It’s a known fact, until now and even today, that the United States of America, leader of consumerism, capitalism and mecca of instant gratification and leader of materialism, has the largest trade deficit (imports minus exports of the country). It reached a high of USD 1.1 trillion in 2023 and reduced to 914 billion USD in 2024.

Using Market As Bait

The United States opened its markets and intelligently used this bait as a tool to influence and increase its influence on every matter, including financial, geo-political and social, by allowing countries to sell more in the US.

In addition to this, smartly, the United States moved the production of low value-added products to the rest of the world. Where high-end technology was required, their copyright and patents were continued to be owned by the companies in the United States, whilst the manufacturing or the execution the same (Outsourcing the product creation, retaining the copyrights on technology) happened in other countries, ensuring higher margins, fewer challenges on the local soil and sustained profitability for the US corporations for longer periods. During the time, when the US was busy skimming the elite work, China took the leap and took over all so-called redundant or low value jobs, but silently learning and recreating and regrouping the technology through process redesigning thereby not violating the patent or the copyright.

Slowly and steadily, China started exporting from basic necessities like hand towels to high-end chips, creating a trade deficit for the US with US D 295.4 billion in 2024, six per cent jump over 2023. In other words, 30 per cent of the total trade deficit of the US is just created by one country exporting massive goods and services and then using the same money to push and nudge the US down, militarily and technologically and financially.The result is what one is witnessing today. Tariffs and Reciprocal Tariffs.

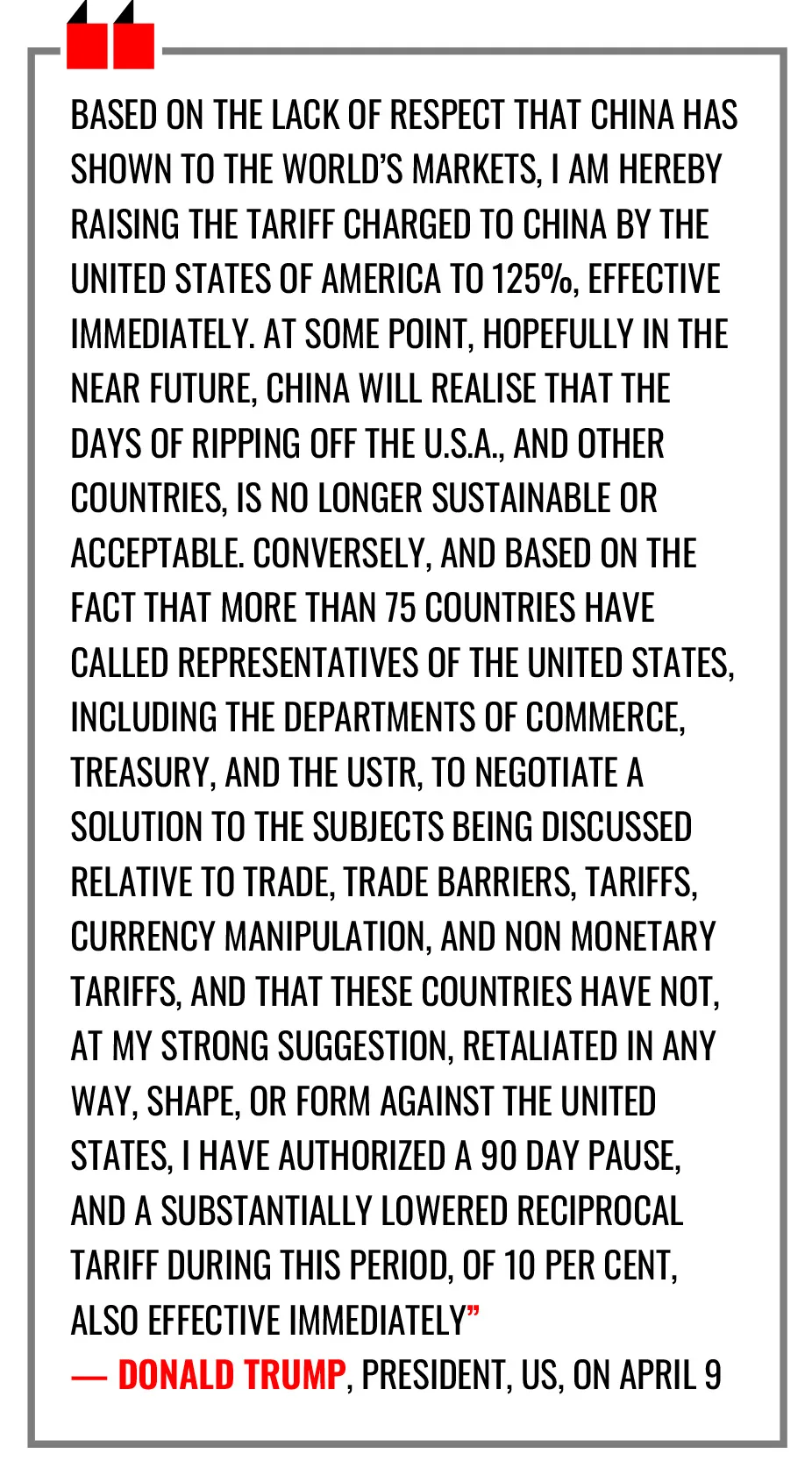

On April 2 2025, the President of the United States signed an executive order increasing the tariffs on all imports coming to the United States from 57 exporting nations with a range of 11 per cent to 50 per cent, protecting the economy from dumped cheap goods, protecting the jobs of local people and reducing the trade deficit for its nation. The day he termed as Liberation Day. President Trump has been a strong advocate, proponent, and backer of import tariffs, and in his previous term, he imposed tariffs on Chinese solar panels, washing machines to steel to aluminum from five per cent to 50 per cent. Quite a few of them got renegotiated and were brought down, whilst some of them remained intact through his term as well as Biden’s term. Trump didn’t use tariffs only for the economic protection of the country, as one can witness in the case of China, but sometimes to solve social issues as well.

First Term Analogy

The case in point is Mexico. May 30, 2019, President Trump then announced a five per cent tariff on all products coming from Mexico, effective from June 10 2019. He further announced that another five per cent hike, in addition to freshly hiked tariffs, will take effect from July 1 2019 and another five per cent hike after three months, until Mexico ensures that it stops illegal migrants from infiltrating the United States. Mexico quickly responded, taking swift action on the illegal entry of migrants into the US and post negotiations, the tariffs were removed.

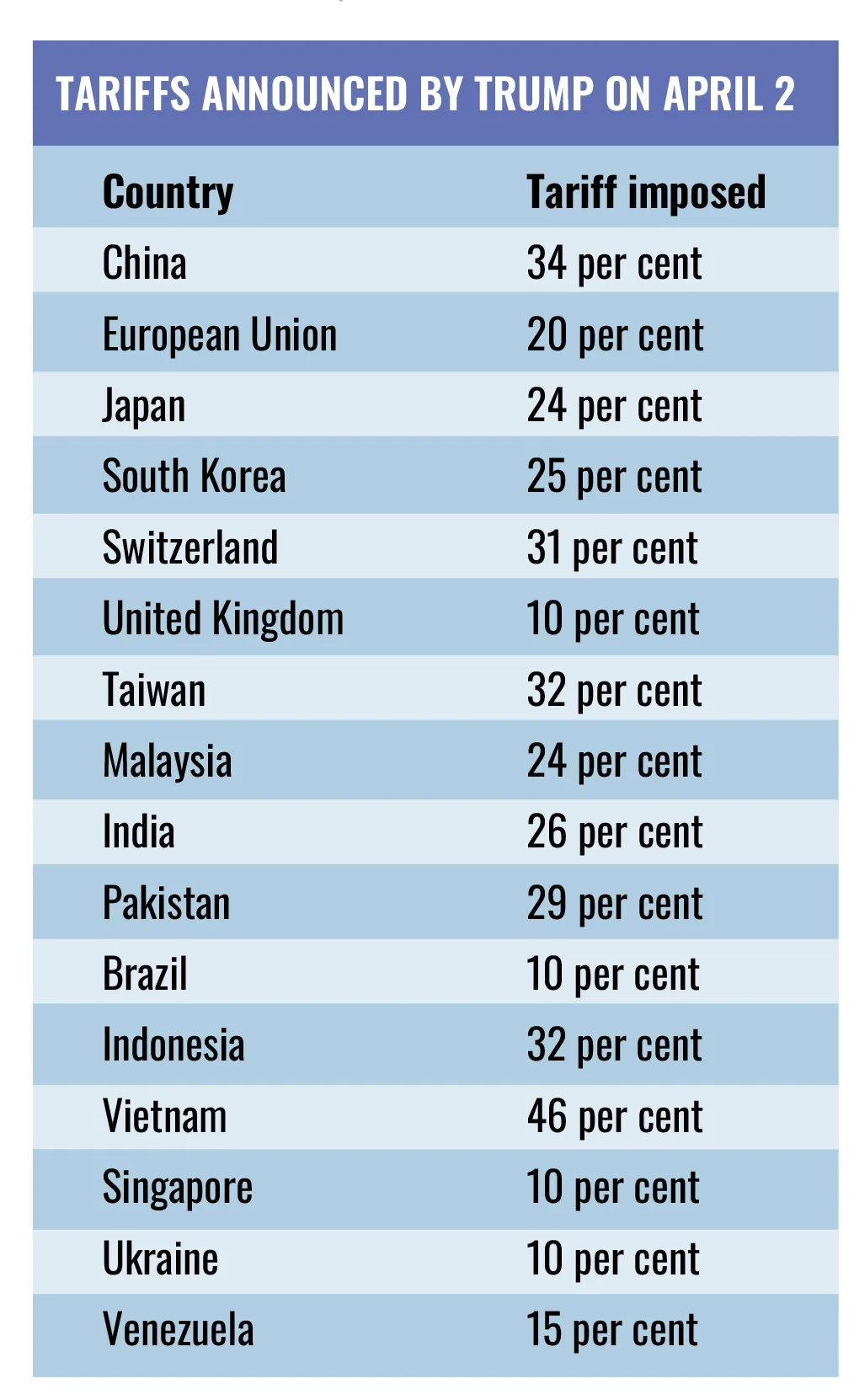

This time around, Asian nations face the toughest task and bear the worst brunt of the Trump reciprocal tariffs. With Cambodia at 49 per cent additional tariff, Vietnam at 46 per cent, Indonesia with 32 per cent, Taiwan with 32 per cent, Thailand at 36 per cent additional tariff, China with 34 per cent and Bharat with an additional 26 per cent tariff.

The European Union, which has the lion’s share of 18.5 per cent in the US imports, was levied a 20 per cent additional tariff, whilst the UK was levied an additional 10 per cent and Switzerland with 32 per cent. The result of this is that most countries started to arrive on the negotiation table with the US.

China behaved differently. Instead of negotiating, it levied a retaliatory 34 per cent import fee, and the outcome was grave. President Trump warned China of an additional 50 per cent over and above 34 per cent if China does not withdraw retaliatory tariffs on the US goods sold in China.The US warning turned into reality, and the 104 per cent tariffs were imposed on certain Chinese goods that are being imported into the US. Immediate counter action by China, came in by imposing 84 per cent duty on the US goods. Also, certain US companies have been added to the list of unreliable companies, thereby not allowing the government or any Chinese entity to do business with such US corporations. Though initial warnings and war of words were exchanged between the US and the neighbouring countries of Mexico and Canada, no further tariffs were imposed. Earlier, on April 2, 2025, Trump had imposed 25 per cent tariffs on Mexico and Canada for not curbing migration and fentanyl trafficking but exempted USMCA (United States-Mexico-Canada Agreement) compliant goods, giving a soft exit to both the countries.

These tariffs are surely harmful for the countries that are exporting to the US as it will increase the price of the end goods for the end customer, and that will, in turn, impact the purchasing propensity. Furthermore, it can also harm the US economy as other countries may start putting (as has been seen in case of China) further reciprocal tariffs on the goods exported by the US like phones, Air crafts, machinery etc. reducing the demand in those countries for the US manufactured products and that can lead to layoffs in the US and possiblly leading to recession in the US. Quite a few market players believe that if the cost of goods and services in the US due to tariffs go up, it will make goods and services more expensive for the US National and US citizens, stoking inflation. In February 2025, inflation in the United States stood at 2.8 per cent, down from three per cent in January 2025. Global financial markets, including the US, have been spooked with this event, assessing the immediate and long-term impact of these tariffs and the negotiations that will finally be unearthed in future.

Refinancing Public Debt

Can there be a larger motive behind tariffs and trade war? Let us understand. In 2019, the US economy was USD 21.3 trillion, whilst the US National Debt was USD 22.72 trillion (107 per cent of the GDP).Then COVID-19 struck the world, humanity came to a standstill, demand slumped, businesses got shut down, and the economy worldwide halted.

As per macroeconomics specialists, there are only two ways of reviving the economy – Employing Fiscal (boosting Capex) or monetary (boosting consumption) measures. Fiscal takes time to show impact and effect, whilst monetary is instant. Whilst Bharat chose fiscal measures by expanding the balance sheet and rebuilding Bharat and Bharat’s infrastructure, the US chose monetary measures, giving cash doles to individuals, families and businesses. The resulting demand for goods in the US surged as services couldn’t be consumed as yet due to COVID-19. As pandemic receded, the demand for services also went up significantly, thereby pushing the average inflation of 2.4 per cent (for the last decade) to a whopping 9.1 per cent in June 2022 (a 40-year high). Moreover, to pay this cash, the US issued significant US debt (enhanced Government borrowing) amounting to 4.1 trillion USD (18 per cent jump in Government debt) in the single year.

Then, it didn’t pinch the economy much to borrow more as the US interest rates were cut to rock bottom with the Fed rate ranging between 0 per cent to 0.25 per cent and the 10-year US Gsec then trading at a yield ranging between 0.6 per cent to 0.7 per cent. The US has been pushing the can of borrowed money down the road, and the same has come to haunt it. Between 2019 and 2024, the US economy grew from 21.3 trillion USD to 29.72 trillion USD. However, its public debt jumped from 22.72 trillion USD to 36.218 trillion USD (122 per cent of the GDP). Thus, in the last five years, the US economy grew 40 per cent in absoilute terms, the debt grew by 60 per cent. Of this 36.21 trillion USD, 28.9 trillion USD is external debt held by the public, whilst 7.29 trillion USD is intra-governmental debt held by various US Government agencies and departments.

Of this 28.9 trillion Dollar debt held by the public at large, including Governments, institutions, sovereigns, individuals, HNIs etc, 7.6 trillion USD is coming to maturity in the next 12 months (25 per cent of the US Government debt held by the public needs to be refinanced in the next 12 months). As of Feb 2025, US foreign reserves stood at 35.6 billion USD and in 2024, the US fiscal deficit (expenses minus income of the Government) stood at 1.8 trillion USD or 6.4 per cent of the GDP. In simple layman’s terms, the US as of now doesn’t have liquid funds to repay the debt, so the option left to the US is to refinance the same by issuing fresh debt securities. The current 10-year to 30-year US Gsec is trading in between 4.15 per cent to 4.625 per cent, whilst the Fed rate (short-term rates) is at 4.50 per cent.

If the US refinances the securities at such high interest rates (seven times higher than what was borrowed during COVID-19), the annual interest cost will be sharply higher every year for the next 10 to 30 years, and thus it’s not prudent to do so. This is the game plan of the US.

Stoke Tariff War

As the economy will slow down, cut the interest rates quickly to propel the economy back and borrow money at cheaper cost. Furthermore, to rationalise the federal budget, the Department of Government Efficiency (DOGE) has been laying off people. As of now, DOGE has laid off over 280,000 Federal Workers. The US economy grew by 2.8 per cent. If DOGE has to clean the system and lay off further excess fat, it’s easier with less hullabaloo if the clean up happens in recession, than in a buoyant economy.

History of trade wars

1815–1846: Corn Laws

Britain’s high tariffs on imported grain protected landowners but caused widespread hardship, leading to their repeal and a shift toward free trade

19th century Opium Wars

In the mid-19th century, two conflicts over the opium trade, which became known as the Opium Wars, pitted China against the British Empire. The first began in 1839, when Britain launched a military expedition to force China to open its market to Indian opium sold by British merchants. Britain won the clash in 1842, with success going beyond opium as China was forced to give up the region of Hong Kong, open five ports to world trade, and limit its customs tariffs to five percent. In the second Opium War, from 1856-1860, Britain allied with France, and again the imperial power came out on top, forcing China to open up eleven additional ports to foreign trade and maintain diplomatic relations with the West.

1890: McKinley offensive

In 1890, William McKinley — then a Republican lawmaker, later a US president — saw through a new law that slapped an average tariff of nearly 50 percent on imports into America. While the tax hike boosted the development of tinplate production in the US, for example, it also caused prices to soar. In elections that same year for the US House of Representatives, Republicans suffered big losses, losing their majority to the Democrats. Two years later, the incumbent Republic president was dumped by voters in favour of a Democrat. McKinley’s unpopular law was repealed in 1894. He nevertheless went on to become US president in 1897. He was assassinated in 1901, months after winning a second term. Trump often mentions as McKinley as inspiration his protectionist policies.

1930: Smoot-Hawley Act

The Smoot-Hawley Act, named after the two US politicians behind it, imposed tariffs of nearly 60 percent on over 20,000 imported agricultural and industrial products. Trade partners, led by Canada, retaliated with taxes on US exports, which fell by more than 61 percent between 1929 and 1933.

1985: Pasta war

This dispute began in 1985 when president Ronald Reagan, in a bid to protect US industry, raised tariffs on pasta imports from Europe . Europe responded with taxes on US imports of nuts and lemons. The standoff lasted nine months before the United States and the European Economic Community (EEC) –as the EU was then known –reached an agreement.

1993-2012: Banana war

In 1993, the EU granted preferential customs regimes to the former European colonies in Africa, the Caribbean and the Pacific, to the detriment of bananas produced by US multinationals in Latin American countries.These countries filed a complaint with the WTO, which condemned the EU several times, and Latin American countries were authorised to apply retaliatory measures. An agreement was signed in 2012, allowing for a reduction in import tariffs on bananas from 11 Latin American countries and the end of actions taken by these countries against the EU.

2002: Bush vs EU

In 2002, US President George W. Bush imposed three-year surcharges of up to 30 percent on 10 categories of products including flat-rolled steel, machine wires and welded tubes. These measures, intended to boost the US steel industry, affected nearly 29 percent of imports. The EU filed a complaint with the WTO and published a list of US products it threatened to tax by up to 100 percent. At the end of 2003, Bush opted to lift the tariffs.

Lastly, most industrialists who will feel the pinch of Trump’s tariffs due to the levy of retaliatory tariffs by other countries had their allegiance with Democrats, thus nullifying their monetary prowess. Though in the bargain, some industrialists who are friends will also suffer, but the majority are the ones who opposed Trump’s candidature and supported Biden and then Kamala Harris.

Favourable Prospects for Bharat

As the tariff war and negotiations unfold, Bharat, at the moment, looks strong with its pole position. As of March 2025, the total exports of goods to the US from Bharat stood at 90 billion USD, whilst services exports from Bharat to the US stood at 385 billion USD. Two sectors, Information Technology that constitutes 54 per cent of total services exports and pharmaceuticals that comprise of ten per cent of the total goods exports to US are free from any additional levies or tariffs (Though Trump has mentioned Pharmaceutical levies are coming.) Sectors To Benefit from Trump’s Tariff

- Textiles: The current US textile market is valued at 189 billion USD and expected to be a 277 billion USD market by 2033, with Bharat exports to the US being merely 10.5 billion USD, less than six per cent as of 2024.

With Trump levying a 26 per cent tariff on Bharat and China, Bangladesh and Vietnam being levied 34 per cent, 37 per cent, and 46 per cent, tariffs respectively, Bharat is staring at a very big opportunity to displace other Asian competitiors in a large growing market.

- EMS: Electronic Manufacturing Services (EMS) where Trump has levied China (54 per cent), Vietnam (46 per cent), and Sri Lanka (44 per cent) whereas Bharat has levies of 26 per cent. Thus Bharat can quickly gain the market share on account of tariff differential.

The list is long. Whilst there would be some short term challenges of cost escalation to the end consumer and thus some demand reduction, this impostion of differential tariffs on different countries can be a big edge for Bharat to win in segments like mineral fuels, apparael and clothing, Some specific chemical products, and iron and steel products.

- Free Trade Agreement: Bharat and China are witnessing a demographic dividend, whilst the rest of the world is either aging or burdened with extremism and illiteracy.

China’s demographic dividend will end by 2031, whilst Bharat’s demographic dividend is expected to remain relevant till 2057. Most European and West Asian nations were slow and skeptical in signing Free Trade Agreements (FTAs) with Bharat. The UK negotiated an FTA for over two years and then dropped suddenly. But Trump’s move has given a fillip to these FTAs, with over 50 countries talking straight with Bharat to sign FTAs. Already, 13 FTAs are in place with various countries/ regions and six with limited coverage Preferential Trade Agreements (PTAs). The UK has come back on the table discussing nuances of implementation of FTA with Bharat. This change in world order, driven by Tariff wars and China getting disjointed with the US and aligning itself with Turkey, Pakistan, Bangladesh, etc, gives a huge opportunity to Bharat to work with Global South, Europe, West Asia and the US to expand its footprint economically, socially and spiritually.

It’s time that Bharat utilises its deep inner knowledge and spiritual awakening to create a world, not a

continent, that pursues the value and principle of Vasudhaiva Kutumbakam.

Comments