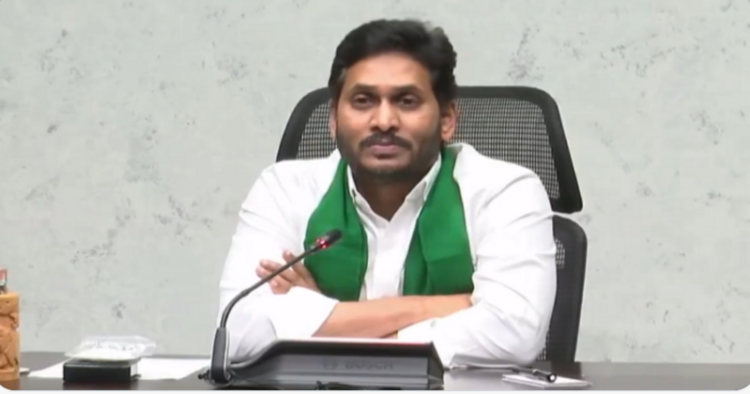

State Chief Minister Jaganmohana Reddy and Finance Minister Buggana Rajendranath Reddy have repeatedly led people astray without giving an explanation for their inefficient financial management. The Jaganmohan Reddy government is spreading lies by comparing the state with the financial aspects of the central government instead of comparing the debt collection and its burden with the other states with similar conditions. Once we look at the way the central and state governments have dealt with financial issues for the current financial year, the facts will be revealed.

According to the Budget 2022-23 presented by the Union Finance Minister Nirmala Sitharaman, the fiscal deficit (loans) for the entire country this financial year is estimated at 14.31 lakh crores, of which the loan to be raised in the first six months i.e. by September 2022 is estimated at 8.45 lakh crores, but the actual loan raised for 8.29 lakh crores means that 16 thousand crores loans raised less than the estimated. Also, by limiting the loan required for the next six months to 5.92 lakh crores, the total debt to be raised of this financial year has been revised to 14.21 lakh crores, which is 10 thousand crores less than the budget estimate.

On the other hand, according to the Budget 2022-23 presented by Andhra Pradesh Finance Minister Buggana Rajendranath Reddy, the fiscal deficit of the state for this financial year is estimated at 48,724.11 crores, but by August 2022 it will reach 91.50% i.e. 44,582.58 crores, which means that the financial situation of the state for the next six months is very scary. The debts shown in March 2021-22 shall have been corrected, and the debts incurred by the state government in the current year must be revised. As warned by the central government, if the corporation’s loans made by transferring the budget revenue are added as loan with in the FRBM limits, there is a risk that the state Debt to GSDP ratio will be the highest in the country. As Buggana Rajendranath Reddy in a statement said that between 2019-22 the growth of central government debt was 14.37% while the growth of state debt was only 13.28%, but it is before correcting the adjustments in the state wrong debt statistics. Isn’t it a fact that after the revision of the debt as per the adjustments exposed by the Union Government on Corporation Loans raised on transfer of Revenues with special GOs, Outstanding Bills, Discom Debts etc, the state debt will soon reach 10 lakh crores ? It is a fact that the entire country has been affected by Covid and the central government is still providing assistance to it, but it is Chidambara’s secret that the loans raised and assistance provided by the Centre have evaporated due to the illegitimate financial management of the State Government.

When the State Government is saying that the growth rate of the state is much higher than Central Government growth 7%, Why are they turning the state into piles of debt without spending the capital expenditure required for the creation of infrastructure for future employment and revenue to the State? Jagan and Buggana have repeatedly comparing the State financial management with the central government, though we said that is not the way to evaluate the financial performance of the State and compare with other similar natured States in the country with proper accounting of the books of accounts for the better understanding the facts.

Further, CM YS Jagan Mohan Reddy says Andhra Pradesh’s GST Collection Is More Than The National Average. Then, Questioning the People that Why The Debt is raising disproportionately when Income is raising? When Andhra Pradesh’s GST collection is more than the national average as said by Chief Minister Y S Jagan Mohan Reddy by showcasing the average GST collection in the country was 27.8 percent, while in Andhra Pradesh, it was 28.79 percent. Fact is, Maharashtra posted the highest state-wise GST collections for September 2022 at Rs.21,403 crore. It is followed by Karnataka – Rs. 9,760 crore, Gujarat – 9,020 crore, Haryana – 7,403 Crore and Tamil Nadu – 8,637 crore. In addition to this, States or Union Territories such as Bihar 67%, Nagaland 61%, Lakshadweep 731% and the Andaman and Nicobar Islands 69% posted impressive year-on-year growth in GST revenue. My question is that where is the position of Andhra Pradesh in terms of GST collection as well as year-on-year growth for the September month between 2021 and 2022. On the other hand, Daman and Diu posted a de-growth (- 38%) Year on Year basis for the month of September. In these circumstances, CM YS Jagan Mohan Reddy shall be taken in to consideration to evaluate the performance of the States which have been achieved the best results in terms of Collection and Growth, but not on average figures after adjusting the lower collections, lower growth and negative growth states.

While the revenue target till September 2022 was Rs 27,445 crore, the state had collected Rs 25,928 crore, which means a 94.47% target was achieved as per the information had been revealed by the CM YS Jagan Mohan Reddy. In this case, When there is a positive and impressive Revenue achieved in the first half of the current financial year and then, Why the Revenue deficit has already reached to 36,983.28 Crore as registered at 217.09% on the budgeted estimation for Rs. 17,036,15 Crore in the first five months by August 2022. Further, borrowings as per the budgeted estimation for the current financial year was for Rs. 48,724.11, But it had been reached to Rs. 44,582.58 Crore in the first five months means that it has been reached to 91.50%, then What about the financial repercussions for the remaining second half. Hence, Honourable CM YS Jagan Mohan Reddy shall depict the true and fair picture about AP State Financial conditions rather than the presentation of the window dressed information and comparing with the incomparable for misleading the public.

Finally, Global stress challenges our economy significantly apart from the internal recovery stress due to post COVID-19 impact. Actually, Growth in Direct and Indirect Taxes collections for the up to 2ndQ of the current financial year has registered impressive with the efforts of the Union Government and RBI fiscal policy though Rupee to Dollar stress has been continuing as Dollar has been using for exchange of financial transactions in the Global Market. Despite odds in the international economy, influence of Atmanirbar Bharat Packe performing our economy reasonably positive after GST collection has been improved month by month, and it is marching ahead to 1.50 Lack Crore per month on average in coming days. In addition to this, Union Government has collected gross Direct taxes for Rs. 8.96 Lack Crores and after refunds, net collection has recorded for Rs.7.45 lack cores in the first six months of the current financial year, it is 52.46% of the total year estimated collection. In which, very important to note is that 32% growth in Individuals tax collections played a crucial role along with the 16.73% growth in Corporates in this admirable performance. Here, it is very much vital the performance of State Governments too in the performance of Nation Economy and all this positive indications are not possible without the efforts from the State Governments as per the Union Government policies. But, few states are underperforming in attracting the Investments, Incurring the Capital Expenditure below their estimations, creating self-destructive approaches for Unconducive atmosphere in the states with unrest and so on has been depriving the actual growth of the Nation, It should be rectified immediately.

Comments