China’s $19 trillion economy, long driven by exports and investment, appears to be reaching the limits of that growth model. Confronted by slowing global demand, a property crisis, and mounting fiscal strains, Chinese policymakers are signalling a urgent turn toward strengthening domestic consumption as the next pillar of growth. The forthcoming 2026–2030 Five-Year Plan is expected to give households and spending a far greater role than ever before.

While boosting domestic demand has been a recurring objective for over a decade, the upcoming plan will make it more explicit and central to China’s development priorities. It represents a major shift, from a growth model dominated by exports and production to one balancing domestic consumption and high-tech industry. “The suggestion explicitly pledged to raise the consumption share in GDP. The philosophy of consumption policy also seems to have shifted from almost export-centric to demand-balanced,” Citi analysts observed in a note.

The renewed emphasis on consumption comes as structural imbalances deepen in China’s economy. The protracted property slump has sapped household wealth, while the trade war with the United States and declining global demand have curbed export growth. In response, the Communist Party’s top leadership this week pledged to “reasonably raise the proportion of public service expenditure in fiscal spending to enhance residents’ consumption capacity.”

Redirecting resources to households and building a consumption-led economy

Officials also promised to strengthen consumer-focused policies, reform income distribution to lift household earnings, and increase the central government’s share of social spending to better support ordinary citizens.The new policy direction aligns with recent official statements that Beijing will allocate a larger share of government investment toward people’s livelihoods and significantly raise household consumption as a share of GDP over the next five years. “The allocation of resources will shift more towards consumption, as large-scale expansion of traditional industries and infrastructure has reached its limit,” said a policy adviser who requested anonymity. “Future investment will focus on high-tech industries and new infrastructure.”

According to several policy advisers, China may aim to raise the household consumption rate by around five percentage points over the next five years, though it remains uncertain whether a concrete target will be set. Household consumption currently makes up about 40 per cent of GDP, far below the nearly 70 per cent seen in the United States. Some experts suggest China should aim for a 50 per cent consumption rate within the next decade to create a more stable, demand-led economy.

For years, Beijing’s efforts to foster a consumption-driven growth model have struggled to gain traction. Weak consumer confidence, slow income growth, inadequate welfare provision, and the housing downturn have all limited spending. Meanwhile, China’s services sector has developed more slowly than its industrial and export sectors, constraining opportunities for domestic-led growth.

Balancing consumption and industry through fiscal reorientation

Policymakers now appear determined to redirect more fiscal resources away from businesses and infrastructure projects toward household support. Analysts and investors are watching for concrete measures that transfer financial resources from state and corporate investment to consumers, which will be crucial to unlocking spending potential.

Alongside the shift toward domestic demand, the leadership reaffirmed its commitment to maintaining a strong manufacturing base, particularly in emerging and strategic sectors such as renewable energy, aerospace, and advanced materials. Manufacturing still accounts for roughly a quarter of China’s GDP and remains central to its ambitions for technological self-reliance.The outline of the 2026–2030 Five-Year Plan, unveiled last week, reflects this dual focus, prioritising manufacturing and technology advancement while pledging to boost household consumption. The full plan, with detailed growth targets, will be presented at the National People’s Congress meeting in March 2026.

Fiscal policy will play a central role in this rebalancing effort. Currently, government investment spending exceeds 6% of GDP annually, excluding major off-budget funding by local government financing vehicles and policy banks. Redirecting even part of this spending toward household welfare will take time given China’s entrenched export- and investment-heavy structure. Of the 1.3 trillion yuan ($182.5 billion) in ultra-long special treasury bonds planned for this year, 300 billion yuan will be used to support a consumer goods trade-in scheme designed to encourage households to replace older products with newer ones. The remainder will fund equipment upgrades and infrastructure projects.

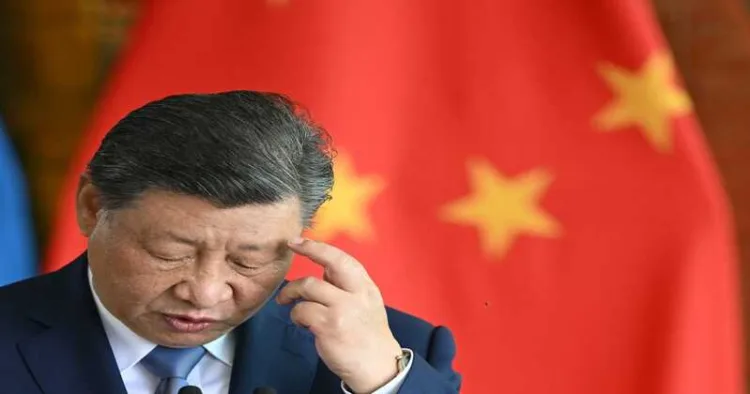

Xi cites increasing downward pressure and insufficient effective demand

President Xi Jinping underscored the urgency of stimulating domestic demand in remarks published on Tuesday, citing “increasing downward pressure on the economy and insufficient effective demand.” China’s economic growth slowed to its weakest pace in a year in the third quarter, as lacklustre domestic spending left the economy reliant on exports that are increasingly constrained by US tariffs and global headwinds.

Economists argue that sustained consumption growth will require deeper reforms to address income inequality, expand social welfare, and reduce household precautionary savings. China’s pivot away from export dependence toward domestic consumption marks the latest shift in its post-reform history. Yet given weak household confidence and the slow pace of fiscal reorientation, transforming this ambition into real economic dynamism may take years. For now, Beijing’s challenge lies in convincing both its citizens and global investors that the long-promised transition to a consumption-driven economy is finally underway.

Comments