Prime Minister Narendra Modi on May 12, 2020, announced the Special economic and comprehensive package of Rs. 20 lakh crores – equivalent to 10% of India’s GDP – to fight COVID-19 pandemic in India. He gave a clarion call for Aatma Nirbhar Bharat or Self-Reliant India Movement. He also outlined five pillars of Aatma Nirbhar Bharat – Economy, Infrastructure, System, Vibrant Demography and Demand.

Following the call of the Hon’ble Prime Minister, Minister for Finance & Corporate Affairs Nirmala Sitharaman laid down the details of the Aatma Nirbhar Bharat Package in a string of press conferences from May 13 to May 17 2020.

The Ministries of Finance & Corporate Affairs have immediately started implementation of the announcements related to the Economic Package under Aatma Nirbhar Bharat Abhiyaan. Regular reviews and monitoring of the implementation of economic package is being overseen by the Finance Minister personally.

In the latest review taken by Nirmala Sitharaman the following progress has been reported so far:

1. Global tenders will be disallowed in Government procurement tenders up to Rs 200 crore

Giving a major relief to the local MSMEs, Department of Expenditure has amended present Rule 161 (iv) of General Financial Rules, 2017 and GFR Rules relating to Global Tenders. Now, no Global Tender Enquiry (GTE) shall be invited for tenders upto Rs. 200 crore, unless prior approval is obtained from Cabinet Secretariat.

2. Relief to Contractors

It was announced by the Finance Minister that all central agencies like Railways, Ministry of Road Transport and Highways and CPWD will give extension of up to 6 months for completion of contractual obligations, including in respect of EPC and concession agreements.

In this regard, Department of Expenditure has issued instructions that (due to COVID-19 pandemic) on the invocation of Force Majeure Clause (FMC), contract period may be extended for a period not less than three months and not more than six months without imposition of any cost or penalty on the contractor/concessionaire. Instructions were also issued to return the value of performance security to the contractor/ suppliers proportional to the supplies made/ contract work completed to the total contract value. The same is being implemented by various Departments/Ministries.

3. Supporting State Governments

The Finance Minister announced that the Centre has decided to accede to the request and increase borrowing limits of States from 3% to 5%, for 2020-21 only in view of the unprecedented situation. This will give States extra resources of Rs. 4.28 lakh crore.

In an effort to support the financial position of the State Governments presently suffering from stress on account of revenue losses due to lock down, Department of Expenditure issued a communication to all the State Governments for additional Borrowing of 2 per cent of projected GSDP to the States in 2020-21 subject to implementation of specific State Level Reforms.

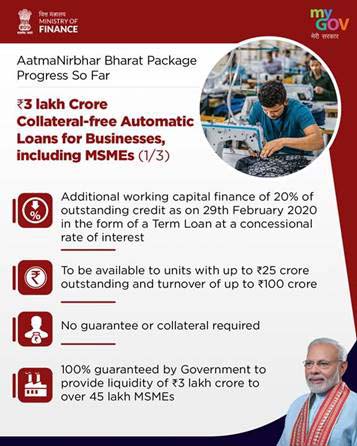

4. Rs 3 lakh crore Collateral-free Automatic Loans for Businesses, including MSMEs

To provide relief to the business, additional working capital finance of 20% of the outstanding credit as on 29th February 2020, in the form of a Term Loan at a concessional rate of interest will be provided. This will be available to units with upto Rs. 25 crore outstanding and turnover of up to Rs. 100 crore whose accounts are standard. The units will not have to provide any guarantee or collateral of their own. The amount will be 100% guaranteed by the Government of India providing a total liquidity of Rs. 3 lakh crore to more than 45 lakh MSMEs.

After taking Cabinet approval on May 20, 2020 Department of Financial Services issued Operational Guidelines for the Scheme on May 23, 2020 and Emergency Credit Line Guarantee Scheme (ECLGS) Fund was registered on May 26, 2020. In a short period of about one and half months noticeable progress has been achieved in identifying units, sanctioning as well as disbursing of loans to MSMEs.

5. Rs 45,000 crore Partial Credit Guarantee Scheme 2.0 for NBFCs

Existing Partial Credit Guarantee Scheme (PCGS) will be revamped and extended to cover the borrowings of lower rated NBFCs, HFCs and other Micro Finance Institutions (MFIs). Government of India will provide 20 per cent first loss sovereign guarantee to Public Sector Banks.

After the Cabinet approval on PCGS on May 20, 2020 Operational Guidelines for the Scheme were issued on May 20, 2020 itself. Banks have approved purchase of portfolio of Rs. 14,000 crore and are currently in process of approval/negotiations for Rs. 6,000 crore as on July 3, 2020.

6. Rs 30,000 crore Additional Emergency Working Capital Funding for farmers through NABARD

New front loaded special refinance facility of Rs. 30,000 crore sanctioned by NABARD during COVID-19 to RRBs & Cooperative Banks. This special facility to benefit 3 crore farmers, consisting mostly small and marginal farmers in meeting their credit needs for post-harvest and kharif sowing requirements. When kharif sowing is already on its full swing Rs. 24,876.87 crore out of Rs. 30,000 crore has been disbursed as on July 6, 2020, out of this special facility.

7. Rs 50,000 crore liquidity through TDS/TCS rate reduction

The Department of Revenue, vide its Press Release dated May 13, 2020, announced the reduction in TDS rates for specified payments to residents and specified TCS rates by 25% for transactions made from May 14, 2020 to March 31, 2021.

8. Other Direct Tax Measures

Between April 8 and June 30, the Central Board of Direct taxes (CBDT) has issued refunds in more than 20.44 lakh cases amounting to more than Rs. 62,361 crore, as stated in press release dated July 3, 2020. Remaining refunds are under process. The Department also issued Notification dated June 6, 2020, the due date for income-tax return for FY 2019-20 (Assessment Year 2020-21) has been extended from July 31, 2020 (for individuals etc.) and October 31,2020 (for companies etc.) to November 30, 2020. Further, the due date for furnishing of tax audit report has also been extended from existing September 30, 2020 to October 31, 2020.

The Department of Revenue has extended the time barring date for assessments getting barred by limitation on September 30, 2020 to March 31, 2021. In this regard, through the Press Release dated June 24, 2020, it has been already been communicated that making payment without additional amount under the ‘Vivad se Vishwas’ Scheme will be extended to December 31, 2020 and the legislative amendments for the same in the Vivad Se Vishwas Act, 2020 (VsV Act) shall be moved in due course to time. Further, through the Notifications, compliance dates mentioned under the VsV Act falling during period March 20, 2020 to December 30, 2020 have been extended to December 31, 2020.

9. Further enhancement of Ease of Doing business through IBC related measures

The Ministry of Corporate Affairs has raised the threshold of default under Section 4 of the IBC, 2016 to Rs 1 crore (from the existing threshold of Rs 1 lakh) i.e. “in exercise of powers conferred under Section 4 of Insolvency & Bankruptcy Code, 2016 (31 of 2016), the Central Government hereby specified Rs 1 crore as the minimum amount of default for the purposes of the said section” vide Notification dated June 6, 2020.

The Ministry of Corporate Affairs is finalising a special insolvency resolution under section 240A of the Code, to provide relief to the MSMEs and the same would be notified soon.

Insolvency and Bankruptcy Code (Amendment) Ordinance, 2020 has been promulgated on June 5, 2020 thereby provided for insertion of Section 10A in the Insolvency and Bankruptcy Code 2016 to temporarily suspend initiation of Corporate Insolvency Resolution Process (CIRP) under Section 7, 9 & 10 of the Code for a period of six months or such further period, not exceeding one year from such date.

10. Rs 30,000 crore Special Liquidity Scheme for NBFCs/HFCs/MFIs

After the Cabinet approval of the Special Liquidity Scheme for NBFCs/HFCs, the Scheme has been launched. RBI has also issued a circular to NBFCs and HFCs on July 1, 2020 itself on the Scheme. SBICAP has received 24 applications requesting about Rs. 9,875 crore of financing as on July 7, 2020 which are being processed. The first application in this regard has received its approval and the remaining are also being considered.

(Source: PIB)

Comments