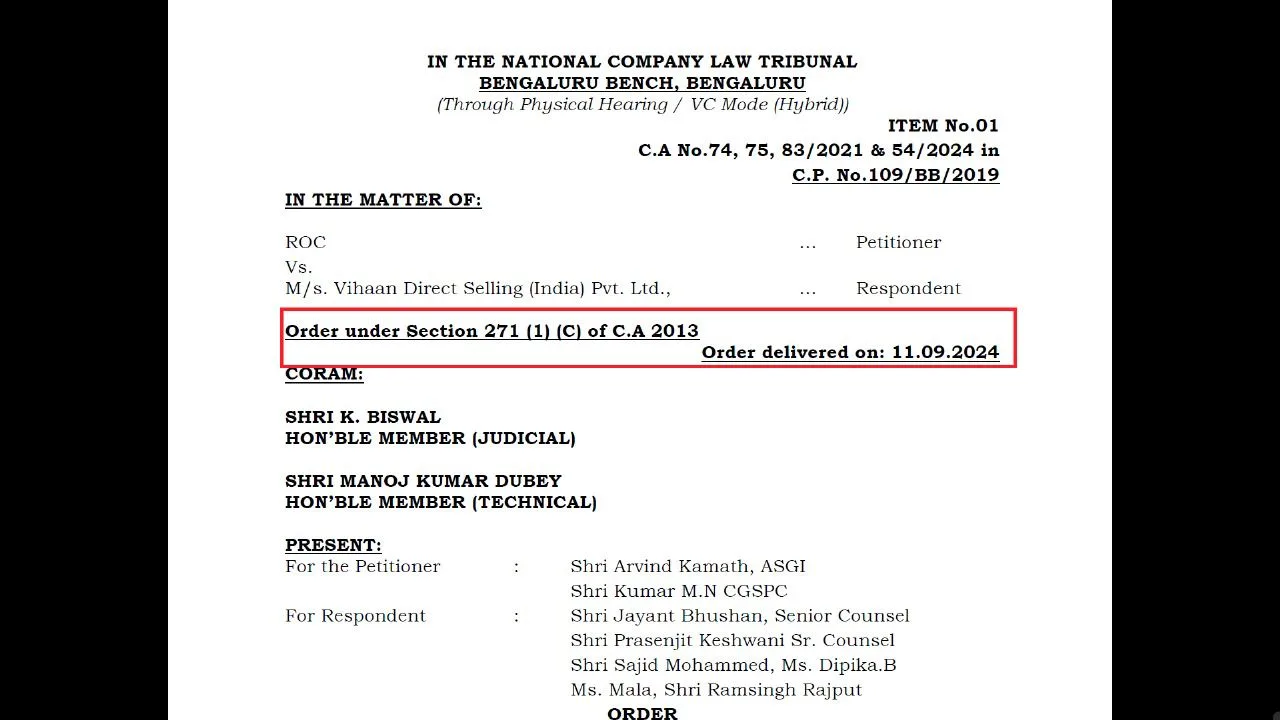

BENGALURU: National Company Law Tribunal (NCLT) Bengaluru while delivering a landmark judgement on Vihaan Direct selling ordered the company to wind up its business and move out of the India. On 11.09.2024 NCLT delivered this order under Section 271 (1) (C) of C.A 2013.

Section 271(1)(c) specifically gives the Tribunal (usually the NCLT) the power to wind up a company when it is unable to pay its debts, meaning that the company has become insolvent or has failed to meet its financial obligations.

In such cases, a creditor, shareholder, or the company itself may file an application before the NCLT to initiate the winding-up process.

This section is part of the broader provisions on company liquidation under the Companies Act, 2013.

Winding up refers to the legal process where the company’s assets are liquidated, and the proceeds are distributed among creditors and shareholders.

It’s important to note that Section 271(1)(c) is just one of the grounds for winding up a company. Other grounds include the company’s failure to follow statutory requirements, unlawful activities, etc.

Vihaan Direct Selling, which has long operated under a cloud of suspicion, is no stranger to controversy. Allegations of running a dubious business model and skirting regulatory scrutiny have dogged the company for years. The final blow came when mounting evidence of its inability to settle debts and meet financial obligations compelled the NCLT to take decisive action.

A company which promised lakhs of Indian investors of giving financial freedom is actually in financial distress. Irony died a thousand times!! Well M/s Vihaan direct selling which is a sub franchise of Hong Kong based MLM company Qnet which has faced shut down twice before is facing the same situation again. M/s Vihaan direct selling has previously faced numerous ED, IT and EOW raids is finally closing down for good. This winding up petition was filed way back in 2019 and it took NCLT Bengaluru 5 years to reach its conclusion.

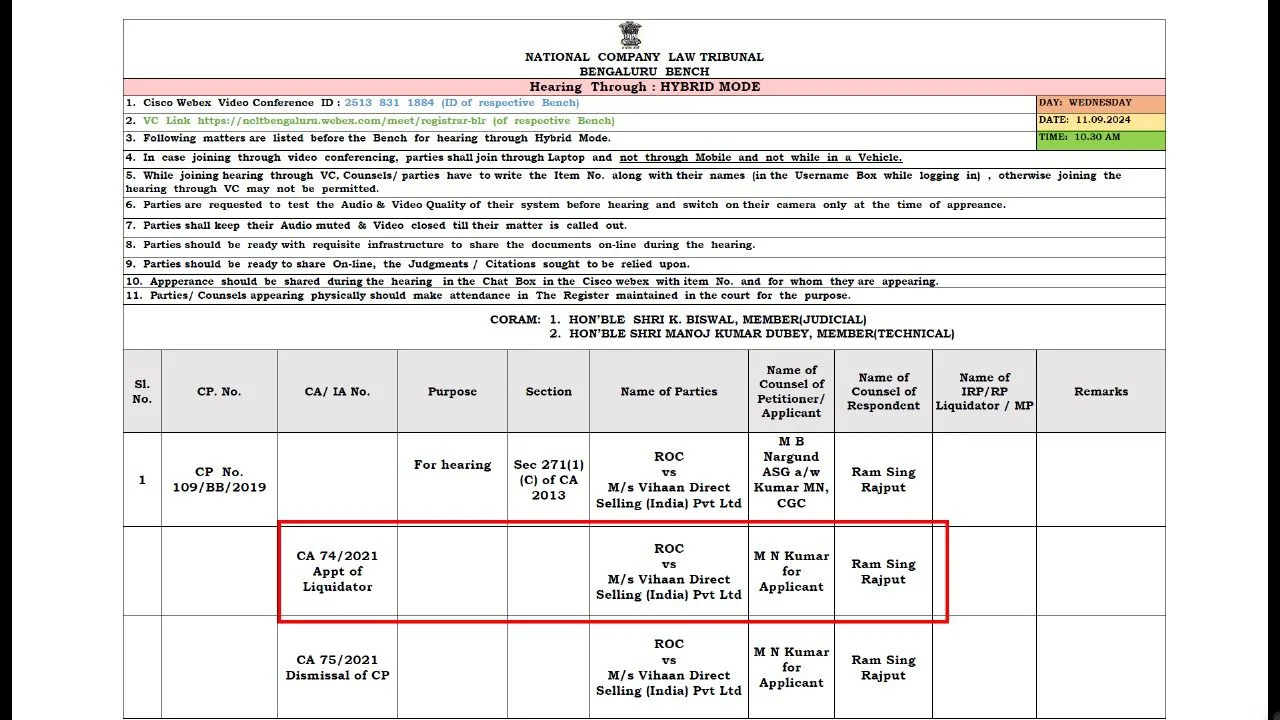

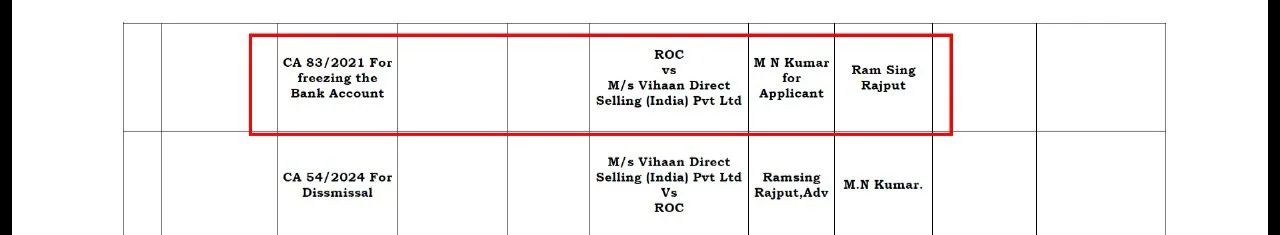

As you can see in the picture liquidator and freezing of bank accounts have also been ordered. Which means this company is running off with innocent and gullible investors’ hard-earned money from india. Now is the high time to ask for refund from your uplines and get your money back. Industry insiders also view the ruling as a pivotal moment in the enforcement of corporate ethics in India. “This sends a strong message to all businesses in the direct selling industry,” said an expert. “No matter how big or influential a company thinks it is, it cannot flout its financial and legal obligations without consequence.”

M/s Vihaan direct selling has been notorious for scamming people in the name of business opportunity but in reality they were selling overpriced products without any refund or buy back policy which is a grave offence under central consumer protection act. Over the years many Qnet IRs were arrested and prosecuted for their crimes of fraud and money laundering. As Vihaan Direct Selling prepares to wind up its operations, the verdict serves as a stark reminder: no corporation is above the law. The NCLT’s fiery judgment is a battle cry for accountability and a harbinger of a new era in corporate governance.

Comments