingoist market mindset is very much a necessity. British economists like Diane Coyle see even the existing market instruments as a distorting force that deepens inequality apart from giving a bad name to market economic policymaking.

Let’s keep away from exotic cryptocurrency mania that’s unsustainable and not our priority anyway.

Comments