Public sector banks in India are doing better in comparison to their private sector counterparts in terms of non-performing assets, a survey conducted by industry body FICCI and banking association Indian Banks’ Association (IBA) found.

A non-performing asset refers to loans or advances that are on the brink of default.

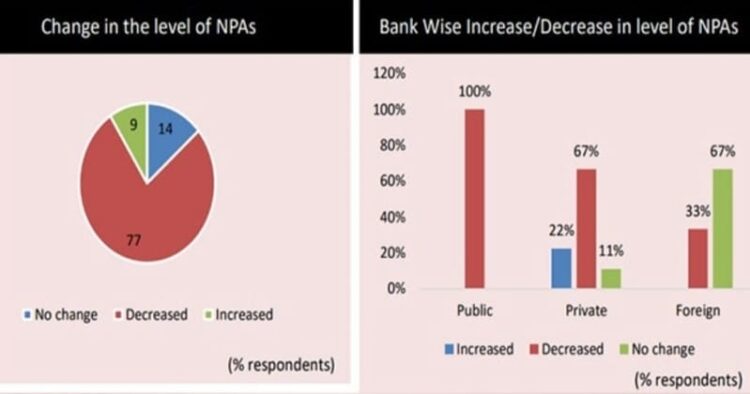

According to the survey, a large majority (77 per cent) of the respondent banks reported a decrease in the NPA levels in the last six months.

All responding public sector banks have cited a reduction in NPA levels, while amongst participating private sector banks, 67 per cent of banks have cited a decrease.

None of the respondent public sector banks and foreign banks have stated an increase in their NPA levels over the last six months, while 22 per cent of private banks reported an increase.

Among the sectors that continue to show high level of NPAs, most of the participating bankers identified sectors such as food processing, textiles, and infrastructure.

According to the survey, respondent banks were more sanguine about the asset quality prospects in the current round of the.

Over half of the respondent banks in the current round believe that gross NPAs will be in the range of 3 per cent – 3.5 per cent over the next six months. About 14 per cent respondents were of the view that NPA levels would be in the range of 2.5- 3.0 per cent.

As per respondents, some sectors that may continue to show NPAs over the next six months include textiles and garments, agriculture and gems and jewellery.

The eighteenth round of the survey was carried out for the period July to December 2023. Those banks that were surveyed together represent about 77 per cent of the banking industry, as classified by asset size.

In regards to requests for restructuring of advances, the survey found they have declined in the Indian banking space.

Loan restructuring is a method used by borrowers and lenders to avoid defaulting on current debts by negotiating the loan terms. It can be done, among others, by reducing the loan EMI, extending the loan repayment tenure, or altering the previously agreed upon interest rate.

According to the survey, around 44 per cent of respondents reported a decrease in requests for restructuring of advances in the current round of the survey as compared to 54 per cent in the previous round.

The proportion of respondent banks citing an increase in requests for restructuring of advances was 17 per cent, which is the same as in the previous round.

Bank-wise analysis revealed that 50 per cent of participating public sector banks have cited a decrease in requests for restructuring of advances, while 30 per cent of such respondents have reported an increase in such requests.

In the case of participating private sector banks, half the respondent banks have cited a decrease, while just 10 per cent have stated that restructuring has increased over the last six months. All participating foreign banks have cited no change in the request for restructuring of advances.

A resilient domestic economy accompanied by a pick-up in credit growth supported by Government capex, a rising provision coverage ratio, restructuring and rehabilitation of all eligible stressed units, and a robust recovery mechanism were cited as the key factors by respondent bankers who expect asset quality to further improve over the next six months.

(with inputs from ANI)

Comments