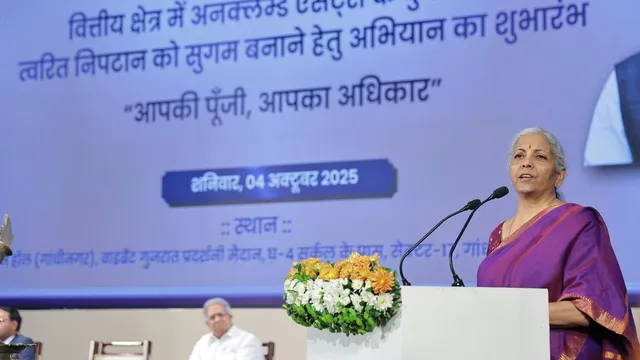

Facilitating financial justice and inclusiveness, Union Finance Minister Nirmala Sitharaman on October 4th rolled out a countrywide campaign entitled “Aapki Poonji, Aapka Adhikar” (Your Money, Your Right) to assist people in retrieving unclaimed financial assets estimated at Rs.1.84 lakh crore that go unrecognised in various institutions.

Rolling out the campaign during a national event in Gandhinagar, Sitharaman stated that the initiative aims to reclaim for individuals and families what is rightfully theirs. “These unclaimed deposits, insurance payouts, mutual fund balances, pensions, and dividends belong neither to the government nor regulators. They are the property of the people who earned them through their toil,” she asserted, mentioning that the government should only serve as a custodian of such monies until legitimate owners approach it.

The finance minister explained that the campaign was built upon a “3-A framework”: Awareness, Accessibility, and Action, to make the process of finding and reclaiming unclaimed money simpler. The government will conduct financial literacy drives, local workshops, and digital outreach programs to inform the population, especially rural and remote communities.

Under the Accessibility component, citizens will be able to trace their unclaimed funds using digital tools such as the RBI’s UDGAM (Unclaimed Deposits Gateway to Access Information) portal, along with district-level facilitation centres. The Action pillar, Sitharaman said, will ensure that claims are processed quickly, transparently, and in a time-bound manner. The campaign will be implemented across all states and union territories from October to December 2025.

According to official data, over Rs 75,000 crore in unclaimed bank deposits have already been transferred to the RBI’s Depositor Education and Awareness Fund (DEAF). Similarly, unclaimed insurance proceeds stand at Rs 13,800 crore, unclaimed mutual fund balances at around Rs 3,000 crore, and unpaid dividends and share-related entitlements transferred to the Investor Education and Protection Fund (IEPF) exceed Rs 9,000 crore.

Besides, almost 172 crore of shares have been transferred to IEPF accounts. The overall unclaimed corpus in the financial system is now Rs 1.84 lakh crore, as per reports of the Department of Financial Services and financial regulators.

The Department of Financial Services (DFS) under the Ministry of Finance is coordinating the campaign and has been actively participating with RBI, SEBI, IRDAI, PFRDA, and the IEPF Authority. These authorities will provide mutual data and simplify claim verification processes in order to ease the process of recovery for citizens. Sitharaman also presented a few of those who were successful in reclaiming their assets with certificates at the ceremony, which represent the real-life gains of the initiative.

Union Home Minister Amit Shah also lent his support in the form of a message, calling the campaign an endeavour to “uphold the dignity and rights of every citizen by ensuring their wealth is returned to them.” He added that the initiative is a reflection of the government’s commitment to transparency, accountability, and financial empowerment.

The campaign has been welcomed by experts as a historic measure that may consolidate public confidence in banks and regulators. Economists observe that the action sends a powerful signal that the government is not attempting to lay its hands on idle money but to return it to its owners. But analysts also warn that the success of the campaign will hinge on the quality of its implementation, especially in targeting citizens who do not have digital skills or financial records.

Challenges like tracking decades-old accounts, identifying people, and coordinating among various regulators might be challenges. Authorities have been directed to leverage continuous KYC and re-KYC campaigns to connect citizens financial history and reduce the generation of new unclaimed assets going forward.

The three-month country-wide campaign is likely to be an important milestone towards the revival of public trust and enhancing financial transparency. If well executed, it could result in the release of thousands of crores to common people, increase saving in the formal economy, and be a precedent for other nations to take inspiration from.

Through “Aapki Poonji, Aapka Adhikar,” the government seeks to convey a strong message that each rupee of the people should come back to them, and that the money systems need to be answerable to the people they serve.

Comments