Narendra Modi Govt. is completing its 4 years to the power. After 30 years, people of India elected a govt with full majority. Expectations were high, considering the ultimate failure of UPA-2 Govt. and arrogant behaviour of Congress leaders. Modi established his development brand outside Gujarat. Congress was ripped off from the election. People of India gave a historical mandate to the Bhartiya Janata Party.

A lot of water has flowed over the dam. Time has come to ask, what has changed? Whether NDA has justified that mandate? Are people feeling more stable than earlier govt.? This article is exploring, what was promised on financial sectors? What have we achieved till now? And what is the road ahead.

Modi Govt. got a legacy of the handicapped economy, thanks to UPA-2 governance and corruption. Systematic meltdown of financial institutions in UPA era was the first challenge in front of newly elected Govt.

The banking sector was demolished by the previous Govt. with their wrong policies and by using coercive measures. NPA issue was steadily coinciding on the banking sector.

Situation is gaining ground slowly. Recent TATA group and Bhushan Steel 36,000 Cr deal is a prime example of the financial success of Modi Govt. Enthused by the successful conclusion of this deal Modi Govt. is expecting 1 lakh crore amount to be returned from remaining 11 NPA cases. Thanks to Insolvency and Bankruptcy Code (IBC) act passed by Modi Govt. in 2015. NPA was not a glamorous issue and not likely to collect brownie points. Yet Modi Govt. hit core issue of the banking sector.

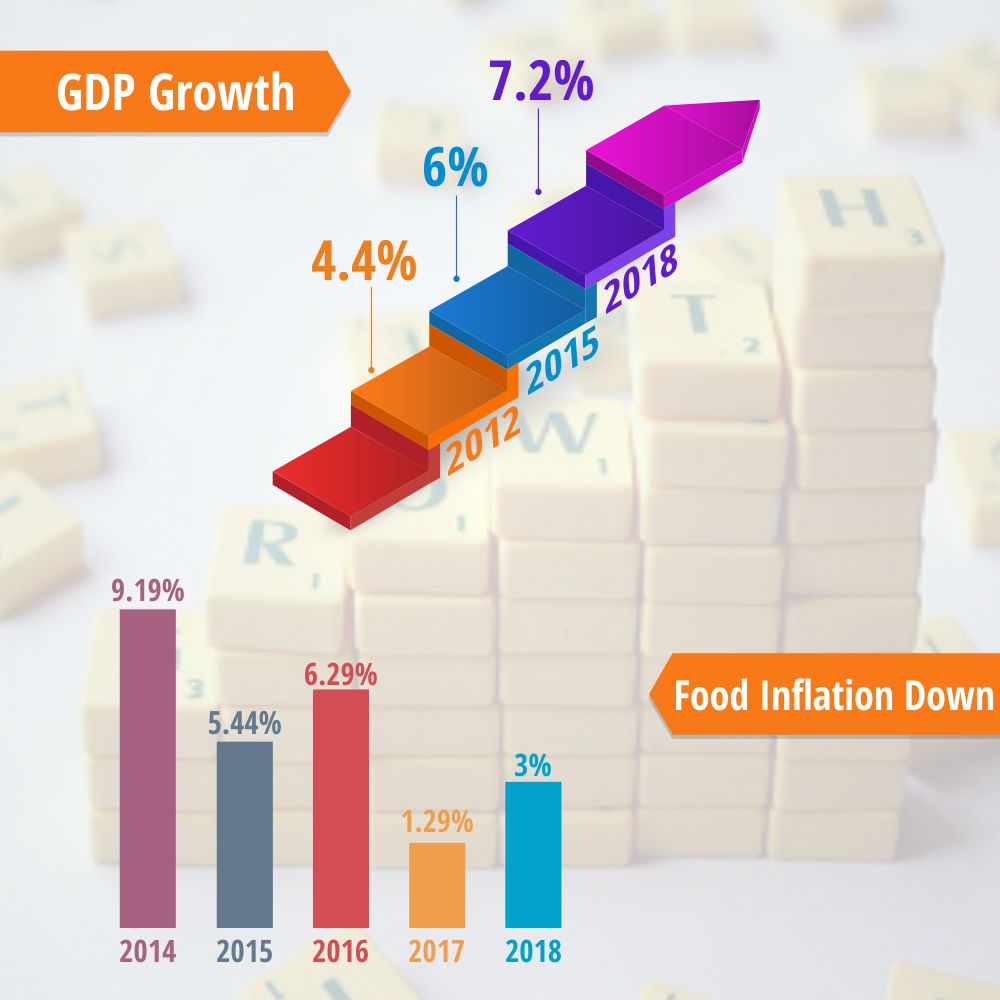

Indian economy was in standstill position in 2014. Although it was survived through great depression period of 2008, corruption cases, lack of political will, dilapidated governance downgraded India in the economic world. First thing Modi Govt. did after coming to power was trust building. The world was sceptical about new Govt. But soon his personal charisma and hold on governance enhanced the trust and reputation of the country in the world.

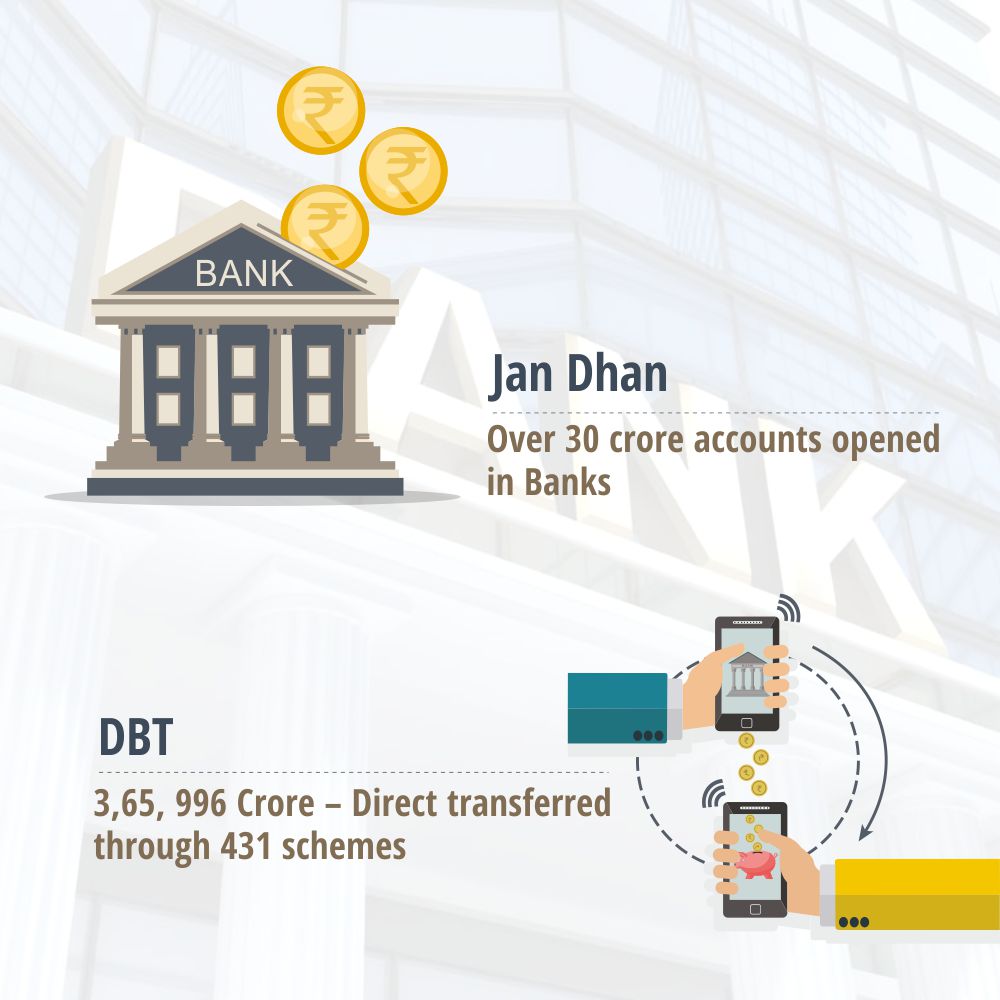

Modi Govt. worked in the chain format. Considering future implementation every move and decision making was carried out. To make direct benefit transfer system viable, Jan Dhan scheme was launched. People’s participation was equally considered while implementing DBT scheme. As soon as a bunch of population opened their accounts in the banks, DBT scheme flourished. Rajiv Gandhi once stated that poor people get only 17 Paise out of 1 Rs. Govt. subsidy. It was merely a statement. Modi Govt. took one step ahead and delivers appropriate results without talking too much on economic front. Modi Govt. by using DBT transferred every penny belonging to the poor class.

Another masterstroke from Modi Govt. was Tax reforms. Demonetisation in the year 2016 will be remembered as one of the historical events. Many people criticised that decision while many applauded. As days are passing, we are witnessing miracle reforms in tax system of India. Due to demonetization, direct tax collection exceeded the revised budgetary target in the FY18. Direct tax collections in 2017-18 at Rs 9.95 lakh Crore, exceeded the revised budgetary target of Rs 9.8 lakh crore for FY18. Also, 6.84 crore income tax returns filed in the year against 5.43 crore in the previous year. A total of 99.5 lakh new income tax assesses were added to the tax net. A growth of 17.1 percent was recorded in net corporate tax growth while net personal income tax clocked a growth of 19.9 percent in last fiscal. After demonetization, Modi government tightened the law against black money in property. India’s long war against unaccounted-for, tax-evaded money has been through what is known as benami transactions through the purchase of property in one person’s name but financed by another. Law was there in the system. But The 1988 Benami Property Transactions Act was weak in nature itself. The newly enacted law empowers authorities to provisionally attach and eventually confiscate benami properties. It also carries jail terms of between one and seven years and a fine that can be up to 25 percent of the fair market value of the property. Results of strict law and its implementation are experienced by many.

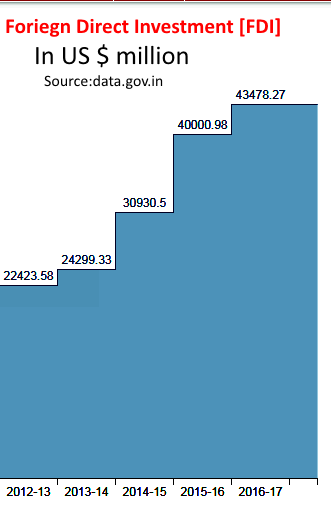

Modi and BJP often treated by the opposition and media as someone who is rigid and lacks communication with other party members. Implementation of GST and set up of GST council was a big slap in the face of people who thought so. Modi Govt. set up a GST council in which all the states are members. It was not possible without political will, communication, understanding and good intention. The GST replaces eight Central taxes and nine State taxes. In tune with indirect taxes in 140 other nations, Modi has brought to completion one of India’s longest pending reforms. The nation will emerge as a strong market in near future due to GST structure. When these restructuring of system was going on, Modi was busy in propagating India’s investment-friendly atmosphere in the world. The world was watching Modi Govt.’s steps towards transforming the country into the business-friendly country. Incessant efforts of Modi Govt. to bring the country out from policy paralysis are acclaimed by every nation in the world. Following numbers give an exact picture. Total FDI equity inflow received in the last three financial years is $ 114.41 billion. This is 40% more than the previous three financial years (2011-12 to 2013-14 when the total FDI was $ 81.84 billion. FDI equity inflow received through approval route was $ 11.69 billion, which is 64% higher than the previous three years ($ 7.15 billion). Total FDI inflow during last three years was increased by 38%.

Source : Click here

Modi Govt. efforts to revive Indian economy were furnished through a chain of actions. Jan Dhan accounts, Demonetisation, GST, FDI flow, RERA implementation in the construction field, laws against black money and Benami properties, increasing tax net of the country. Giving stellar performance in every aspect, India is expected to become 3rd largest economy in the world by the year 2030. Modi Govt. will be remembered in the future as the bravest transforming Govt. While implementing strict economic policies some time they disturbed their core voters too.

For chasing rainbows, the road ahead is not bumpy but not smooth either. Continuing these transformation policies is essential. GST is implemented to become one nation one tax. However, GST is in its primary stage and one nation one tax reforms are way ahead. NPA mess created by previous Govt. is going to penalize Indian economy in every aspect. It will take time to re-establish faith in the Indian banking system. Govt. should oversee the set of rules and regulations defined by the law, many times Govt. officials use this law as a method to terrorise business industry. Will India make its mark in the world economy? Only time will answer.

Comments