Before the implementation of GST, the tax structure in India was complicated and had multiple layers of taxation at both the central and state levels. Items were taxed differently across various states. This was the cause of lack of uniformity and increased compliance costs for businesses. The GST has harmonised the tax rates and brought consistency across the country. Due to this simplification, businesses can easily operate and it is easier for consumers to understand the taxes they are paying.

The Goods and Services Tax (GST) was implemented on July 1, 2017, under the leadership of Prime Minister Narendra Modi. It has been a transformative reform in India’s taxation system. One of the most significant impacts of GST has been the reduction in the tax burden on the common man, providing much-needed financial relief. This landmark tax reform replaced multiple indirect taxes with a unified tax system and simplified the tax structure and made it more transparent.

Tax Relief to the Common Man

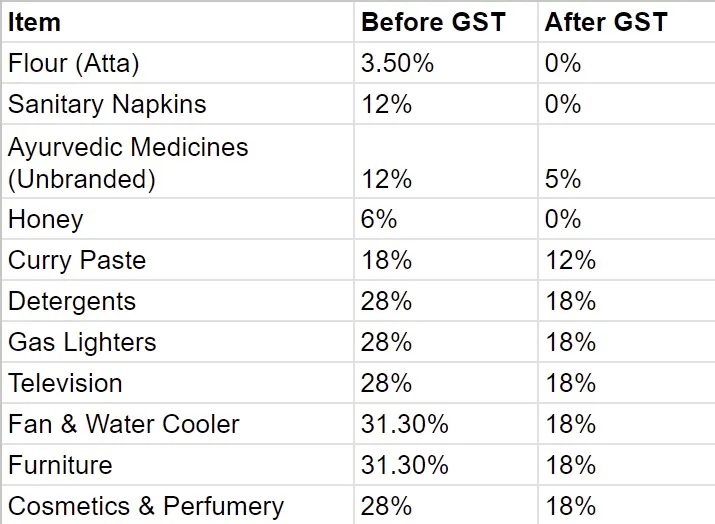

Multiple daily use items before and after the implementation of GST:

Items like flour (atta), sanitary napkins, and honey, which are essential for daily living, have seen their tax rates reduced to zero. Before GST, these items were taxed at rates ranging from 3.5 per cent to 12 per cent, making them less affordable for many households.

Reduced Tax Burden on Common Man

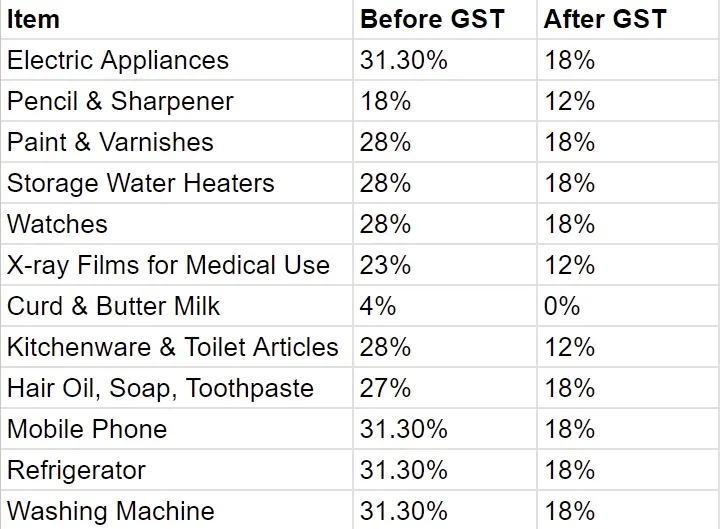

Prices of various daily use items before and after the implementation of GST:

Additionally, products like detergents, gas lighters, and televisions, which previously attracted a tax rate of 28 per cent, are now taxed at 18 per cent. This reduction has made these items more affordable for the average household and has eased the cost of living.

Read More: Sengol Controversy: Sanctity of dharma danda

The tax relief extends to consumer durables as well. Items such as electric appliances, storage water heaters, and refrigerators, which were taxed at a high rate of 31.3 per cent, now have a more reasonable tax rate of 18%. This has reduced the overall cost of these goods, making them more accessible to a larger section of the population.

Sanitary napkins which were previously taxed at 12 per cent, are now exempt from GST, reflecting the government’s commitment to promoting women’s health and hygiene. This exemption is a significant step towards making sanitary products more affordable and accessible.

Furthermore, the tax rates on hair oil, soap, and toothpaste have been reduced from 27 per cent to 18 per cent, lowering the cost of these essential personal care items. This reduction ensures that basic hygiene products are within reach for more consumers, improving overall public health standards.

The GST reform has not only simplified the tax structure but also provided much-needed financial relief to millions of Indian households, underscoring the Modi government’s commitment to economic inclusivity and consumer welfare.

The Goods and Services Tax (GST) regime, implemented under the Modi government, has significantly bolstered the “Make in India” initiative by reducing the overall tax burden on manufacturing. This reform has played a pivotal role in making Indian goods more competitive in the global market.

By eliminating the cascading effect of multiple taxes, GST has lowered the cost of production. This reduction in production costs has made Indian products more attractive to both domestic and international buyers. As a result, foreign investment has surged, and domestic manufacturing has received a substantial boost, leading to job creation and economic development.

The introduction of GST has made tax administration more transparent. The online GST portal has simplified tax compliance for businesses, reducing the scope for corruption and tax evasion. This streamlined tax process has cut down the time and effort required for filing taxes, making it more efficient for businesses of all sizes.

Overall, the GST regime has not only supported the “Make in India” initiative but has also enhanced economic growth by fostering a more transparent and efficient tax system.

The implementation of the Goods and Services Tax (GST) under the Modi government has emerged as a transformative reform for the Indian economy. By reducing the tax burden on essential and daily use items, the government has provided substantial financial relief to the common man.

The GST regime has introduced a simplified tax structure, which has increased transparency and efficiency in the tax system. This landmark reform has not only made goods more affordable but also given a significant boost to domestic manufacturing. These achievements underscore the success of the GST implementation.

The reduction in tax rates on essential items has eased the cost of living for millions of consumers. Additionally, the streamlined tax process has facilitated ease of business, fostering a more conducive environment for economic activities.

Overall, the GST has set the stage for sustained economic growth and development, benefiting millions of consumers and businesses across India. The positive impact of this reform is evident in the increased affordability of goods and the enhanced transparency and efficiency in the tax administration.

Comments