Although various initiatives have been taken by the government and it appears committed towards pushing the growth and reviving the investment cycle, but still a lot needs to be done for mobilisation of investments. Robust infrastructure is the base for economic development and it is the key for production of goods and services. Better infrastructure facilities are the prerequisite for investment mobilisation. While the term infrastructure is very wide, we have restricted this discussion to transportation and power only. As per the report of World Economic Forum released in September 2014, India ranked 71st in annual global competitiveness and slipped by 11 places as compared to previous year.We ranked 85th out of 148 countries for our infrastructure in the same report. Last years of UPA government saw unprecedented policy paralysis and all the development projects were at halt resulting into delays in commencement of projects and poor performance of the sector.

NDA Government has taken corrective measures and many hurdles related to environmental clearances have been eased. As per the data released by Centre for Monitoring Indian Economy Pvt. Ltd. industrial projects worth Rs 3 lakh crore were stalled as on March 31 2014 while infrastructure projects worth Rs.5 lakh crore were stalled as on 30 September 2014 which indicates that the government’s initiatives are giving positive results. Government has issued various sector specific guidelines to bring clarity on various norms. Investment in this sector was estimated for approximately Rs 65 lakh Crores in the 12th five year plan (10 per cent of the GDP). Although the planning commission has been replaced by Niti Aayog, the planned outlay remains more or less similar and 50 per cent of the funding was to come from budgetarysupport (central and state governments) and remaining from equity & debt.

Our banks are already stressed and large amount of capital is locked in ongoing projects which are delayed resulting into extension of the pay-back period.Private players are very cautious while going through Public Private Partnership (PPP) model as many of them have burnt their fingers. Historical data suggests that the FDI inflow was only in those sectors where the investors can get quick return. Considering the cumulative impact of these situations the government may find it difficult to convert the plans into reality due to dearth of funds.

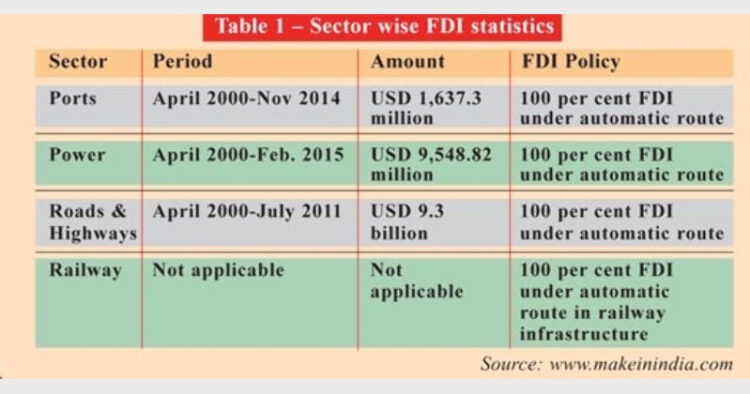

Table below shows the status of FDI received under core infrastructure sectors and FDI policy.

Steps need to be takenThe government has projected that 50 per cent of the fund requirement shall be met by way of equity & debt investments. A mere change in regulation will not make infrastructure sector attractive for FDI but continuous efforts have to be made to remove the bottlenecks and address the concerns of the investors so that they will infuse equity. In the meantime some immediate steps may be taken by the government to meet the

|

Shshank Saurav (The writer is a Chartered Accountant)

(July 19, 2015 Page : 44)

Comments