Cover Story: BALANCING ACT

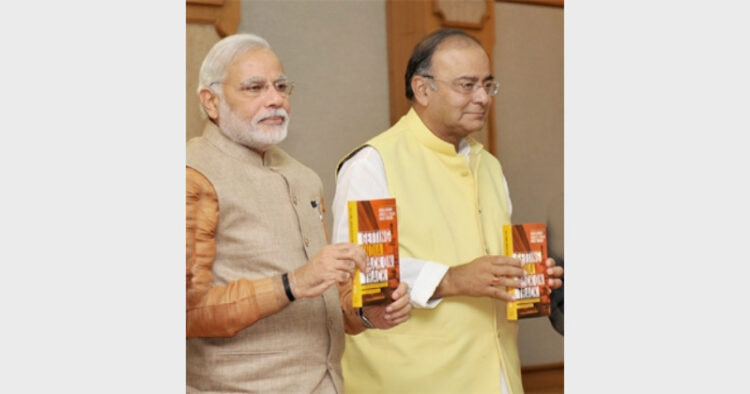

The budget 2014-15 was caught up between high hopes and hard decisions. Finance Minister in his budget speech said, “The prevailing economic situation presents a great challenge. It calls for a conscious choice to be made by all of us. Should we allow this drift to carry on and watch helplessly? Should we allow our future to suffer because of our indecisiveness? Should we be victims of mere populism or wasteful expenditure?”. In such a challenging situation instead of going for Big Bang changes, Arun Jaitely has opted for a Balancing Act between Ensuring Growth & Controlling Inflation, Industry & Agriculture, Populism & Pragmatism, Urbanisation & Rural Development, encouraging Indigenous Entrepreneurship and creating Conducive Environment for Investment in select sectors. While retaining the Stamp Modi of addressing high aspirations, Finance Minister has cleverly played within the limitations of the fiscal restraint. Therefore, despite divergent views about presentation, details and specificities, all over budget is positively received.

The maiden budget of the new NDA government presented on Thursday bears the stamp of Modinomics, because the announcements made by the Finance Minister Arun Jaitley were in line with the vision and promises made by Prime Minister Narendra Modi during his election campaign.

“The Budget will give an impetus to Jan Bhagidari (people’s participation) and Jan Shakti (people’s power),” said Narendra Modi after the Budget.

Budget 2014: Highlights

- Investment limit under Section 80C is increased from Rs 1 lakh to Rs 1.5 lakh.

- Tax exemption limit for small and marginal, and senior tax payers changed from Rs 2.0 to Rs 2.5 lakh. For senior citizens, up to Rs 3 lakh per annum.

- Housing loan rebate raised from Rs 1.5 lakh to Rs 2 lak

- Review revised Direct Taxes Code

- Rs 98,030 crore will go towards women welfare and Rs 81,075 crore to child welfare

- Programme for displaced Kashmiri migrants with Rs 500 crore to be started

- PPF limit to be raised to Rs 1.5 lakh

- Social security: minimum pension of Rs 1000 per month for all subscribers of EPFO scheme

- Rupess 500 crore programme for displaced Kashmiri migrants

- “Fifteen new Braille presses will be established and 10 existing ones will be revived

- Rupees 50,548 crore proposed for Schedule Caste development

- Rupees 1000 crore provided for rail connectivity in northeastern region.

- Rupees 100 crore set aside for project to link rivers

- Rupees 100 crore for the development of Archaeological sites; Gaya to be developed as world class tourism spot

- Government departments and ministries to be integrated through E-platform by 31 December this year

- Rs 37, 800 crore allotted for National Highway

- Rupees 50 crore set aside for Pashmina Production program in J&K

- Rupees 1000 crores announced to set up National Industrial Corridor

- Rs 5000 crore short time rural credit refinance fund for 2014-15

- Slum development to be included in Corporate Social Responsibility activities

- Rupees 8000 crore for National Housing Banking programme

- Rupees 14,389 crore for Pradhan Mantri Gram Sadak Yojana

- Rupees 500 crore for National Rural Internet and Technology Mission

- Rs 200 crore for 'Statue of Unity' of Sardar Vallabh Patel

|

Similar to the Trinity of Brahma (The Creator), Vishnu (The Preserver), and Shiva (The Destroyer) that play an all encompassing role in balancing the Shrishti (Universe), the Union Budget 2014-15 makes a fervent pitch for attaining a balance by creating growth, preserving an ideal level of deficit, and destroying (supply side) inflation.

Bitter Pills

- Lock-in for long term capital gains tax on sale of listed non-equity MFs raised to 3 years, tax rate up from 10% to 20%

- Prices of fizzy drinks, flavoured water, juices & energy drinks to increase by 5%

- Excise duty on cigarettes, cigars, cheroots and cigarillos increased by 11%-72%

- Radio taxis brought under service tax net

- Cut & polished diamonds, coloured gemstones to attract 2% customs duty

- 10% surcharge continues for individuals with income over Rs 1 crore

|

In his maiden Budget speech Jaitley said that, India had a strong urge to grow and free itself from the curse of poverty. “The people are in no mood to suffer unemployment, inadequate basic amenities, lack of infrastructure and apathetic governance. The Indian economy will have to maneuver its way through a sluggish global recovery.”

He said that the government intended to usher in a policy regime that would bring the desired growth, lower inflation, sustained level of external sector balance and prudent policy stance. The FM pointed out that the present economic situation presented a challenge of slow growth in manufacturing, infrastructure and there was a need to introduce fiscal prudence. “The tax to GDP ratio must be improved and non-tax revenues increased”. He has set a target of fiscal deficit of 3.6% for 2015-16 and 3% for 2016-17.

|

Finance Minister Arun Jaitley: The task before me is very challenging because we need to revive growth, particularly in manufacturing and infrastructure to raise adequate resources for our developmental needs…We need to introduce fiscal prudence that will lead to fiscal consolidation and discipline. We cannot leave behind a legacy of debt for our future generations. There is an urgent need to generate more resources to fuel the economy.

Prime Minister Narendra Modi: Since we formed the Government there were discussions about whether this Government can free the nation from crisis but the Railway Budget and today’s General Budget show that we are moving in the right direction.

FICCI President Sidharth Birla: Through this budget the Finance Minister has set the ground for repair of the economy. There has been a mix of both short term and long term measures geared towards boosting confidence of all key constituents.

|

The FM has retained the targets of tax collection at the level of the interim budget presented in February. Proposals have been made with a view to introduce measures to revive the economy, promote investment in manufacturing sector and rationalize tax provisions so as to reduce litigation as well as to address the problem of inverted duty structure in certain areas. In addition, some relief is proposed to individual taxpayers and to certain sectors of the economy.

Opposition Reacts

Sonia Gandhi: There is nothing new, they have merely continued our schemes.

Sharad Pawar: It is a disappointment, rain of announcements, bunch of words and, lastly, insufficient fuel supply to engine of growth.

Lalu Prasad Yadav: All sections of society have been cheated. Where is the BJP's slogan of 'Swadeshi' now?,

wherever you see, it's just FDI & PPP.

|

“The UPA government didn’t increase the tax exemption limits for a long time. This budget has not only made a block buster increase in I-T exemption limit, but also for investments in PPF, LIC, NSC (eligible under Section 80C)etc. and for people paying interest on self occupied house property. This will benefit all tax payers, especially the middle class households,” said Chartered Accountant Abhishek Aneja.

CHEAPER

-

Low-end TV sets

-

LED/LCD TVs below 19 inch

-

Footwear priced between Rs 500 to Rs 1,000.

-

Soaps, Cosmetics, Certain pharmaceuticals.

-

India assembled/ manufactured Desktop, laptops and tablets.

-

Mobile SIMs

-

RO based water purifiers

-

LED Lights, fixtures and lamps

-

Solar equipment and products.

-

Life micro insurance policies

-

HIV/AIDS drugs and diagnostic kits

-

DDT insecticides

-

Sports Gloves

-

Matchbox

|

|

COSTLIER

- Cigarettes & Cigars

- Pan masala, Gutka and chewing tobacco, scented tobacco

- Aerated drinks with sugar, Cold Drinks

- Imported electronic products

- Portable X-ray machines

- Half cut/broken diamonds, polished diamond and gemstones.

- Radio Taxi

|

|

There has been a mix of both short term and long term measures geared towards boosting confidence of all key constituents, which is an attempt to improve the present economic health of the nation.

One of the key priorities has been to see a clear course of action to end tax adventurism. The government has tried to address this by promising not to change any of the tax provisions retrospectively which creates a fresh liability and committing to provide a stable and predictable taxation regime that would be investor friendly and spur growth. However, FM announced the creation of a high-level committee to scrutinise any new case based on the retrospective amendments of 2012 in direct transfers, to avoid further litigation.

In a bid to tackle food inflation, the FM proposed setting up of a Price Stabilisation Fund and a commitment by Centre to work closely with States to re-orient their respective APMCs to provide for establishment of private market yards, along with the introduction of soil health cards, setting up of agri-tech infrastructure fund, launch of a technology driven second green revolution including ‘protein revolution’ and greater focus on irrigation.

Special emphasis has been given on entrepreneurship and skill development for which Skill India initiative has been proposed to be launched. “PM in his pre-poll speeches emphasized on this, and if implemented properly, it would help in doing away with unemployment in a big way and spur growth,” Aneja added.

The budget has given an indication that the government will promote FDI selectively in sectors – 49% in defence and insurance sectors, with full Indian management and control. Keeping with the Basel III norms, Rs 2.40 lakh crore will be infused in the Indian banking system, and the citizens would be allowed direct share holding in these banks. The government will also provide tax incentives for real estate and investment trusts.

While contesting from Varanasi, Modi had promised the electorate that if BJP came to power, it would take up the cause of cleaning river Ganga and ameliorate the condition of the weavers – the majority of which are Muslims. The budget has earmarked Rs 2037 crore for a new integrated project – Namami Ganga, and announced a handloom facilitation centre at Varanasi.

Following BJP’s priority to North East states, special emphasis has been given to infrastructure building, sports and overall development with provisioning of Rs 53,706 crore.

For the first time, the budget has special provisions for displaced Kashmiri migrants, which reflects the Modi government’s approach towards J&K issue.

Out of the total budgeted expenditure, Rs 98,030 crore will go towards women welfare and Rs 81,075 crore to child welfare. The total expenditure is estimated at Rs 17,94,892 crore.

-Debobrat Ghose (The writer is a Delhi-based journalist, who writes on various national issues).

|

Defence Defence

- Rs 5000 crore for defence outlay over and above amount provided under interim budget

- National Police Memorial to be set up. Rs 50 crore set aside for this purpose

- Rs 100 crore for development of Technology Development Fund

- Rs 100 crore War Memorial at Princess Park, India Gate

- Policy of One Rank One Pension to be adopted for defence personnel

- FDI in defence up from 26 to 49 % with Indian management and control

The announcement of a War Memorial and Museum at Princes Park, near India Gate, and contribution of Rs 1000 crores towards ‘One Rank One Pension’, will fulfill long cherished dream of large number of ex-servicemen.

—Alok Bansal, Retired Defence Officer & Director of Centre for Security and Strategy, India Foundation |

Trade & Industry Trade & Industry

- New industrial clusters to be set up on golden quadrilateral

- Special SEZs for women in 100 districts

- Reduction in excise duty for specified food package industry from 10% to 6%

- MSMEs are the backbone of the economy; to be revived through a Committee to examine and report in three months

- Indian Custom Single Window Project to be taken up for facilitating trade

- Tax proposals on indirect tax front would yield Rs 7,525 crore

It is a growth oriented and balanced budget. For industry it is a win win situation. There is booty for all sectors

particularly for IT sector, warehousing, textile, education, etc. Overall the budget is excellent.

—Subhash Agrawal, Chairman and Managing Director, SMC Group & Sr. Member, ASSOCHAM Managing Committee |

|

Agriculture Agriculture

- Rupees 100 crore set aside for Kisan Television to provide information on agriculture issues

- Rupees 50 core for indigenous cattle breed and blue revolution for inland fisheries

- Propose to provide finance to 5 lakh landless farmers through NABARD

- Rupees 100 crore for scheme to provide soil health cards, and Rupees 56 crore for soil testing labs across the country

- Rupees 200 crore for Agriculture University in Andhra Pradesh and Rajasthan, and Horticulture University in Haryana, Telangana

- A new urea policy would be formulated

- Rashtriya Krishi Vikas Yojana- 7860 crore rupees

- Agriculture and Allied Activities- 14362 crore rupees

- Bringing Green Revolution to Eastern Region- 400 crore rupees. Integrated Development of 60000 pulses villages in rain-fed areas

- Promotion of Oil Palm- 300 crore rupees

- Initiative on Vegetable Clusters- 300 crore rupees

- Nutri-Cereals- 300 crore rupees

- National Mission for Protein Supplements-Rs 300 crore

- Accelerated Fodder Development Programme-Rs 300 crore

- Rupees 8 lakh crore target for agriculture credit

- Seting up commercial banks for the farm sector

Much has been declared for agriculture, but I feel it does not contribute in enhancing the income of farmers, which should be on top of any government. If we enhance their income, it helps in arresting many problems at a time. Something more should have been done for agriculture,

villages and particularly for the farmers.”

—Devendra Sharma, Expert on Agriculture

|

Sports Sports

- Budget proposes to set up Sports University in Manipur

- Rs 100 crore set aside for training of sportspersons for the Asiad Games

The formation of National Sports Academy is a good initiative aimed at looking after the sports needs of the country. It is also good that the government is going to develop infrastructure for promotion of sports.

—Chetan Chauhan, Former Cricketer

|

Education Education

- Government t proposes to set up Center of Excellence in MP named after Lok Nayak Jai Prakash Narayan

- Rupees 500 crore set aside to set up four AIIMS – in Andhra Pradesh, West Bengal, Vidarbha and Purvanchal

- 5 IITs, 5 IIMs, 4 AIIMS, 12 medical colleges, 2 agriculture universities to be set up

- The budgetary allocation to Ministry of HRD for various schemes has been increased by 17% to Rs.65, 877 crore. Further, service tax exemption has been granted for institutes offering vocational courses

- Under the total budgetary allocation, Rs 272.58 billion has been allocated for Sarva Shiksha Abhiyan, Rs 39.83 billion for Rashtriya Madhyamik Shiksha Abhiyan, Rs 52.84 billion for scholarships and remaining for up-gradation of existing universities

- Rs. 100 crore for virtual classrooms (e-learning)

- Conduct new teacher training programmes.

- Revive Beti Bachao scheme: Rs 100 crore set aside for it

- National Centre of Humanities will be set up in Madhya Pradesh

- Rs 100 crore for modernisation of Madrasas

Welcome promises for both higher and elementary education. Teachers Training Programme after Pandit Madan Mohan Malviya may prove to be a milestone. Equally, the proposals to set up 5 new IIMs, 5 IITs, 12 more Government Medical colleges, four more AIIMS, etc. are good proposals. The allocations for Sarva Shiksha Abhiyan and Rashtriya Madhyamik Shiksha Abhiyan are also good. All these proposals are expected to take the education sector of the country to new heights.

—Dr JS Rajput, Former Director, NCERT |

Energy and Environment Energy and Environment

- Clean energy cess increased from Rs 50/ tonne to Rs 100/tonne

- To complete gas grid, 15000 km of additional pipeline to be developed through PPP mode

- New and renewable energy deserves high priority; ultra modern power projects to be taken up in Rajasthan, Tamil Nadu, Ladakh with Rs 500 crore

- Governmentt committed to providing 24/7 power supply to all homes. Deen Dayal Upadhyay Gram Jyoti Yojna for electricity supply to rural areas

- Rs 4200 crore for Jal Marg Vikas project on river Ganga connecting Allahabad to Haldia

- 200 Cr for power & 500 Cr for water reforms

|

Women Women

- Crisis Management Center for women will be set up at Delhi; money from Nirbhaya fund will be utilized for it

- Rs 98,030 crore announced for women welfare

- Goverment has announced Rs 100 crore funds for Beti Bachao, Beti Bachao Yojana

- Safety of women will be of prime importance

Since education is the most effective tool to make women self-reliant, the announcement of ‘Beti Bachoa, Beti Padhao’ scheme by Modi government is a welcome step. As far as security is concerned, it is not possible until we change the mentality of the people in the society. Overall the budget is farsighted. Price rise is a temporary issue. In long term the budget will prove beneficial for the entire country.

—Urmil Satyabhushan, Writer

|

|

Health Care Health Care

- The allocation for the Ministry of Health and Family Welfare has been inceased to Rs 373.30 billion. This is an increase of 49% over last time’s 32%

- The expansion of RSBY (Rashtriya Swasthiya Bima Yojana) to other categories such as rickshaw, auto-rickshaw and taxi drivers, sanitation workers, rag pickers and mine workers would also increase the demand for health care facilities. However, the decline in spending from Rs 304.77 billion as budgeted to Rs 248.94 billion

- Two key initiatives – free drug service and free diagnosis service – would be taken up on priority

Announcement for setting up more AIIMS and Medical College is a welcome step. But I feel India today needs more attention on primary healthcare. It should be a joint effort of the Centre State and should be taken up as a Mission like we have Rural Health Mission, etc. If we are able to ensure primary health to the people at their door steps the burden on big institutions like AIIMS will automatically reduce.

—RS Tonk, Consultant & Prof. of Medicine, RML, New Delhi

|

Defence

Defence Trade & Industry

Trade & Industry Agriculture

Agriculture Sports

Sports Energy and Environment

Energy and Environment Women

Women Health Care

Health Care

Comments