Finance Minister Nirmala Sitharaman recently spoke about the twin balance sheet problem, which primarily refers to the deteriorating balance sheets of corporates and banks simultaneously. This happens when poor corporates’ balance sheets force them to default on their loans, thereby resulting in high non-performing assets (NPAs) for banks. In 2018, the NPAs of the banks had reached such an alarming level that if it had come out in the open, the Indian stock market would have crashed. High-profile defaulters like Vijay Mallya, Nirav Modi and Mehul Choksi had grabbed headlines during this period.

How did the NPAs of Banks rise to Rs 10.3 trillion in 2018?

In India, banks are under the control of the Ministry of Finance and during the rule of the United Progressive Alliance, the big-wigs were able to easily get loans by having connections in the government at the top level. Prime Minister Narendra Modi minced no words and lashed the crisis on the previous UPA government. He had said that the huge NPAs were a result of Congress’ ‘phone-a-loan scam’ which meant that the huge amount of loans were given to few businesspersons on the basis of calls from people close to the ruling government.

The banks which were under pressure to sanction those loans during that time failed to undertake proper risk assessment. The end result was that these borrowers did not repay the loans which ultimately became NPA. It is alleged that when the UPA government was voted out of power, NPAs of public sector banks had touched Rs 2.78 lakh crore and it could be much higher as a number of banks hid their bad loans by restructuring them.

How did banks cover their bad loans and when did it actually come into the limelight?

To hide bad loans, the banks gave new loans to the old defaulters to enable them to pay interest on old loans or extended the repayment period or lowered the interest rate of old loans. This meant that the NPAs did not even come to the books. According to the Reserve Bank Of India (RBI), the average time lag between the occurrence of the fraud and its detection is 57 months. This meant that if any fraudulent activity took place in 2013-2014, then it would come into limelight only in 2017-2018.

It is only when the Modi Government came to power, they realised that India’s banking system was sitting on the NPA bomb. The Indian banking system had crippled to such a great extent that banks did not wish to give loans to new borrowers, especially small and medium-sized enterprises, which are the main employment generators.

From 2015-16 to 2019-20, the Public Sector Banks booked collective losses of Rs 2,07,329 crore.

In 2017-18, there was the highest amount of net loss, which was Rs 85,370 crore, followed by Rs 66,636 crore in 2018-19; Rs 25,941 crore in 2019-20; Rs 17,993 crore in 2015-16 and Rs 11,389 crore in 2016-17.

Modi Government’s 4 R strategy to diffuse the NPA bomb

In order to diffuse the NPA bomb, Modi Government drew a 4 R Strategy which was:

1. Recognising NPAs transparently – All NPAs were recognised

2. Resolution and recovery – New laws were made for recovery

3. Recapitalising PSBs – They infused money in Banks

4. Reforms in the financial ecosystem – Brought about several reforms in the banking sector.

The three new laws which PM Modi-led National Democratic Alliance Government brought about for the recovery the loans were:

1. Insolvency and Bankruptcy Code (IBC) in 2016

2. National Company Law Tribunal (NCLT)

3. National Company Law Appellate Tribunal (NCLAT)

Among these, the IBC proved to be a game-changer for the banking sector as it It instilled fear among defaulters and prompted them to settle their dues before facing liquidation or losing control of their businesses.

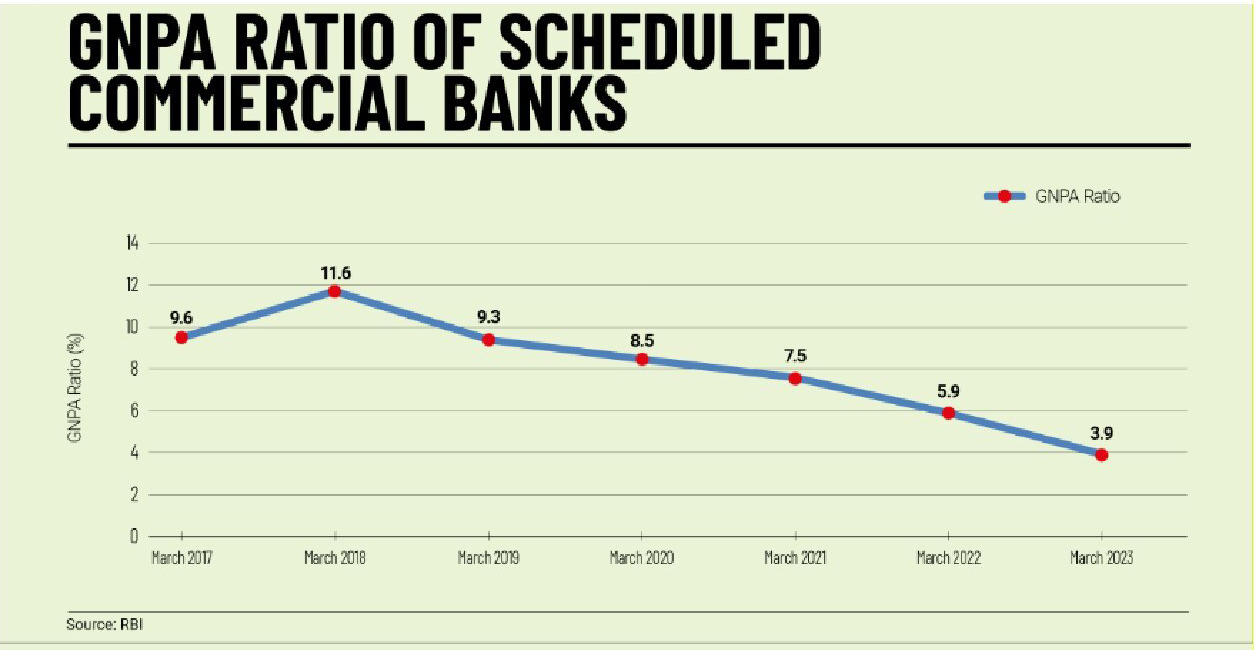

It enabled banks to recover a significant amount from their bad loans. As of March 2023, banks had recovered Rs 2.25 lakh crore through IBC. The Reserve Bank of India (RBI) has said in its recently released report called the Financial Stability Report (FSR) for June 2023 that the Gross Non-Performing Assets (GNPA) of the scheduled commercial banks, which declined to a 10-year low of 3.9 per cent in March 2023, is expected to fall further to 3.6 per cent by March 2024.

Another major step the Indian Government took to set the condition of the banks right was to recapitalise them with fresh capital infusion from the budget and market. This helped them to improve their capital adequacy ratio, PCR and profitability.

Other measures taken by NDA Government to curb fraudulent activities in Banks

Some of the other measures which PM Modi led government took to prevent, detect and punish fraud in the banking system included:

- Increase vigilance and audit

- Have dedicated agencies such as SFIO and ED to investigate and prosecute fraudsters

- The government introduced new guidelines for the appointment of board members, CEOs and MDs of banks based on merit and performance

- It also gave more operational autonomy and flexibility to banks in decision making

Twin problem of balance sheet has now become “twin balance sheet advantage”

RBI’s financial stability report showcases that there has been a significant improvement in the banks’ gross non-performing asset (GNPA) ratio after hitting a high 11.6 per cent in March 2018. In order to improve the condition of the banks owing to high NPA, between 2016-17 and 2020-21, the government infused Rs 3.10 lakh crore in public sector banks. This resulted in the decline in the NPAs of the banking sector.

Dip in the NPA of Banks

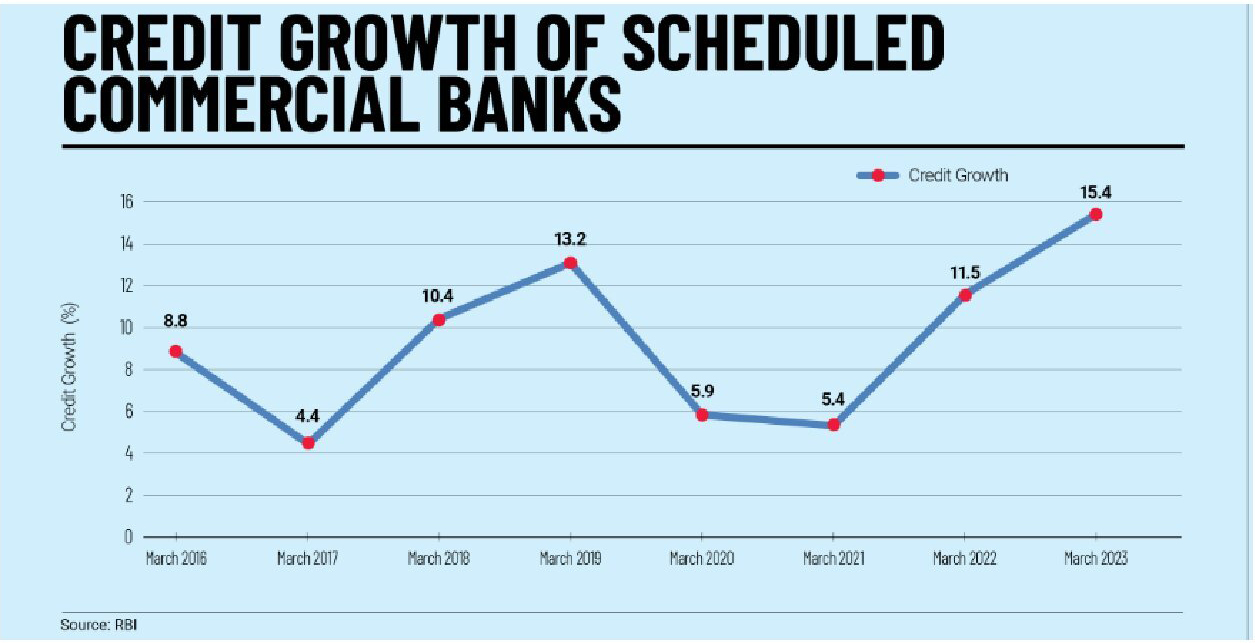

Increase in the Credit Growth of Scheduled Commercial Banks

Owing to the decline in the NPA, in the last financial year the credit growth touched an all-time high at 15.4 per cent, thereby resulting in significant improvements in the balance sheets.

The steps taken by the Modi Government helped to diffuse the NPA bomb which was created and nurtured by the UPA government. The end result is that today the Indian banking system has emerged much more efficient, stronger and profitable. This is one of the major reasons why countries across the world are giving so much importance to India.

![A Representative image [ANI Photo]](https://organiser.org/wp-content/uploads/2025/12/representative-image-e1765612818961-120x70.webp)

Comments