In a remarkable display of transparency and democratic values, Union Finance Minister Nirmala Sitharaman invited the man onto the stage to address his concerns. She emphasised the government’s commitment to empowering people through loans and encouraged media coverage of both the event and the individual’s issue.

The man, identified as Sathish, explained that he had been doing business since 2004 and had faced financial difficulties during the lockdown. He had approached the Bank of Baroda for a loan but had faced constant rejection. The Minister assured him of assistance if he submitted the necessary paperwork.

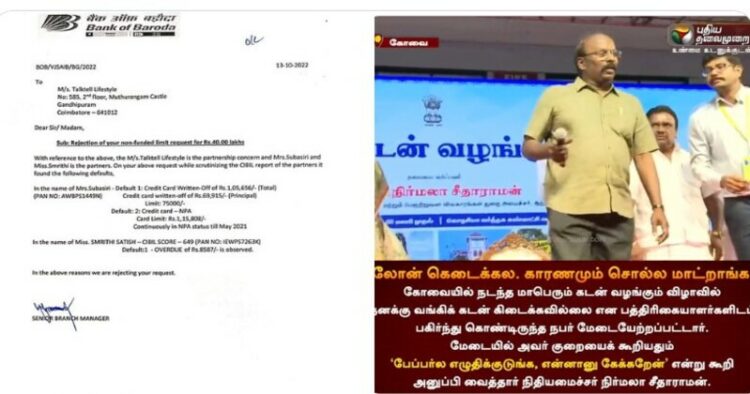

Upon further investigation, it was revealed that Sathish operated a business named “Talk Tell Lifestyle” with his wife, Subasiri, and daughter, Smriti, as partners. On verification, it was found that Sathish’s wife, Subasiri, had an outstanding credit card debt of Rs1,15,808, while his daughter, Smrithi’s bank account showed overdue payments, and her credit score did not meet the required standards. Despite this, Sathish had submitted a loan application.

Last October '22 when Bank Of Baroda informed defaulter’s spouse Sathish that he couldn't secure a fresh loan of ₹40 lakhs.

The reason? He had concealed an existing loan under his wife's name, which had gone unpaid.

Suddenly today Sathish decides to make a scene at Hon.… pic.twitter.com/0gaDMGRGQU

— Dr.SG Suryah (@SuryahSG) October 3, 2023

In October 2022, Sathish had been informed by the Bank of Baroda that he could not secure a fresh loan of Rs 40 lakhs due to an existing unpaid loan under his wife’s name. Despite this, Sathish persisted in his claims at the event.

An alleged fact-checker, Mohammed Zubair, labelLed Sitharaman’s remarks as “arrogant.” However, it is important to note that the Finance Minister had requested media coverage for both the event and the individual’s issue, underscoring her commitment to transparency.

Earlier in her address, Sitharaman had highlighted the Modi government’s commitment to prioritizing aspirational districts for assistance, particularly for rural farmers and entrepreneurs. She mentioned that 23,800 received retail loans, 2,904 new beneficiaries were granted Mudra loans, and 18 rural youth, including those from Scheduled Communities, Scheduled Tribes, and women, received Stand Up India loans. Additionally, 2,500 self-help groups in Coimbatore were assisted, benefiting one lakh account holders through various government schemes. Loans worth Rs 3,748 crore were disbursed during the Credit Outreach to more than one lakh beneficiaries, Around 5,000 attended the meet.

In October 2022, Sathish had been informed by the Bank of Baroda that he couldn’t secure a fresh loan of Rs 40 lakhs due to an existing unpaid loan under his wife’s name. Despite this, Sathish persisted in his claims at the event.

An alleged fact-checker, Mohammed Zubair, criticized the Finance Minister’s remarks as “arrogant,” although she had called for transparency and media coverage of the entire event.

What arrogance by the Finance Minister.. pic.twitter.com/8z3jDECo50

— Mohammed Zubair (@zoo_bear) October 3, 2023

During her address, the Finance Minister highlighted the Modi government’s commitment to prioritizing aspirational districts for assistance, particularly focusing on rural farmers and entrepreneurs. She mentioned that 23,800 people received retail loans, 2,904 new beneficiaries were granted Mudra loans, and 18 rural youth, including those from Scheduled Communities, Scheduled Tribes, and women, received Stand Up India loans.

Additionally, 2,500 self-help groups in Coimbatore received assistance, benefiting one lakh account holders through various government schemes. In total, loans worth Rs 3,748 crore were disbursed during the Credit Outreach program to more than one lakh beneficiaries, with around 5,000 people attending the event.

Comments