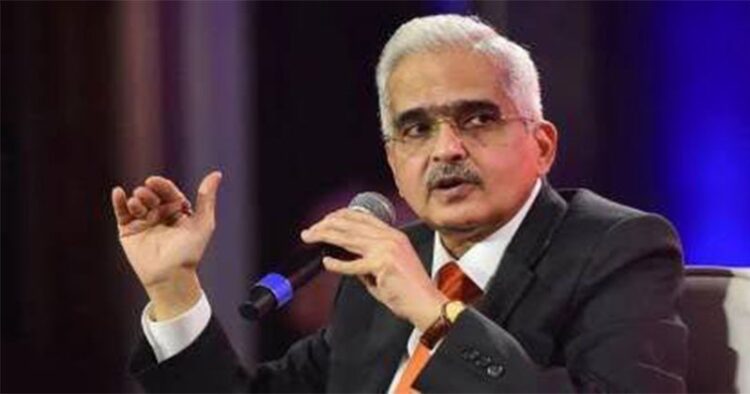

According to the Governor of the Reserve Bank of India Shaktikanta Das, India is the “5th best-performing country globally” and the “highest-ranked G20 country according to the Climate Change Performance Index 2023”.

On March 17, during the 17th K P Hormis Commemorative Lecture by the RBI Governor Shaktikanta Das said, “Given that India is widely expected to remain as one of the fastest growing economies in the world, our energy demand could rise manifold. The challenge for us is twofold: one, to meet the projected increase in energy demand; and two, to rapidly transition from fossil fuel to renewables.”

“Climate proofing of our infrastructure has also been a priority, more so in view of the large investment in infrastructure in recent years,” the Governor said. “Through global forums such as the Coalition for Disaster Resilient Infrastructure (CDRI)4, India is providing leadership to global efforts for addressing these challenges,” the RBI governor said.

The G20, which accounts for 85 per cent of global GDP and 75 per cent of global trade, was put to the test, according to the Governor, by the ongoing global crisis.

“Following the East Asian financial crisis of 1997, the G20 was founded in 1999 as a forum for the Finance Ministers and Central Bank Governors to discuss global issues and policy options,” he added.

“After the global financial crisis of 2008, G20 was upgraded to the level of heads of states/governments in 2009,” RBI governor said, adding, “In an interconnected world, national policies alone may not be fully effective when the nature of the shocks is global and persistent.”

Governor Shaktikanta Das said, “Of the multiple risks facing the world community, the surge in inflation has posed a complex monetary policy dilemma in every economy between raising interest rates enough to tame inflation, and at the same time minimising the growth sacrifice to avoid a hard landing.”

He said the aggressive monetary policy tightening by systemic central banks since early 2022 and the consequent appreciation of the US dollar have led to several economies, with a high share of external debt, becoming highly vulnerable to debt distress.

On the recent development in the US banking system, he said this had brought the criticality of banking sector regulation and supervision to the fore. “These are areas which significantly impact preserving every country’s financial stability.”

He said these developments in the US drive home the importance of ensuring prudent asset liability management, robust risk management and sustainable growth in liabilities and assets; undertaking periodic stress tests; and building up capital buffers for any unanticipated future stress.

“They also bring out that cryptocurrencies/assets or the like, can be a real danger to banks, whether directly or indirectly,” he added.

The Governor stated that the RBI had taken the necessary actions in each of these areas and that the financial sector’s regulation and supervision and that of the regulated entities had been enhanced appropriately.

Shaktikanta Das said the regulatory steps included, among other things, the implementation of leverage ratio (June 2019), large exposures framework (June 2019), guidelines on governance in commercial banks (April 2021), guidelines on the securitisation of standard assets (September 2021), scale-based regulatory (SBR) framework for NBFCs (October 2021), revised regulatory framework for microfinance (April 2022), Revised regulatory framework (July 2022) for Urban Cooperative Banks (UCBs) and guidelines on digital lending (September 2022).

According to the Governor, RBI’s supervisory systems have been strengthened significantly in recent years through measures which include a unified and harmonised supervisory approach for commercial banks, non-banking finance companies and urban co-operative banks.

Comments