In 2025, India is becoming a global electronics powerhouse. Seven new projects, worth Rs 5,532 crore were approved under the Electronics Component Manufacturing Scheme (ECMS), a decision that carries the promise of changing the country’s manufacturing landscape. These projects is expected to generate Rs 44,406 crore in production value and create over 5,000 new jobs by marking the beginning of a new growth cycle for India’s electronics ecosystem.

The announcement made by Union Minister of MeitY, Shri Ashwini Vaishnaw was more than just another policy update. It represents the intent to build, to innovate and to ensure that India doesn’t remain just a market for global electronics, it will become a central node in the global supply chain.

From Policy to Progress

The ECMS officially notified on April 8, 2025, is backed by an ambitious outlay of Rs 22,919 crore or approximately USD 2.7 billion. The scheme will run for six years, with an optional additional year. Its aim is both simple and strategic develop a self-sustaining ecosystem for the manufacturing of electronic components in India.

The focus is on encouraging large and small manufacturers to produce the parts that power modern electronics from micro-components to complex sub-assemblies within Indian borders. As a result of this government hopes to reduce import dependence, increase domestic value addition and plug Indian industries into global value chains in a meaningful way.

By September 30, 2025, investment commitments under ECMS had reached Rs 1,15,351 crore, almost twice the original target of Rs 59,350 crore. Expected production over the next six years has been estimated at Rs 10,34,751 crore, it’s 2.2 times higher than what was initially projected. Even the estimated incentive outgo of Rs 41,468 crore, is nearly 1.8 times the original estimate of Rs 22,805 crore.

Equally impressive in employment potential, this scheme is projected to create 1,41,801 direct jobs. By surpassing the target of 91,600, alongside a large number of indirect opportunities in logistics, design and testing.

What the First Approvals Cover

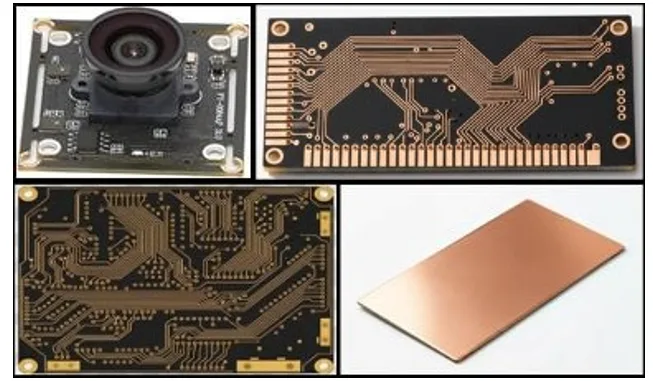

The first batch of ECMS approvals spans a range of advanced components which is required deep within our devices got public attention. Each of these is a crucial piece in the chain that runs from silicon wafers to smartphones.

- Camera Module Sub-Assemblies: Used in smartphones, drones, medical scanners and even robotic systems, these modules form the eyes of modern electronics. As India begins local production, it will not only reduce dependence on imports but also builds capacity for exports to global markets.

- Multi-Layer PCBs (Printed Circuit Boards): These PCBs are the backbone of every modern device, found in automotive systems, medical equipment, defence technology and everyday gadgets. Producing them domestically means greater reliability and shorter supply chains a critical step in making India’s electronics truly Made in India.

- HDI (High-Density Interconnect) PCB: Used in wearables, smartphones and aerospace equipment, HDI boards are highly advanced, allowing for compact yet powerful designs. They represent the fine engineering edge India is now moving toward.

- Copper Clad Laminates: These serve as the base material for PCBs and are essential to aerospace, industrial and ICT applications. Domestic production enhances integration of not only devices but also the materials that enable the devices to be made.

- Polypropylene Films: Critical to making capacitors, these films enable the operation of everything from computers to automobiles. Their integration into the ECMS helps secure India control over one more critical link in the chain of manufacturing.

These goods mark the transition away from putting together end products to producing the fundamental constituents that imbue today’s technology with life.

India Manufacturing Map Expands the Bigger Picture

The first seven ECMS projects are spread across Tamil Nadu, Andhra Pradesh and Madhya Pradesh. They account for investments worth Rs 5,532 crore, expected production of Rs 44,406 crore and the creation of 5,195 new jobs.

This geographic diversity is not accidental. Tamil Nadu a well-established electronics hub, is now deepening its industrial base through component production.

Andhra Pradesh and Madhya Pradesh are rising as fresh manufacturing anchors aided by improved infrastructure and state-level incentives. Balanced distribution in this manner makes sure that growth is not confined to those classic industrial belts but extends to newer areas too. India electronics saga has changed completely. What was a peripheral industry is now one of the nation’s largest success stories.

In 2024–25, electronics became India’s third-largest and fastest-growing export category, moving up from the seventh position in 2021–22. In the first half of FY 2025–26, electronics exports touched USD 22.2 billion and the sector is on track to become India’s second-largest export segment.

In 2014–15 India produced scale of electronics worth Rs 1.9 lakh crore. By 2024–25, that figure had jumped to Rs 11.3 lakh crore a six-fold increase. Exports grew even faster from Rs 38,000 crore to Rs 3.27 lakh crore, an eight-fold jump. This sector has also created around 25 lakh jobs, proving its role as a major employment engine.

The most visible part of this story is mobile phone manufacturing. A decade ago India domestic output stood at just Rs 18,000 crore. By 2024–25, it had risen to Rs 5.45 lakh crore. Thus having a jump of 28-fold leap in ten years. India is the world’s second-largest mobile phone manufacturer, with over 300 manufacturing units compared to just two in 2014.

India exported mobile phones valued at just Rs 1,500 crore in 2014–15. In 2024–25, it reached Rs 2 lakh crore, 127 times increase. Amongst international brands, Apple company shipped iPhones valued at Rs 1,10,989 crore, a 42% year-on-year growth and a milestone of reaching over Rs 1 lakh crore for the first time.

In just the first five months of FY 2025–26, smartphone exports reached Rs 1 lakh crore, up 55% compared to the same period last year. This turnaround from being import-dependent to nearly self-sufficient and perhaps is one of the most defining achievements of India’s manufacturing policy. The country now makes almost every mobile phone it consumes and now contributing internationally.

A Decade of Focus and Reforms

Behind these numbers, lies a decade of steady reforms and coordinated policy moves. Programmes like PLI (Production Linked Incentive), DLI (Design Linked Incentive) and now the ECMS, have provided both direction and confidence to investors.

Infrastructure development from electronics parks to semiconductor clusters has complemented fiscal incentives. Skill development and supply-chain facilitation have kept the workforce in sync with technology upgradation.

India was previously most famous for exporting software, now it is being recognized for its manufacturing capabilities particularly in high-tech industries. This change not only indicates economic development but also a structural change in the way the nation is involved in global industry.

From Importer to Innovator

India imported almost all of its high-value electronic components. The balance of trade was heavily skewed and assembling imported parts was often the norm. That scenario has changed dramatically.

India manufactures now designs and exports a wide range of components from camera modules to PCBs. It has integrated itself into global supply chains not as a low-cost assembly hub, but as a capable and trusted partner.

This progress aligns perfectly with the broader Aatmanirbhar Bharat (Swadeshi India) vision, where self-reliance complements global integration rather than replacing it. The country is no longer on the sidelining the global electronics industry rather it’s becoming a part of it.

The approval of the first ECMS projects is more than an industrial milestone represents a turning point. With total investment commitments of Rs 1.15 lakh crore, expected production of ₹10.34 lakh crore and 1.4 lakh direct jobs on the horizon, India is laying the groundwork for something much larger.

The evolution of India’s electronics sector is a story of persistence of policy working hand in hand with entrepreneurship. It’s about factories in Tamil Nadu with new production lines, about young engineers in Andhra Pradesh designing circuit boards and about global companies seeing India not just as a market but as a manufacturing destination.

From assembling devices for others to manufacturing for the world, India’s transformation is both real and measurable. The Electronics Component Manufacturing Scheme is not just another chapter, it’s the prologue to an era where India stands tall as a global electronics leader.

Comments