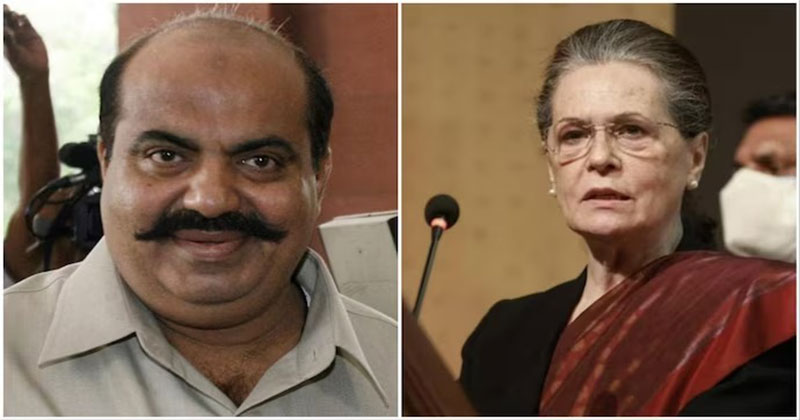

Mangaluru: In a major crackdown on fraudulent deposit schemes, the Mangaluru City Police have arrested four men accused of duping thousands of people in Dakshina Kannada and Udupi districts through bogus “Lucky Schemes.” Commissioner Sudhir Kumar Reddy identified the arrested as Ahmed Qureshi, Nazir alias Nasir, Mohammed Ashraf, and Mohammed Hanif. Together, they are alleged to have cheated over 16,000 people of more than Rs 14 crore through two different fraudulent enterprises.

Case 1: New Shine Enterprises fraud

The first case involves New Shine Enterprises, which lured members by promising them prizes and cash through a monthly lucky draw system. The accused reportedly collected Rs 1,000 per month for nine months and Rs 1,500 for the last two months from participants over an 11-month period. In return, they assured them of attractive prizes ranging from cars, bikes, plots, and gold rings to bumper cash rewards.

Police investigations revealed that the scheme amassed Rs 4.20 crore from around 3,000 people in the region. However, once the collection period ended, the accused abruptly shut down their office near Shamshuddin Circle, 2nd Block, Katipalla, without returning deposits or distributing promised prizes.

A complaint was filed by Shivaprasad, leading to the registration of a case at Surathkal police station on August 16. The accused Ahmed Qureshi (34) and Nazir (39) were arrested and produced before the court, which remanded them in police custody until August 25.

Commissioner Reddy confirmed that the duo operated without prior approval from any competent authority, violating provisions of the Unregulated Deposits Prohibition Act. They are also facing additional charges: Qureshi has two attempt to murder cases registered at Surathkal and one case for obstructing a government servant at Mangaluru South, while Nazir has one attempt to murder case against him.

During searches, police seized computer equipment, lucky draw boxes, registers, DVRs, and other records from offices located in Aisha Complex, BMR Complex, and Shine Mart. Assets including bank accounts, gold jewelery purchases, plots, vehicles, and property documents were also identified. Authorities have written to the District Collector, Deputy Divisional Officer, and Revenue Department seeking confiscation of all assets acquired through public money.

The police also revealed that Abdul Wahab and Bashir, linked to another entity called Wafa Enterprises Lucky Scheme, are under investigation based on statements from the accused.

Case 2: New India Royal and Green Light Lucky Schemes

In the second case, accused Mohammed Ashraf and Mohammed Hanif allegedly ran schemes under the names New India Royal Scheme and Green Light Lucky Scheme. They collected Rs 1,000 per month for one year from participants, promising monthly prizes like cars, bikes, plots, gold jewellery, and cash.

The fraudulent scheme managed to attract 13,000 members, raising more than Rs 10 crore. As in the earlier case, once the collection period ended, the accused failed to return the money or deliver prizes. They then suddenly shut down their office located in the BMR building near Shamshuddin Circle, Katipalla.

A complaint by Bhujanga Poojary led to the registration of a cheating case at Surathkal police station on August 11, 2025. The accused were arrested on August 12 and remanded in judicial custody for 15 days.

Police confirmed that previous ventures like the New India Premium Scheme and New India Bumper Scheme operated by the accused will also be investigated.

Seized assets in this case include bank accounts, gold ornaments, vehicles, land, a house in Bolur village, another in Bajpe, and five flats in Bajpe Tarikambla. Computer equipment and business records from their offices were also recovered. Authorities have recommended confiscation of all these properties under the Unregulated Deposits Prohibition Act.

Police appeal to victims and agents

Commissioner Sudhir Kumar Reddy appealed to members of the schemes and agents who collected money to approach the police with documents supporting their claims. “We want victims to come forward with all relevant records to ensure justice and recovery of assets. Such fraudulent deposit schemes will be pursued to the fullest extent of law,” he said.

Police also highlighted the scale of deception, noting that many victims had invested their savings in the hope of securing prizes. The schemes operated under the guise of community trust and personal networks, enabling the accused to gain credibility before absconding with the funds.

Comments