Rooted in tradition and driven by technology, India shipbuilding industry is poised for international recognition. The sea faring community has always been connecting the subcontinent to the world trade network. Its economic base has been moulded for centuries through the practice of seafaring and trade. With its roots traced back to the Indus Valley Civilization, archaeological records from places such as Lothal in modern-day Gujarat depict India extensive maritime heritage, with Lothal dockyard being one of the oldest known tidal docks in the world.

Shipbuilding also known as the “mother of heavy engineering,” plays a central role in national development through job generation, investment attraction and enhancement of strategic autonomy. Every investment in this industry increases employment 6.4-fold and returns 1.8 times the invested capital, demonstrating its high economic multiplier effect. The industry guarantees large scale employment generation, especially in coastal, rural and remote areas in line with the overall national goal of an Aatmanirbhar Bharat.

Growth and Development of the Shipbuilding Industry

Post-independence India shipbuilding activities were confined to public sector units like Mazagon Dock Shipbuilders Ltd in Mumbai, Garden Reach Shipbuilders & Engineers Ltd in Kolkata and Hindustan Shipyard Ltd in Visakhapatnam. The last decade has been a transformation era with the arrival of private players. During this decade, there has been impressive growth in cruise tourism, inland water transport and port infrastructure. Strategic investment, policy reforms and waterway expansion have improved cargo transport, coastal interconnectivity and jobs. Thus, making the maritime industry a vital engine for economic growth and regional integration. India has 1,552 Indian-flagged ships by November 2024 with a combined Gross Tonnage (GT) of 13.65 million.

Major Government Policies and Initiatives

The government has introduced various strategic measures to revive and develop the shipbuilding sector. Shipbuilding Financial Assistance Policy (SBFAP) provides 20 per cent to 30 per cent financial aid to ships, who are using green fuels or hybrid propulsion systems, promoting eco-friendliness.

Right of First Refusal (RoFR) provides Indian shipyards with priority in government tenders for the procurement of vessels, with an updated hierarchy in favour of Indian built, Indian flagged and Indian owned ships. According to the Public Procurement Preference, ships up to Rs 200 crore in cost shall be sourced from Indian shipyards under the Make in India Order, 2017.

For the sake of green maritime operations, the Green Tug Transition Programme (GTTP) supports environmentally friendly tugboat operations with an objective to decrease carbon footprints. The Harit Nauka Guidelines also support the adoption of green technologies for inland waterway ships. For standardization as well as for efficiency, five standard tug designs have been published for use by major ports to achieve uniformity and increase domestic production.

MoUs and Strategic Collaborations

The government and industry stakeholders are also aggressively seeking strategic alliances, expanding infrastructure and financial arrangements to support domestic shipbuilding capabilities. The Shipping Corporation of India and oil Public Sector Undertakings have entered an MoU to establish a vessel-owning joint venture to cut reliance on overseas fleets and increase demand for ships built in India.

MoUs have also been incorporated among the major ports and the coastal states for the creation of shipbuilding clusters in association with joint investment, putting India among the world’s top five shipbuilding countries by 2047. The clusters will have shipyards, R&D centers, MSMEs and green innovation clusters to enable sustainable marine engineering.

Cochin Shipyard and Mazagon Dock have entered into MoUs with Tamil Nadu authorities to set up major shipbuilding facilities, a Rs 15,000 crore complex with one million GT annual capacity being one of them, which promises huge employment generation.

The Sagarmala Finance Corporation signed MoU with the financial sector to tap into varied funding streams for green shipbuilding, fleet modernization and maritime logistics. This partnership mixes international finances and domestic capital to establish a strong maritime investment system.

Cochin Shipyard has also collaborated with HD Korea Shipbuilding to build big commercial ships in India. This program is set to create thousands of jobs and strengthen MSME-connected supply chains with the help of CSL new dry dock and a Rs 3,700 crore fabrication unit planned at Kochi.

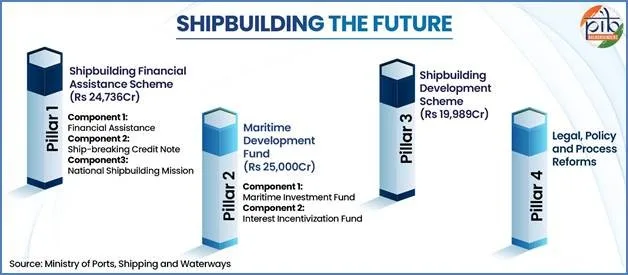

In September 2025 the government rolled out a holistic revitalization scheme with a three-pronged focus on enhancing domestic shipbuilding capability, making long-term financing more accessible and developing an eco-system that is competitive in the global sphere.

Pillar 1: With an overall outlay of ₹24,736 crore, this scheme is the foundation pillar to build up India’s indigenous shipbuilding and maritime innovation ecosystem. It brings together focused incentives, strategic missions and the lifecycle support mechanisms.

Component 1: Financial Support

The Financial Assistance module is to offer a robust incentive mechanism to Indian shipyards thus enabling them to overcome cost disadvantages and increase global competitiveness. Shipyards building ships with a value of less than Rs 100 crore will get 15% financial assistance and shipyards building ships with a value exceeding Rs 100 crore will get 20 per cent support. As a mark of the increasing significance of sustainability, green, hybrid or specialised vessels will get 25 per cent of assistance. In order to benefited, shipyards are required to achieve a minimum value addition of 30 per cent in India, thus enhancing domestic manufacturing and technological expertise. The overall financial commitment for this component amounts to Rs 20,554 crore and the scheme shall operate until March 2036.

Component 2: Ship-Breaking Credit Note

The Ship-Breaking Credit Note is a initiative that proposes to stimulate ship breaking in India along with stimulating new ship construction. It is a credit note of 40% of the scrap worth of a ship, which is issued when the ship is dismantled at a shipyard in India. This credit note may then be used to offset the cost of building a new ship in India, essentially joining ship-breaking and shipbuilding into one circular economy. The notes are transferable and stackable, providing players in the industry with flexibility and carry a three-year validity period. The overall budgetary allocation for this segment is Rs 4,001 crore, reinforcing the government objective to establish India as a dominant force in both ship building and recycling industries.

Component 3: National Shipbuilding Mission

The National Shipbuilding Mission will act as the administrative and strategic pillar of India shipbuilding efforts. The mission will be responsible for the guidance and coordination of national shipbuilding activities, fund management, policy synchronization and coordination of procurement between ministries and industry players. One of the areas of emphasis will be to enable foreign collaborations for reinforcement of local technological capabilities and expertise. The mission is framed with a 10-year tenure to ensure long-term planning and implementation. The government has assured to settle all the obligations and liabilities after the scheme tenure by providing financial continuity and stability to the shipbuilding sector.

Pillar 2: Maritime Development Fund (Rs 25,000 crore)

The Maritime Development Fund is to reinforce India’s EXIM trade spine, which supports 95 per cent of trade by volume and 65 per cent by value. Notwithstanding such a vital role, the sector has hitherto faced inadequate access to affordable finance. The fund will address this imbalance and facilitate maritime development.

Component 1: Maritime Investment Fund

The ₹20,000 crore Maritime Investment Fund is a hybrid finance model of 49% government capital on concessionary terms and 51 per cent commercial capital of multilateral agencies, port authorities and sovereign wealth funds. It will be equity-based funded to develop Indian shipping capacity, ship and repair yard construction and improvement in port, inland and coastal water transport infrastructure with the help of public-private partnership.

Component 2: Interest Incentivization Fund

With a corpus of Rs 5,000 crore up to March 2036, Interest Incentivization Fund provides a maximum interest incentive of 3 per cent to banks and financial institutions that give loans to Indian shipyards. The scheme shall be launched and coordinated through agencies to encourage credit at reasonable cost and facilitate shipbuilding development in India.

Pillar 3: Shipbuilding Development Scheme (Rs 19,989 crore)

Shipbuilding Development Scheme endeavours to consolidate India’s maritime ecosystem by providing long-term assistance with emphasis on infrastructure, safety and risk. It has a cumulative corpus of ₹19,989 crore up to March 2036 consisting of Rs 9,930 crore for greenfield cluster development, Rs 8,261 crore for brownfield capacity upgradation, Rs 1,443 crore for shipbuilding risk coverage and ₹305 crore for capability development projects

Pillar 4: Reforms of Legal, Policy and Processes

For upgrading the governance and enhancing financial access, infrastructure status has been granted to big ships (notified on September 19, 2025), ensuring availability of low-cost long-term funds.

India is proposing to construct more than 110 ships locally within the coming decade through oil and gas PSUs’ demand aggregation. Five major legislative reforms the Bills of Lading, Carriage of Goods by Sea, Coastal Shipping, Merchant Shipping and Indian Ports Acts to revamp maritime legislation and rationalize coastal trade are on the agenda for 2025.

Effects of the Reform

The overall effect of these programs is to raise India’s shipping and port infrastructure to international standards. They will generate significant employment, improve investment and increase shipbuilding and maritime capacity. Adding structured financing, policy incentives and strategic partnerships will raise vessel numbers and port throughput significantly, raising India’s competitiveness in the international maritime market.

India’s shipbuilding industry is on the threshold of a new phase of growth acceleration supported by strong policy initiatives, financial tools and infrastructure upgradation. With a combined thrust on innovation, sustainability and indigenous manufacturing, these programs aim to make India one of the world’s top shipbuilding destinations.

The vision is consistent with Maritime India Vision 2030 and synergistic with the national vision of Viksit Bharat 2047. Through catalyzing employment generation, driving global investment flows and promoting technological innovation, India’s shipbuilding sector can become a beacon of maritime prowess and economic resilience. The collaborative action by the government, industry and financial institutions will ensure that the country’s maritime heritage rooted in tradition and driven by technology, it can navigates boldly towards a sustainable and globally competitive future.

Comments