Small traders across Karnataka have erupted in anger and disbelief after the state’s GST officers sent them massive tax due notices, even as the state tries to wash its hands of the issue by blaming the Union government, a claim many are calling both misleading and absurd.

The controversy began when the state’s Commercial Tax Department issued sudden notices to thousands of small vendors, from fruit and flower sellers to milk and vegetable suppliers, demanding back taxes worth lakhs and even crores for transactions, many of which were conducted through popular UPI platforms like Google Pay and PhonePe. Traders say the notices have come without warning and threaten to push already struggling local businesses into financial ruin.

Union Minister Pralhad Joshi has called out the Congress government’s hypocrisy, reminding the public that under the GST framework, there are two clear parts: the CGST, which falls under the central government’s jurisdiction, and the SGST, which is entirely under the state government’s jurisdiction. “The Centre has only one-third power in the GST Council; the remaining two-thirds of decision-making lies with the states. So this is squarely the Congress government’s doing,” Joshi said, accusing the ruling party of misleading people to cover up its revenue mismanagement.

Adding to the outrage is the fact that these notices have not been issued in any other state at this scale. Small traders argue that they have become soft targets for the state’s Commercial Tax Department while big defaulters continue unchecked.

Local shop owners, many of whom embraced digital payments during the pandemic, now say they feel cheated.

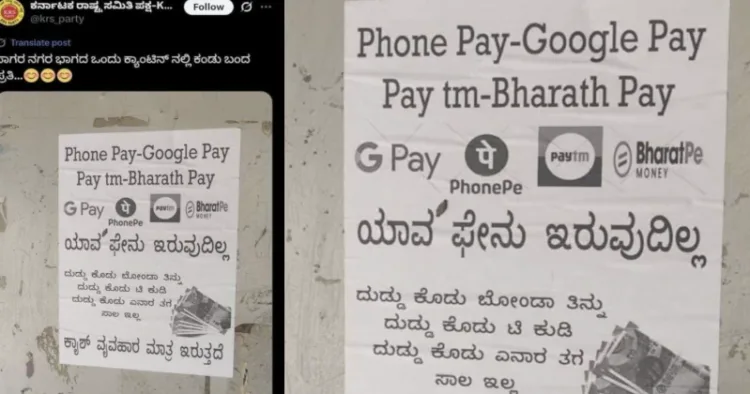

A poster that has gone viral at a modest tea stall in Sagar taluk in Shivamogga district sums up the mood: “No UPI here. Pay cash and eat. Pay cash and drink tea.” Traders are now concerned that every small UPI transaction could lead to tax scrutiny, penalties, or harassment from officials eager to demonstrate collections.

ಸಾಗರ ನಗರ ಭಾಗದ ಒಂದು ಕ್ಯಾಂಟಿನ್ ನಲ್ಲಿ ಕಂಡು ಬಂದ ಪ್ರತಿ…😊😊😊 pic.twitter.com/ivW1mnveOr

— ಕರ್ನಾಟಕ ರಾಷ್ಟ್ರ ಸಮಿತಿ ಪಕ್ಷ-KRS Party (@krs_party) July 19, 2025

The move threatens to derail India’s much-praised digital payments success story, which has been hailed worldwide as a model for transparent, cashless transactions. Many traders say they adopted UPI payments in good faith, only to be punished for their trust with sudden tax demands for previous years that they were never properly informed about.

The backlash is quickly turning into a major political flashpoint. The BJP and JD(S) have accused the Congress government of intentionally targeting honest, small-scale traders to squeeze extra revenue while deflecting blame onto the Centre. They argue that this is nothing but an attempt to malign the Union government to hide the state’s inability to manage its finances responsibly.

In response, angry traders have called for statewide protests. Many milk and flower vendors plan to stop sales on July 23 and 24. On July 25, thousands of traders are expected to shut their shops and gather at Freedom Park in Bengaluru in what could be one of the biggest protests by the state’s retail sector in recent years.

“If the government had told us about these tax rules clearly in 2021-22, we would have paid in small amounts. Now they slap huge dues overnight and label us defaulters. We feel betrayed,” said a small dairy vendor in Kengeri in Bengaluru city.

Comments