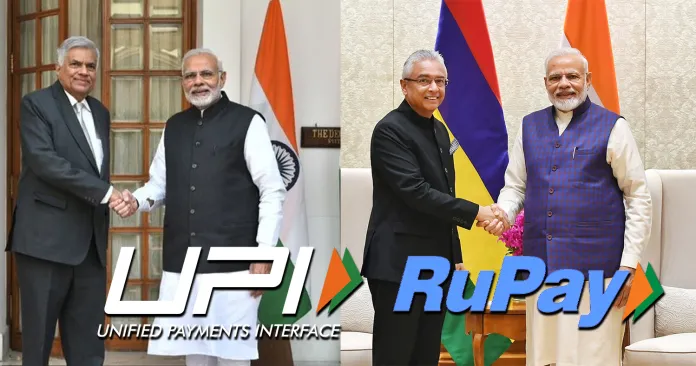

A week after the Unified Payments Interface (UPI) was launched in Paris, France, Sri Lanka and Mauritius are going to be the latest countries to enable the Indian digital payment system. RuPay cards will also be introduced in Mauritius today.

Prime Minister Narendra Modi will join his Maldivian counterpart Pravin Jugnauth and Sri Lankan President Ranil Wickremesinghe virtually (video conferencing) to witness the launch event at 1PM, the Ministry of External Affairs (MEA) said in a press release.

“Given India’s robust cultural and people to people linkages with Sri Lanka and Mauritius, the launch will benefit a wide cross section of people through a faster and seamless digital transaction experience and enhance digital connectivity between the countries,” said his office.

Indians visiting the two countries will be able to use the UPI to make payments while Mauritians travelling to India will also be able to use it. The extension of RuPay services will also enable Mauritian banks to issue RuPay cards and use them for settlements in both Mauritius and India.

“India has emerged as a leader in Fintech (financial technology) and Digital Public Infrastructure (DPI), the Prime Minister has placed a strong emphasis on sharing development experiences a innovation with partner countries,” the government said. The UPI was launched at the Eiffel Tower in Paris, on February 2, 2024 during the Republic Day Reception which the government had termed as a part of PM Modi’s vision of taking UPI global.

According to the official website of the National Payments Corporation of India (NPCI), the Unified Payments Interface (UPI) is a mobile payment system in India that allows round the clock payments via virtual payment address. It powers multiple bank accounts. It powers multiple bank accounts into a single app and brings several banking features under one hood. It also caters to Peer to Peer collect request which can be scheduled and paid as per requirement and convenience.

It was launched on April 11, 2016 by Dr Raghuram Rajan the then Governor of Reserve Bank of India (RBI). As aa fintech technology UPI is a major hit in India and has played a leading role in the digital payments’ success story. It has more than 380 million (38 crore) users in India as per the NPCI International Payments Limited (NIPL). In January 2024, as many as 12.3 billion (1220 crore) transactions were made through the facility.

Comments