The Sanatan way tells us: “The natural and eternal way to live is to cooperate for the common human good.” E-cooperation, not just E-commerce Cut to 2022. Bharat is following the Sanatan principle. “India leads the world in real-time digital payments by clocking almost 40 per cent of all such transactions,” said Prime Minister Shri Narendra Modi.

With more than 48 billion digital transactions, Bharat led the global list in 2021. Bharat did almost three times more transactions than China, which is second by completing 18 billion transactions, and 6.5 times more than the transactions done by the United States, Canada and the United Kingdom.

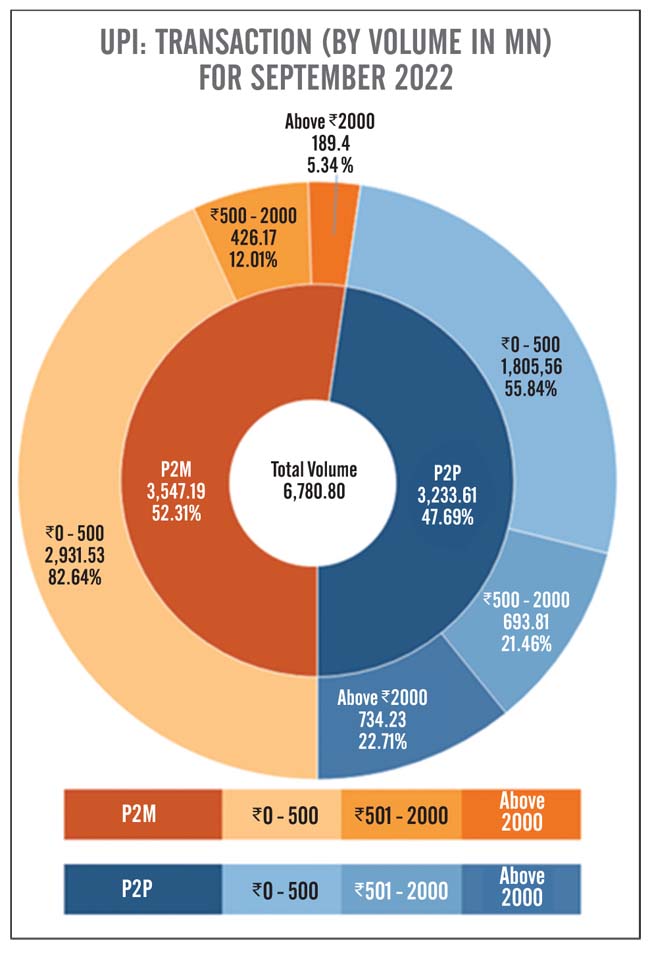

Last month, the UPI was used for over 6.7 billion transactions in the world’s second-largest internet market. Fifty two per cent of these transactions were P2M payments done by a person to a merchant. Eighty two per cent of P2M payments were under Rs 500. Thus, UPI is a payment tool for ordinary Indians for their regular payments.

A BCG report predicts that the e-payments market in India will increase by three times and be worth up to $10 trillion in the next five years and nearly 65 per cent of all payments will be e-payments.

Importantly, Bharat’s UPI is the number one digital payment interface with a Compound Annual Growth Rate (CAGR) of 160 per cent. As of July 2022, 338 banks integrated UPI with their digital platform. Due to this unprecedented growth and global expansion, UPI is leading the global payment domain. It has eased up the payment process and facilitated the evolution of other businesses.

Startup-20 under India’s G-20 presidency

Bharat proposed a new group at the G-20 level for startups. Bharat called for G-20 countries to adopt open source and inter-operable platforms like UPI and Aadhaar to promote inclusive digitisation across the world. Of the 21 billion-dollar startups in the fintech space, nine are payments unicorns, and all have integrated UPI solutions for a seamless checkout experience across platforms. Among these are companies like Razorpay, CRED, PhonePe, Pine Labs and Paytm. However, PhonePe led the UPI space with a 47.7% market share in July 2022 and processed transactions worth Rs 5.24 lakh crore.

One problem with UPI is that it is inaccessible to foreigners travelling to India. During the G20 presidency, Bharat should launch UPI services for foreigners travelling in India.

Recently considering UPI’s success, Fortune magazine stated: “As Silicon Valley fantasizes about Web3.0, India leaps ahead on payments”. UPI is doing specifically what blockchain is invented to do by cutting out mediators, and by creating (for now, at least) a payment instrument free of transaction fees, it has attracted 260 million unique users and 50 million merchants in India alone.

UPI, one of the most successful digital public goods (DPG), is the best thing to happen to Bharat where the fruits of innovation have primarily eluded the masses. But it is not so this time. Even the most small-time merchants/vendors have adopted UPI and benefited. For both buyers and sellers, the outcome has guaranteed a smooth and inclusive payments ecosystem without the chaos and hassles of plastic money. The only glitch? Nobody is ready to pay for the newfound convenience.

Given the idea behind the public good policy, UPI services are currently free for customers and merchants. However, banks and payment service providers/third-party admins like PhonePe and Google Pay are struggling to cope with costs incurred in the zero-MDR (merchant discount rate) regime as merchants are no longer paying them the service charge.

Although the Government has been compensating the banks on an ad-hoc basis, all non-banking PSPs/fintech startups in this space rue the lack of a sustainable revenue model as they have no other income to cover their costs.

Effective January 2020, the MDR issue has been a thorn in the flesh for all TPA/PSP stakeholders. According to a Mint report, the industry is estimated to lose Rs 5,500 crores from UPI and RuPay MDR made zero.

As per sources, “Last year, the Government gave Rs 1,300 crores to banks for UPI txns. So each taxpayer paid Rs 600 approx for UPI to already profitable banks. TPAs like PhonePe, Google Pay and the like made nothing. While Paytm Bank gets some incentive from the Government on UPI, Paytm as a TPA can unlock Rs 800 crores annual revenues from UPI MDR. Guess what that can do to its stock price.” The newest Reserve Bank of India’s initiative to link UPI with credit cards will also have growth implications. To begin with, customers will have a wider choice of payments, and big-ticket purchases will rise now. Second, MDR will be back for all credit cards, including RuPay. The rate has been fixed at 2 per cent of the transaction size, barring small merchants with a turnover of up to Rs 20 lakh. Of this, 1.5 per cent will go to the card-issuing bank as an interchange, and the rest will be split as fees among RuPay (or other networks when they come in) and all acquiring entities.

In the last five years, the Digital India programme has driven rapid technology implementation in the country. Some of the top digital technologies supported programmes that have engaged huge space in the e-governance model include Aadhaar expansion, Direct Benefit Transfer, Common Services Centers, DigiLocker, mobile-based UMANG services, participatory governance through-MyGov and Jeevan-Pramaan. Not only UPI, but Bharat also has a boutique of offerings for social good.

Sanatana way: E-cooperation for social good

Our existence is under threat, the challenges like climate change killing people across borders, but we are so ignorant that we are busy negotiating petty benefits. By 2030, we need 50 per cent more food, 45 per cent more energy, 50 per cent reduction in CO2 emissions to survive (Labs, Feb 2018). However, with the current fragmented and narrow-minded approach, we are not ready to save our planet. The scale and pace of these global challenges like climate change is a matter of great concern. To speed up the implementation and delivery of a sustainable development goal to solve these existential threats, cross-border electronic cooperation can play an important role.

The WTO members should reduce all kinds of barriers to achieving the SDGs by at least 50 per cent by 2030. Existence should be given preference over economics. For countries and SDG below 50 score, there should be some consideration while WTO members negotiate e-commerce policy framework.

Given the idea behind the public good policy, UPI services are currently free for customers and merchants. However, banks and payment service providers/third-party admins like PhonePe and Google Pay are struggling to cope with costs incurred in the zero-MDR (merchant discount rate) regime as merchants are no longer paying them the service charge

E-cooperation should bring special provisions for natural calamities, emergencies and eradicating life-threatening diseases like COVID-19. Example. Gates Foundation is aggressively working to eliminate malaria from the planet. For such NGOs, initiatives should have special provisions in the e-commerce framework with no or minimum barriers.

Thus Bharat, the land of Sanātana Dharma, urges G20 members to broaden their horizon from cross-border electronic commerce to electronic cooperation.

Comments