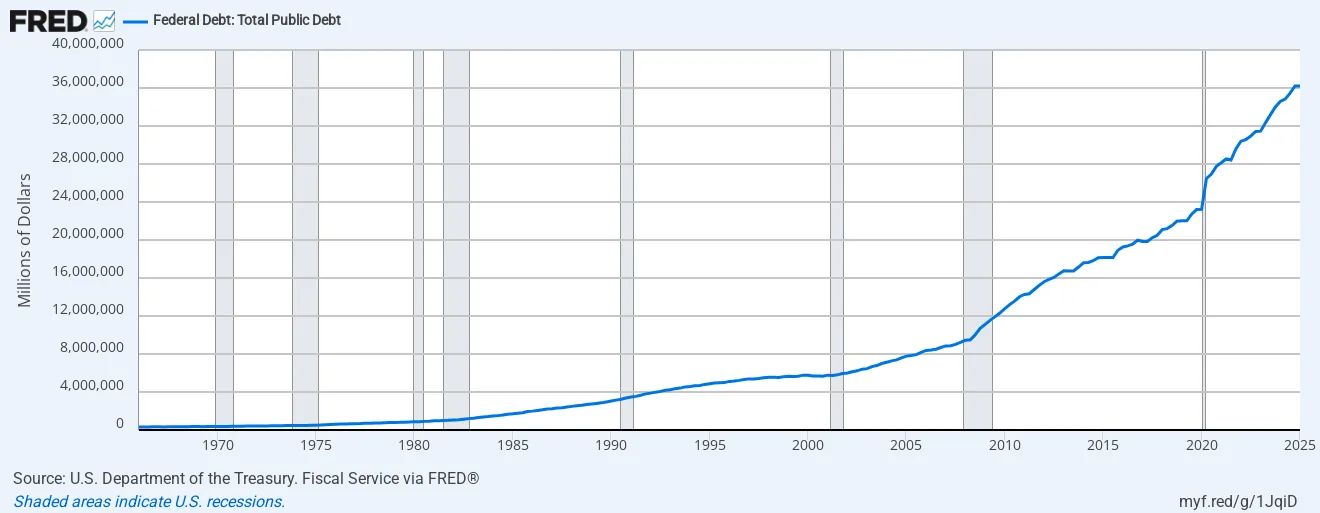

National debt of the USA is hitting headlines past few days as an impact of its ever-expanding debt crisis and tumultuous fiscal deficit. President Donald Trump’s economic and fiscal policies have indeed accelerated this burden. The latest debt numbers, further reflects the irreparable debt crisis of the USA and has sent warning signals across the global economy.

The US national debt has surpassed $37 trillion mark, thus further deepening the fiscal deficit of the American economy. The increasing debt burden can escalate inflation and cost of living crisis within the US. These mammoth numbers will erode the trust of the investors in American bond market which has been hailed as the most trusted bond markets of the world since decades. Most importantly, in the long-run dollar might loss its credibility as the most stable & reserve currency of the world and the volatility in the American economy will indeed have global repercussions as majority of the global economic transactions are undertaken in dollars.

Skyrocketing National debt burden and fiscal deficit

With the US national debt crossing the $37 trillion dollar mark, the debt to GDP ratio of the USA is at a stark 120 per cent. Economic analysts claim that this might reach to 200 per cent by 2047. Even the fiscal deficit of USA is 6.3 per cent of GDP. Mere interest payment on the debt costs $1 trillion for the USA annually and this is projected to reach $1.8 trillion by 2034. By 2035, interest payments could consume nearly one-third of all the federal revenue. At current levels, the federal debt equates to $1,00,000 per person in the country.

It is also analyzed that this colossal debt burden could shrink the US economy by $340 billion in the next decade. The most threatening fact is that inflation, massive job losses, and cost of living crisis will follow this spiking debt burden and fiscal cliff. The domestic jobs could fall by 1.2 million by 2035. The purchasing power of the households might fall by $300 to $1,200 over five years. In the long-run the onus of bridging the widening fiscal deficit may be transferred on the common Americans with increased tax rates and reduced purchasing power.

Trump’s ‘Big Beautiful Bill’ further builds the debt burden

Despite deepening debt burden, the spending of the US government is neither vigilant nor judicious. The latest ‘Big, Beautiful’ bill executed by Donald Trump further sharpens the federal spending, instead of cutting down. With an intention to ‘Make America Great Again’, apparently, the US President has raised the debt ceiling to $5 trillion. The tax exemptions and cuts asserted in the latest bill, might add trillions of dollar additional burden to the US economy. Economic analysts and fiscal experts adhere to the fact that Trump’s ‘Big Beautiful Bill’ indeed accelerates the debt burden of the US.

Analysts speculate that global confidence in the dollar as a stable reserve may wane in the long-run. As an impact, gradually US treasury bonds are becoming costlier and investor confidence is waning. Investors are looking for safe-heavens and in a paced-manner moving out of the US market. This leads to reduced demand for the US bonds leading to low prices. This debt burden and the erosion of trust in the US economy, sends economic and geopolitical shock waves across the global economic spectrum. As US treasuries serve as a benchmark for the global money market, decline in demand and prices of the US treasury bonds, impacts the prices of federal bonds across the globe, thus affecting the global economy.

Comments