The Southern state governments like Congress govt in Karnataka and LDF govt in Kerala, as another ploy of raising anti-Delhi sentiments, are distorting the mandate of the 15th Finance Commission only to whip up misplaced regional feelings for electoral gains

All that shatters is not ‘the centre’. Some southern Indian states do not seem to believe in this. Waging a seemingly subtle, yet concealed political attack on the ruling government at the Centre, the Kerala Government organised a meeting of the finance ministers of the Southern States on April 10 to protest against the terms of reference of the 15th Finance Commission. While the finance ministers of Tamil Nadu and Telangana did not attend the meet, their counterparts from Andhra Pradesh, Karnataka and Pondicherry participated and vehemently criticised the terms of reference of the Commission as against the law of the land. Though there was criticism about the recommendations of the Finance Commissions in the past, this is the first time ever when the terms of reference evoked such a sharp criticism from any State Government. The Government of Andhra Pradesh is now going to host a meeting of finance ministers of all the State Governments next month to mobilise opinion against the terms of reference of the 15th Finance Commission.

Mandate for the Commission

The Finance Commissions are constituted every five years under Article 280 of the Constitution. The President of India constituted the 15th Finance Commission (FC) in November 2017 for the period 2020—25 under the chairmanship of Sri NK Singh, former Revenue Secretary and member of the Planning Commission. The Commission was given the mandate of determining the quantum of devolution of revenues from the Union to the States (vertical devolution) and the principles of sharing the same among different states (horizontal devolution). The Commission was given some unique terms of reference in the background of the abolition of the Planning Commission and the rolling out of the Goods and Services Tax (GST) last year. As pointed by the Chairman of the FC, the GST has completely changed the taxation landscape and has led to the creation of the GST Council, a unique federal institution. The FC was asked to assess the impact of the new indirect tax regime. The Commission was also asked to study the impact of increased devolution to the states on Union finances. It has to examine also whether revenue deficit grants have to be provided at all. The Commission was mandated to use the 2011 census data for working out the relative shares of the different states in the central tax pool.

Misplaced Propaganda

The Southern States of Kerala, Andhra Pradesh and Karnataka are agitated over the usage of 2011 census data for determining their relative shares. They are worried about getting “penalised” for their better performance on the population front. The Karnataka Chief Minister raised his voice by saying “While I recognise the need for correcting regional imbalances, where is the reward for development? The states of the South have nearly reached replacement levels of population growth. Yet, the population is a prominent criterion for devolution of central taxes. For how long can we keep incentivising population growth?”.

However, population alone is not the sole criterion for determining the relative shares of the different States. The population is no doubt one of the factors used for the devolution. But it does not decide ‘who gets what’. The population was given significant weight in the devolution formulas by the first seven Commissions. The Eighth FC reduced the weight to 22.5 per cent. Since then the weight to population has hovered around 28 per cent. The Income Distance criterion (the difference between the per capita income of a state and that of highest per capita income state) is given higher weight than the population criterion in the devolution formulas. As a consequence, the poorer states with lowest per capita income are getting relatively higher shares in the divisible pool. There is nothing in the terms of reference to penalise better performing the Southern States. On the other hand, the better performing states are going to be benefitted because the FC was asked specifically to work out performance-based incentives to the states in the following areas (Point number 7 of the TOR):

- “Efforts made by the states in expansion and deepening of tax net under GST;

- Efforts and progress made in moving towards replacement rate of population growth ;

- Achievements in the implementation of flagship schemes of Government of India, disaster resilient infrastructure, sustainable development goals, and quality of expenditure;

- Progress made in increasing capital expenditure, eliminating losses of the power sector, and improving the quality of such expenditure in generating future income streams;

- Progress made in increasing tax/non-tax revenues, promoting savings by the adoption of Direct Benefit Transfers and Public Finance Management System, promoting digital economy and removing layers between the government and the beneficiaries;

- Progress made in promoting ease of doing business by affecting related policy and regulatory changes and promoting labour-intensive growth;

- Provision of grants in aid to local bodies for basic services, including quality human resources, and implementation of performance grant system in improving delivery of services;

- Control or lack of it in incurring expenditure on populist measures; and

- Progress made in sanitation, solid waste management and bringing in a behavioural change to end open defecation”.

Though the population is an important criterion, it is not the sole determinant of relative shares of different states. There is no relation between the percentage share of the population of a state and its percentage share in the devolved funds. Take the case of Maharashtra. It has larger population after UP as per both 1971census and 2011 census. The percentage share of U.P in the devolved resources is as high as 18 against its population share of 15.3 per cent. Maharashtra just received 5.5 per cent of funds against a population share of 9.2 per cent. The per capita income of UP is lower than the national average while that of Maharashtra is slightly higher than the national average. It is the difference in the per capita income levels that are leading to lower per capita income states ( Bihar, UP and Jharkhand) receiving relatively higher shares and higher per capita income states (Maharashtra, Haryana, Gujarat and Tamil Nadu) having disproportionately smaller shares in the devolved resources.

Constitutional Position

The Constitution is very clear on the charge of revenues collected. The first charge is devolution and not meeting centre’s expenditure, including its statutory commitments. Any attempt to reduce tax devolution amounts to a violation of the federal spirit of the Constitution. The Modi Government enhanced the level of devolution from 32 to 42 per cent based on the recommendations of the 14th FC. The present Commission is only asked to study the impact of this higher level of devolution on the Union finances. The terms of reference of 15th FC are very clear about financial devolution and they do not suggest in any way that its recommendations lead to lesser financial devolution to the states.

Adding fuel to the fire

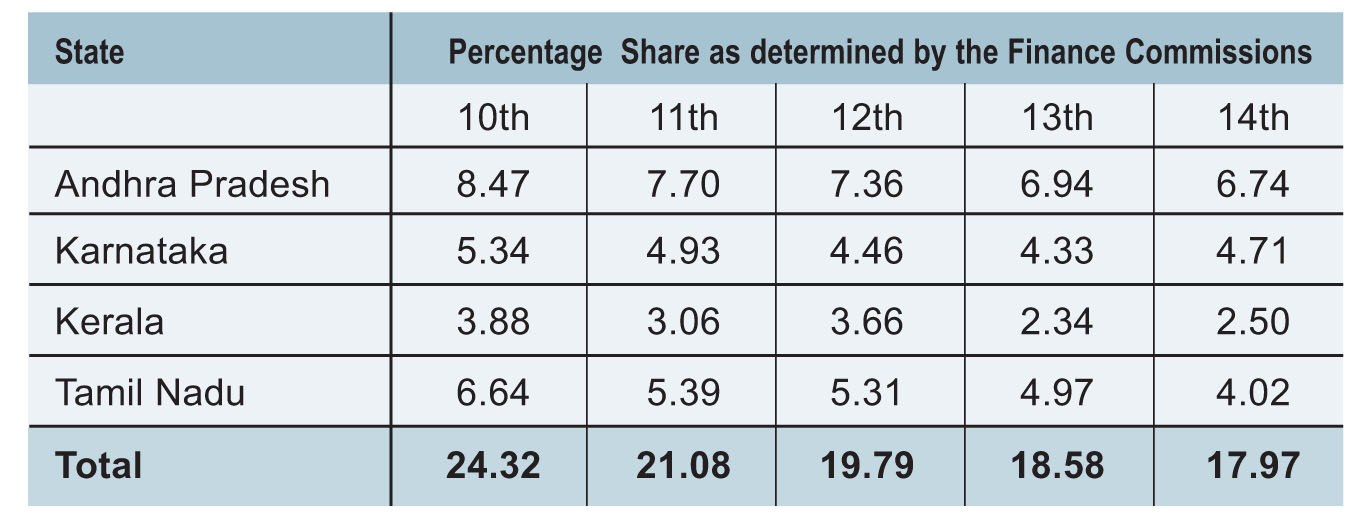

The former finance minister P Chidambaram had said the central government has “lit a fire” and it should be doused before the southern “flames scorch the federation”. This provocative statement is uncalled for from a former finance minister. He himself stated that the percentage share of southern states in central taxes has been declining from the 10th FC onwards.

There has been a steady decline in the relative share of all the four Southern states from about 24.32 per cent to 17.98 per cent during the last 25 years. But the states have never protested in the past. It is strange that even before the 15th FC made up its mind regarding the weight to be assigned to a different criterion, particularly to population and income distance, politicians like Siddaramaiah, Vijayan and Chandrababu are vociferous about the possible injustice to their states, because of the usage of 2011 census data.Though they know that population alone is not the sole criteria for horizontal devolution, they went to the extent of saying that the continuation in the Indian federation is untenable if 2011 census figures are adopted. They should think twice why even with 1971 census data, their relative shares declined.

Once the FC decides the relative share of different states, there will be transfers of funds from the Union to the States. These are untied transfers or general purpose transfers. These transfers enable the State Governments to provide comparable levels of public services at comparable rates. Population criteria serve as a proxy for a state’s needs. Using the latest census data is both logical and appropriate for assessing the needs of the states.

Adopting 1971 census data for devolution for the period 2020-25 may result in reverse discrimination against the heavily populated states. Pegging the Lok Sabha seats on the basis of 1971 census data until 2026 may be desirable to prevent the domination of Northern states in the Lok Sabha. The same logic cannot be extended to fiscal transfers.

Framing the issue of ‘Equal payment- Equal transfers’ in terms of North and South is not only misleading but also dangerous

In every country, the focus would be on the relatively poorer and backward regions. In order to develop them, there would be transfers of funds in favour of these regions. The poorer regions receive more than the developed regions though they contribute lesser amounts to the divisible pool of the resources. However, Siddaramaiah states that ‘for every one rupee of tax contributed by UP, the state receives Rs 1.79. For every one rupee of tax contributed by Karnataka the state receives Rs 0.47’. This is not the case of Karnataka alone. Maharashtra gets only Rs 0.15 as its share in the devolved resources per every rupee it contributes to the divisible pool. Bihar receives as high as Rs 4.2 for every rupee it contributes. Maharashtra is worst hit than the Southern States in terms of what it receives from the divisible pool in relation to its contribution.

The principle of equity dictates that poor and poorer states get more funds to overcome their historical disadvantages. The federal structure enables the poorer states to get a larger share of central taxes. The Southern and Western states contribute more to the central tax pool. Most of the corporate houses have their registered headquarters in the metropolitan capital cities of these states-Chennai, Hyderabad, Bangalore, Mumbai and Ahmedabad. Though they operate on an all-India basis and sell their products and services throughout India and also abroad, corporate taxes are paid in the states where headquarters are located. Thus, their tax contribution is not entirely based on their business operations within the state where their main office is located. Needless to say that a large part of the income generated by the corporate houses is because of the business operations outside the state.

Electoral Posturing

The western states like Maharashtra and Gujarat and northern states like Punjab and Haryana also contribute more than what they receive from the divisible pool. What Southern states are foregoing does not reach either Maharashtra or Gujarat in Western India or Punjab, Haryana or Delhi in Northern India.Framing the issue of ‘Equal payment- Equal transfers’ in terms of North and South is not only misleading but also dangerous. The real issue is how to balance the interests of those that contribute more and receive less and those that receive more and contribute less. Devolution of funds in India seems to be very progressive. But in per capita terms, both Bihar and UP received lesser transfers compared to AP, Karnataka and Kerala in 2016-17. Bihar and UP together account for a quarter of Indian population.

Tax devolution is a constitutional entitlement of every state and any attempt to reduce devolution amount violates the federal spirit of the Constitution. The states have every right to demand a just and equitable share. Using 2011 census does not necessarily reduce the relative shares of the Southern States since population alone is not the sole criterion for devolving funds to the states. There are other factors that play a balancing act and much depends upon the weight that is assigned to different criteria.

(The writer is former Professor of Economics, The Hindu College, Machilipatnam, Andhra Pradesh)

Comments