On July 8, 2025, the Financial Action Task Force (FATF), the global watchdog for combating money laundering and terrorist financing, released its report titled “Comprehensive Update on Terrorist Financing Risks”. The report highlights the escalating misuse of e-commerce platforms, online payment systems, and emerging technologies by terrorist groups and lone actors to finance, plan, and execute acts of violence.

Drawing on case studies, including the 2019 Pulwama attack and the 2022 Gorakhnath Temple attack in India, the report underscores how digital platforms have become both enablers and shields for modern terrorism. It also addresses the role of state-sponsored terrorism, the exploitation of fintech innovations, and the urgent need for enhanced global cooperation and regulation to counter these evolving threats.

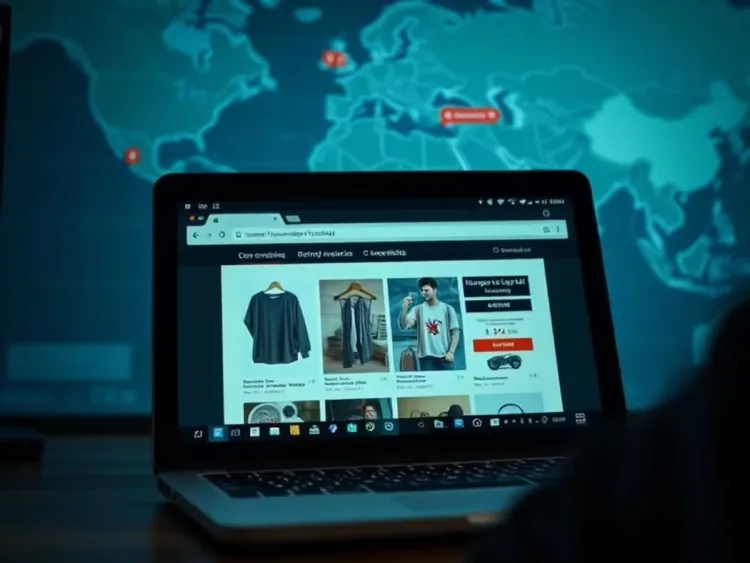

The rapid digital transformation of global economies has revolutionised commerce, communication, and financial systems. However, these advancements have also created vulnerabilities that terrorist organisations and lone actors exploit with increasing sophistication. The FATF’s 2025 report, Comprehensive Update on Terrorist Financing Risks, serves as a sobering reminder of how technology has become a double-edged sword in the fight against terrorism.

By leveraging e-commerce platforms, digital payment systems, cryptocurrencies, and encrypted communications, terrorists are bypassing traditional financial safeguards to fund and execute attacks. This report examines the FATF’s findings, focusing on two high-profile Indian case studies, the 2019 Pulwama attack and the 2022 Gorakhnath Temple attack, to illustrate the real-world implications of these risks. It explores the methods used by terrorists to exploit digital platforms, the role of state sponsorship, and the FATF’s recommendations for addressing these challenges.

The 2019 Pulwama Attack: E-Commerce as a Tool for Terror

The Pulwama attack, which occurred on February 14, 2019, in Jammu & Kashmir, India, remains one of the deadliest terrorist incidents on Indian soil. A suicide bomber affiliated with the Pakistan-based Jaish-e-Mohammed (JeM) detonated an improvised explosive device (IED), killing 40 Indian Central Reserve Police Force personnel.

The FATF report reveals a chilling detail: critical materials, including aluminium powder used in the IED, were purchased through Amazon, a leading e-commerce platform. This case highlights how terrorists exploit the accessibility and anonymity of online marketplaces, referred to by the FATF as Electronic and Physical Online Marketplaces (EPOMs), to procure materials for deadly attacks.

The investigation, conducted by India’s National Investigation Agency, led to charges against 19 individuals, including seven foreign nationals, under anti-terrorism laws. The use of a mainstream platform like Amazon not only facilitated discreet acquisition of explosive components but also complicated tracking efforts due to the volume of legitimate transactions on such platforms.

The Pulwama attack highlights the broader challenge of monitoring e-commerce ecosystems, where terrorists can blend into the digital crowd. It also raises questions about the adequacy of existing safeguards on platforms that prioritise user convenience and scale.

The 2022 Gorakhnath Temple Attack: Lone Actors and Digital Payments

On April 3, 2022, Ahmad Murtaza Abbasi, a lone-wolf attacker influenced by the Islamic State (ISIS), attempted an attack on the Gorakhnath Temple in Uttar Pradesh, India. The incident occurred just one day before a scheduled visit by Uttar Pradesh Chief Minister Yogi Adityanath, suggesting a targeted act of religious violence.

The FATF report details how Abbasi used PayPal to transfer approximately Rs 6.7 lakh (around $7,685 USD) to entities abroad believed to be linked to terrorist activities. Abbasi’s financial activities involved 44 international transactions facilitated through PayPal, with Virtual Private Networks (VPNs) used to mask his online identity.

PayPal’s detection systems eventually flagged and suspended his account, preventing further misuse. However, the case highlights the vulnerabilities of digital payment platforms, which offer speed, convenience, and cross-border access, features that terrorists exploit to move funds anonymously. Indian authorities confirmed Abbasi’s ideological alignment with global jihadist networks, debunking claims by his family that he was mentally unwell. This case illustrates the growing threat of lone actors who, radicalised online, leverage digital tools to finance and execute attacks with minimal physical infrastructure.

The Role of State-Sponsored Terrorism

The FATF report emphasises the persistent challenge of state-sponsored terrorism, where certain governments provide financial, logistical, and ideological support to terrorist organisations. While the report avoids naming specific countries, India has repeatedly accused Pakistan of supporting groups like JeM, responsible for the Pulwama attack.

State sponsorship enables terrorist networks to sustain long-term operations, including recruitment, training, and attack planning. The FATF notes that state-backed terrorism complicates global counter-terrorism efforts, as it often involves sophisticated financial networks that are difficult to dismantle.

For instance, funds from state sponsors may be funnelled through legitimate businesses or digital platforms, obscuring their origins. This dynamic underscores the need for international pressure, including sanctions and diplomatic measures, to hold state sponsors accountable.

How Terrorists Exploit Digital Platforms

The FATF report outlines several methods by which terrorists exploit digital ecosystems, leveraging their accessibility, anonymity, and global reach. These include:

1. Procurement of Explosives and Equipment: E-commerce platforms provide easy access to dual-use materials, such as chemicals, tactical gear, and electronic components, which can be delivered discreetly. The Pulwama case exemplifies how terrorists exploit EPOMs to acquire bomb-making materials without arousing suspicion.

2. Fund Generation through Sales: Terrorist groups engage in online sales or fake transactions to launder money and generate income. By posing as legitimate vendors, they can move funds through e-commerce platforms while evading detection.

3. Anonymous Financial Transfers: Digital wallets, peer-to-peer (P2P) payment systems, and cryptocurrencies enable pseudonymous or anonymous transactions. These tools allow terrorists to transfer funds across borders without relying on traditional banking systems, which are subject to stricter oversight.

4. Crowdfunding and Propaganda: Social media platforms serve as hubs for extremist recruitment, propaganda dissemination, and fundraising through crowdfunding campaigns. Terrorists exploit these platforms to radicalise individuals and solicit donations under the guise of charitable causes. The FATF warns that the very features that make digital platforms attractive, speed, scalability, and accessibility, also make them vulnerable to exploitation by those intent on financing violence.

Terrorist Adaptation to Fintech and Emerging Technologies

The FATF report highlights the growing sophistication of terrorist networks in leveraging fintech innovations. Mobile payment apps, P2P services, and cryptocurrencies have democratised access to global financial systems, allowing terrorists to operate outside traditional banking channels. Terrorists use encrypted communication platforms, VPNs, and multiple digital identities to evade detection.

The report cites examples of micro-transactions, gift cards, and blockchain-based currencies being used to obscure money trails. These methods enable terrorists to finance attacks with minimal risk of interception, as small, fragmented transactions are harder to trace. Emerging technologies, such as artificial intelligence and decentralised finance (DeFi), pose additional challenges. AI-driven tools could potentially be used to automate propaganda dissemination or optimise financial transactions, while DeFi platforms, which operate without centralised oversight, offer new avenues for anonymous funding.

The FATF emphasises that these technological advancements are creating a digital arms race, where policing must continuously adapt to keep pace with terrorist innovations.

FATF’s Recommendations: Countering the Threat

To address these evolving risks, the FATF proposes several measures for its over 200 member jurisdictions:

1. Strengthen Regulation of Digital Payment Systems: Governments and financial regulators must enhance oversight of fintech firms, e-commerce platforms, and digital payment services. This includes implementing robust Know Your Customer (KYC) protocols and transaction monitoring systems to detect suspicious activities.

2. Enhance International Cooperation: Cross-border transactions require global collaboration to share intelligence and coordinate enforcement actions. The FATF urges nations to establish real-time information-sharing mechanisms to track terrorist financing networks.

3. Monitor EPOMs and Crowdfunding Platforms: E-commerce platforms and social media channels must be subject to stricter scrutiny to prevent their use for terrorist fundraising or propaganda. This may involve collaboration between governments and private-sector platforms to develop advanced detection algorithms.

4. Hold State Sponsors Accountable: The international community must impose sanctions, diplomatic pressure, and other measures on governments found to support terrorist organisations. This includes targeting financial networks that facilitate state-sponsored terrorism.

The Digital Arms Race

The FATF report highlights that the rapid evolution of technology is outpacing current counter-terrorism measures. The anonymity offered by digital platforms, combined with the global reach of fintech, enables terrorists to operate with unprecedented agility. Lone actors, in particular, pose a unique challenge, as their minimal digital footprints make preemptive detection difficult.

The rise of AI, blockchain, and decentralised financial systems is likely to exacerbate these risks. For instance, AI-driven chatbots could be repurposed for radicalisation, while blockchain-based transactions could render traditional financial tracking obsolete. Addressing these challenges requires not only technological innovation but also a paradigm shift in global counter-terrorism strategies.

India’s Stand and Global Implications

India has consistently advocated for stronger global action against terrorism, particularly at forums like the United Nations. It has called for enhanced information sharing between financial institutions and intelligence agencies to disrupt terrorist financing networks. The Pulwama and Gorakhnath Temple attacks highlight India’s vulnerability to both organised terror groups and lone actors, emphasising the need for robust domestic and international countermeasures.

Globally, the FATF’s findings have far-reaching implications. As digital platforms become integral to economic and social systems, their misuse by terrorists threatens not only individual nations but also global stability. The interconnected nature of digital ecosystems means that vulnerabilities in one country can have ripple effects worldwide.

Vigilance in the Digital Age

The FATF’s report serves as a critical wake-up call for governments, technology companies, and financial institutions. The exploitation of e-commerce platforms, digital payment systems, and emerging technologies by terrorists represents a paradigm shift in the nature of global terrorism. The cases of the Pulwama and Gorakhnath Temple attacks illustrate how digital tools have blurred the lines between legitimate commerce and illicit activities.

As terrorists adapt to new technologies, the international community must respond with equal agility, leveraging innovation, cooperation, and regulation to close vulnerabilities. The challenge is immense: technology’s benefits, connectivity, efficiency, and accessibility must be preserved while mitigating its risks. The question is not whether terrorists will continue to exploit digital platforms, but whether the global community can act decisively to stay ahead in this digital arms race.

Comments