Probably Trump’s decision have been guided by the following long term compulsions and factors – First, there is growing discontent among lower and middle-income group people of America because of growing unemployment and income disparities. And the major contributing factors to these are – most of the American MNCs are outsourcing manufacturing from China, Mexico, Vietnam etc.

Due to liberal trade policy, American markets have been flooded with goods imported from Canada , Japan, Bharat, Bangladesh, Indonesia, Brazil, South Africa etc. During election campaign Trump has frequently addressed this issue through the slogan “America for Americans “, ” “America first “. So it is highly expected that like his first term, in his second term also Trump should take ” Course Correction Steps” so that American MNC are compelled to start domestic production creating employment opportunities for local people. That’s why Trump is against everyone, foe or friends.

Second, America is the largest consumer of high value goods and services. Particularly China has been earning billions of dollars by exporting goods and services to America and has become the second largest economy. Now China is a challenge for America like Japan in the decades of 1980s. Chinese threat is greater than Japan because, Japan was only a challenge for America in terms of trade and economy but

China is a threat both in terms of trade – economy and global influence.Therefore, it is inevitable that America should try to balance China and undoubtedly it is clear that Trump is determined to treat China in the same way it has treated Japan in 1980s and onwards, so that China continues to remain a major trading partner of America but could never topple America both in terms of economy and global influence .

Third, since the fall of Soviet regime the world has become America centric unipolar. But now emergence of BRICS as a powerful economic coalition is threatening the sole dominance of America and creating possibility of a bipolar world again with America, NATO in one side and BRICS on the other. America is trying to weaponize dollar where BRICS are trying to dedollarize the global economy. US and NATO imposed sanctions over Russia since Ukraine war but imports of huge quantity of crude oil from Russia by China and Bharat have helped Russia a lot to counterbalance the affects of sanctions. Not only that, China has fueled the economy of Russia in this crisis days. So, Trump has threaten to impose secondary sanctions or extra tariffs on countries who will purchase oil from Russia or enter into any kind of trade deal with Russia which is going to indirectly affect both China and Bharat.

So Geo- politics, global dominance, world trade& economy, tariff war – all the issues have been intermingled. In this context we have to consider this volatile tariff imposition by Trump. Apparently it seems that Trump’s tariff is problematic for Bharat but a careful probing into the matter will reveal immense opportunities for Bharat to ” fish in troubled water.”

Now, according to 2024 data so far as available, major import partners of the US are – EU – 18.5 percent, Mexico – 15.5 percent, China – 13.4 percent, Canada – 12.4 percent, Japan – 4.5 percent. Let’s look at the latest countrywise tariff rates imposed by Trump either by bilateral trade deal or by formal letters: Canada – 35 percent, EU and Mexico – 30 percent, Japan – 15 percent, South Korea, Malaysia – 25 percent, Bangladesh – 35 percent, Myanmar – 40 percent, South Africa – 30 percent, Indonesia – 19 percent.

In contrast to this, in a situation of pending trade deal, Bharat’s exports to America are currently subject to 26 percent tariff.

At present, Trump has adopted harsh line against Russia, China and far left Lula’s Brazil. So, far as Bharat is concerned, it has no rivalry with US either due to economic or global influence, at least at this present juncture. In the context of global dominance, Bharat is an important part of QUAD. On the contrary, CCP has been constantly showing hostility towards Bharat – it may be border disputes, claiming Arunachal as a disputed territory, naming various places there in the Chinese language, restricting exports of rare earth minerals and speciality fertilisers despite of continuous increase in Bharat’s imports from China. In fact CCP is silently trying to choke Bharat’s manufacturing and exports so that in future Bharat can’t replace China as the most important trading partner of the western world like in past China itself replaced Japan at the courtesy of the Western world. Only and only for this reason, Bharat and China can never be natural ally so far CCP is in the helm of affairs of China as the proverb goes, “There can’t be two swords in one sheath.” Recently, CCP has soften its approach towards Bharat but it’s just for absorbing the shock given by Trump.

So, Trump may bargain, pressurise to open our market for dairy & agro products, to stop purchase oil from Russia – but it can’t take much harsh approach against Bharat, because to counter China, America is indirectly dependent on Bharat.

So, Bharat has to play a balanced and dignified role in between America and the China-Russia axis. Russia-Bharat-China alliance is a trap for Bharat set by Russia and China just to counter America and NATO countries at the cost of Bharat. For long-term gain, it wouldn’t be a wise decision for Bharat to play in the hands of Russia-China or America-NATO axis. And for that, not only trade negotiations but we have to consider larger strategic issues such as Defence, climate change, civil nuclear treaty etc. We may have to open our market to some extent for America for Oil and Gas, ethanol, beverages, spirits, AI and almonds instead of agro and dairy products.

On that very optimistic assumption, we could expect that as per the final deal, tariffs on Bharat may vary from 15 to 25 percent keeping parity with Japan, South Korea and Vietnam ( like Bharat, all have more or less same kind of relationship with China.)

Despite of these critical and sensitive situation we may say that Trump’s tariffs open big windows for Bharat’s exports across multiple sectors. But how? Let’s discuss Bharat’s potential export gains ( country wise) from Trump’s tariffs. According to a Money control analysis –

(1)Bharat may replace 10% of affected countries’ US exports.

(2) South Korea risks lossing $ 5.4 billion in US exports to Bharat.

(3) Bharat eyes 11.5% of South Korea’s US market share.

(4) Bharat could claim 19.3% of Indonesia’s shipment.

(5) So far as Bharat’s capability, sectors in focus – Pharma, auto parts, iron and steel, Textiles, electrical & electronic equipments.

Country estimated top export gains categories to target

Now, let’s discuss Bharat’s potential export gains from Trump’s tariffs on top two US imports partner EU and Mexico. Major goods US imports from Bharat are – (1) pearls, precious stones, metals, coins (2) electrical and electronic equipments (3) Pharmaceutical products (4) machinery, nuclear reactors, boiler (5) articles of iron and steel (6) other made textile articles (7) motor vehicles (8) organic chemicals (9) articles of apparels not knit or crocheted.

In 2024 major US imports from Mexico are – (1) motor vehicles $137.23 BN, (2) machinery, reactors, boilers $105.83 BN (3) electrical and electronic equipments $ 87.56 BN (4) furniture $12.82 BN (5) plastic $ 8.23 BN (6) article of iron and steel $ 7.34 BN (7) pearls, stones, metal $ 5.82 BN (8) iron and steel $ 3.31 BN (9) aluminium $1.84 BN (10) toys, game $ 1.74 BN

In 2024 major US imports from EU are – (1) Pharmaceutical products $113.32 BN (2) machinery, reactors, boilers $ 99.4 BN (3) vehicles $ 56.8 BN (4) electrical and electronic components $ 42.60 BN (5) organic chemicals $34.53 BN (6) plastics $10.95 BN (7) articles of iron and steel $ 8.67 BN (8) pearls, precious stones $6.73 BN ( 9) iron and steel $5.86 BN (10) furniture $5.52 BN (11) inorganic chemicals $5.20 BN.

So far as Bharat’s manufacturing and exporting capabilities as per the above datas are concerned, Bharat could replace at least 15 to 20% of EU and Mexico’s US market share. Because major US imports from EU, Mexico and Bharat are more or less same. Moreover as per recent developments, instead of importer Bharat has become an exporter of toys to 153 countries.

At last let’s discuss Bharat’s potential export gains from Trump’s tariffs on China, the most complex case.

Following two days of “in depth and candid” talks in London, U.S. and Chinese negotiators “agreed in principle” to a framework for “implementing the consensus” between Trump and Xi June 5 call as well

as previous talks between their delegations in Geneva, said Li Chenggang, China’s international trade representative.

“The two largest economies in the world have reached a handshake for a framework,” said U.S. Commerce Secretary Howard Lutnick. “We’re going to start to implement that framework upon the approval of President Trump, and the Chinese will get their President Xi’s approval, and that’s the process.”

On June 11, Trump, posted on Truth Social: “Our deal with China is done, subject to final approval with President Xi and me. Full magnets and any necessary rare earths will be supplied, up front, by China. Likewise, we will provide to China what was agreed to, including Chinese students using our colleges and universities (which has always been good with me!). we are getting a total of 55% tariffs, China is getting 10%. The relationship is excellent! Thank you for your attention to this matter!” and it clearly suggests that the current tariff arrangements will remain in place.

A White House official told Reuters that the 55% rate represents the baseline 10% tariff Trump has imposed on goods imported from nearly every country plus an additional 20% tariff on Chinese, Mexican, and Canadian imports related to an order about fentanyl on top of 25% levies on imports from China imposed during Trump’s first term. Lutnick told CNBC that the 55% rate would “definitely” remain unchanged .

The 55 percent tariff consists of the worldwide 10 percent minimum baseline tariff imposed since April 2, 2025, the 20 percent “fentanyl” tariffs imposed since March 4, 2025, and the 25 percent Section 301 tariffs ( list 1,2,3) on most Chinese goods in place since Trump’s first term in office.

The current US-China trade relationship is highly complex, shaped by a tangled web of tariffs that have been imposed, adjusted, revoked, and reinstated going back to 2018. This ongoing situation, which first began

under the first Trump administration and has continued throughout the Biden presidency, has escalated significantly since Trump took office again in January 2025.

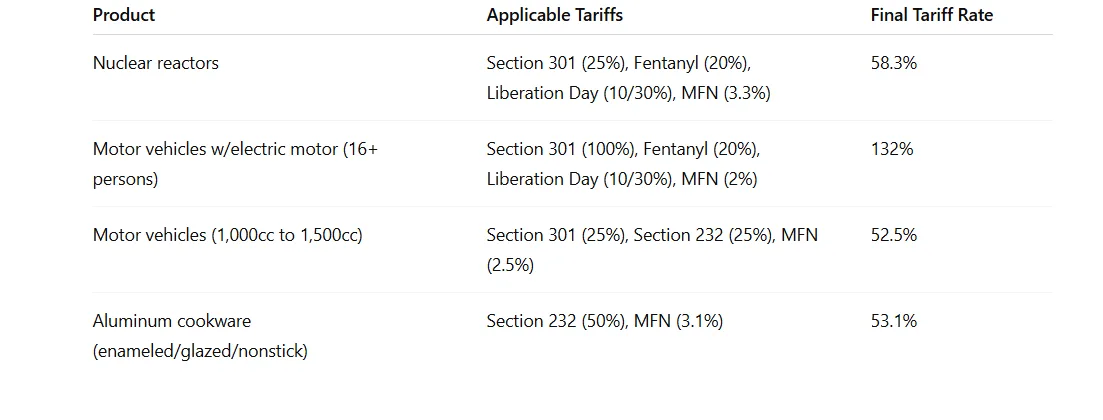

The complexity arises from multiple overlapping tariffs, including the Section 301 tariffs ( list 1,2,3-25%, four years review 100%) that seek to tackle what the US deems are China’s unfair trade practices, Section 232 tariffs (25-50%) related to national security concerns (mainly on steel, aluminum, and automobiles), fentanyl-related tariffs (20%) addressing illicit drug trade, reciprocal tariffs imposed in response to other countries’ duties, and most-favored-nation (MFN) tariffs that apply broadly.

Many of these tariffs are stacked, meaning multiple duties apply simultaneously on the same goods, significantly increasing the overall cost of imports from China.

According to the Peterson Institute for International Economics (PIIE), as of May 2025, the US’s average tariff on Chinese goods stands at 51.1 percent, covering all imports. In comparison, China’s average tariff on American goods is 32.6 percent, also applied broadly. PIIE notes that current US tariffs are about 1.5 times higher than when Trump began his second term in January 2025.

Assessing final tariff rates

Due to the different tariff lines in effect for different products, the final tariff rate on goods entering the US from China, or vice versa, will vary considerably. Below are some example tariff rates for Chinese products subject to varying tariff rates when entering the US.

Major US imports items from China which are common to Bharat are –

(1) Electrical , electronic equipments, (2) machinery, reactors boilers (3) toys, games, sports items,(4) plastics (5) furniture (6) vehicles (7) articles of iron and steel (8) articles of apparel knit or crocheted (9) footwears (10) other made textile articles (11) organic chemicals (12) Pharmaceutical products (13) stones, plaster, cement mica (14) Aluminium items

Most of the items are not of so much a high-tech category and those can be made in Bharat currently.

It is clear that to avoid supply chain disruption Trump will not impose tariff at the same rate on the same goods or products of China and other major exporting countries.

Moreover, Trump’s Vietnam deal going to put 20% tariff on import of Vietnamese goods and 40% tariff on goods that come through Vietnam that have been transhipped there. Basically, Vietnam is a place where China ships a lot of its goods, sticks a label on it and says made in Vietnam and therefore, gets around some of Trump’s tariffs on China. So, Trump is trying to really crackdown on this hub for goods that are transhipped from China through Vietnam. In a nutshell, Trump’s Vietnam deal shows China tariffs won’t fall much further.

So, we may be optimistic that in terms of tariff rate, Bharat would be in a much better position to reap the benefits of potential export gains. It could be easier for Bharat to grab the lion’s share of those exports to America very quickly.

China’s economy is heavily dependent on exports and the US is its biggest market. In recent years, companies have moved their supply chain outside China in an attempt to avoid tariffs, and Chinese businesses have also been developing non-US markets but no country can replace the purchasing power of US consumers.

Now, at this present juncture, China’s internal economy and business scenario is not favourable at all. While Japan’s debt-fueled bubble burst years after the Plaza Accord, China’s debt bubble has already collapsed before the trade war gained full momentum.

Today, China is struggling with massive corporate and local government debt, deflationary pressures, and a deep real estate collapse. Domestic demand remains stubbornly weak, and policymakers have already exhausted much of their monetary and fiscal arsenal. It has began since Corona period and China’s growth rate has dropped. America and the West know it’s very well and they have struck at the right time.

With gradual rise of middle and upper middle class in China, it is no longer the cheapest manufacturing destination and Bharat has recently become the cheapest manufacturing hub.

Bharat should be self-reliant in most of the imported products, ingredients imported from China by building necessary infrastructure.

We should have to follow the following policies –

1) Cost effective manufacturing

2) Efficient supply chain and logistics

3) Massive production capacity

4) Technological capabilities

5) Wide product range

For building massive production capacity, we need a heavy investment. The private sector will do their best in their own interest. FDI at favourable terms are also welcomed. But I think particularly for Pharma sector, Greenfield technology, AI &Quantum computing and related research, Rare earth exploration and mining – the Government should form NAVARATNA type PSUs through public offerings and issues of global depository receipts i.e. GDR. Government should also take initiatives to form “Amul ” type separate cooperatives for each sector specially – animal husbandry, organic farming and forest products, garments and apparels.

For Technological capabilities, related research and developments Germany, Japan and Israel could be reliable partners.

So, let’s hope for the best outcome compatible to the above hypothesis from much awaited Bharat-America and China-America final trade deal, so that Bharat could proceed on the basis of the most favourable terms under a given situation following game theoretic model and keep intact our sovereignty, integrity, independence and self Reliance.

Comments