The new initiative signals India's ongoing efforts to climb the electronics value chain and also coincides with attempts by global manufacturers to lower their dependence on China because of the ongoing trade war between Washington and Beijing.

Singapore: Last week, the Indian government announced an INR 760 billion (USD 10 billion) incentive plan to attract global semiconductor and display makers to its shores.

Based on a Reuters report, among those said to be interested in setting up manufacturing facilities in India are Israel's Tower Semiconductor, Taiwan's Foxconn, and a consortium from Singapore. Diversified natural resources group, Vedanta Limited, is also keen to set up a display plant.

The statement also added that "The program will usher in a new era in electronics manufacturing by providing a globally competitive incentive package to companies in semiconductors and display manufacturing and design."

This new scheme supports Prime Minister Modi's "Make in India" plan, which targets making the manufacturing share of GDP reach 25 per cent by 2025. According to McKinsey & Co., manufacturing accounted for 17.4 per cent of GDP in the fiscal year 2020. It is estimated that services, which has been the mainstay of India's economy, contributes over 50 per cent of GDP.

An increase in manufacturing activity will help broaden the economic base, create more good quality jobs, make India less reliant on imports, and even out the ebbs and flows of the economic cycle. The massive loss of jobs in the services sector during the COVID lockdowns attests to the need for more varied employment options.

This new initiative signals India' ongoing efforts to climb the electronics value chain. It also coincides with attempts by global manufacturers to lower their dependence on China because of the ongoing trade war between Washington and Beijing. Singapore has been one such beneficiary of the trade war.

In June this year, the world's third-largest contract chipmaker globally, GlobalFoundries, announced that it is investing USD4 billion to build a new production facility in Singapore. The plant, which is scheduled to begin production in 2023, will primarily serve automotive, 5G mobility, and secure device industries. GlobalFoundries is already making 40 per cent of its chips here.

The investment is the latest bid by a leader in the semiconductor industry to ease the chip shortage impacting automakers and electronics manufacturers worldwide.

With its favourable tax and regulatory environment, a pool of highly skilled workers, ease of connectivity, and well-developed semiconductor ecosystem, Singapore has long been an attractive destination for investment in high value-added manufacturing. Outside of the "big 4" in Asia – Taiwan, China, South Korea, Japan – Singapore has the largest semiconductor manufacturing industry in the region.

In 2000, Singapore produced SGD 84 billion (USD 61.5 billion based on current conversion rate) worth of computer, electronic, and optical products, including semiconductors. This represented 52.7 per cent of Singapore's manufacturing output that year. However, following the dot com bubble burst in the early 2000s and amidst fierce competition from its North Asian neighbours and, particularly Taiwan, on both the technological and cost fronts, its market share declined dramatically in the following years.

It took until 2014 for the sector to again produced SGD 84 billion worth of goods, but as other parts of Singapore's economy have grown, this amount translated to a smaller share of overall manufacturing of about 29 per cent. By 2018, Singaporean manufacturers were producing SGD 139.6 billion worth of computer and electronic parts, and by 2020 the sector had grown to 46.3 per cent of total manufacturing output.

Based on Singapore's Ministry of Trade and Industry, Singapore accounts for about five per cent of global wafer fabrication capacity and 19 per cent of the worldwide semiconductor equipment market share.

The semiconductor industry in Singapore consists of both foreign-owned chip makers and local contract manufacturers who support the chip-making industry. Besides GlobalFoundries, well-known chip makers like Samsung, Intel, SK Hynix, Micron and Qualcomm have a presence in the city-state.

Local companies include UMS Holdings, which has been in the business for over 20 years. UMS specialises in precision engineering and focuses on manufacturing high-precision front-end semiconductor components and performs complex electromechanical assembly and final testing services. Another notable Singapore based semiconductor company is test solutions provider AEM Holding. Recently, government investment firm Temasek Holdings raised its stake in AEM to almost 10 per cent. ASTI Holdings is a Singapore-based semiconductor manufacturing service provider offering IC programming and packaging solutions to its customers.

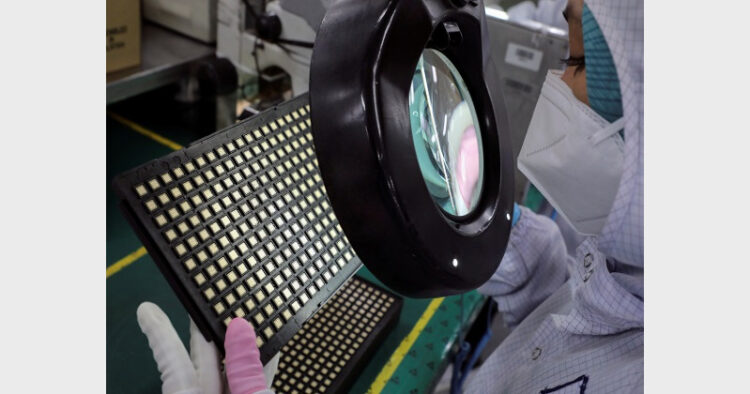

India has, in recent years, boosted its capabilities in the electronics manufacturing sector. It is the world's second-biggest smartphone maker behind China. Leading Apple contract manufacturers like Foxconn, Wistron and Pegatron have factories in India. So has Apple's rival Samsung. Samsung has established large handset manufacturing plants in Noida and Sriperumbudur. The former, which has a capacity of 120 million, is said to be the world's largest mobile phone factory.

Managing director of Indian contract manufacturer Optiemus Electronics, A. Gururaj, was quoted by Reuters as saying that the new initiative to attract semiconductor investments will help cut expensive tech imports. "The government's plan will help bring advanced technology, more employment and bigger investments into India," he continued.

The government expects the just announced scheme to create about 35,000 high-quality positions, 100,000 indirect jobs and attract investment worth INR 1.67 trillion (USD 22 billion).

Technology Minister Ashwini Vaishnaw told a news briefing the plan would help develop "the complete semiconductor ecosystem – from the design of semiconductor chips to their fabrication, packing and testing in the country."

Courtesy: ANI

Comments