In a legislative step touted as the most sweeping revision of India’s direct tax system in more than six decades, the Lok Sabha on August 11 passed the Income-Tax (No. 2) Bill, 2025, without debate, even as Opposition protests rocked the House. The bill, replacing the Income Tax Act, 1961, infuses into law a far-reaching bunch of structural changes, including a legislated tax-free threshold of Rs 12 lakh for individual taxpayers under the new regime, and includes almost all of the 285 suggestions made by a parliamentary Select Committee.

The release comes after the Finance Ministry last week withdrew the initial Income-Tax Bill, 2025, tabled in February during the Budget session amid concerns raised by stakeholders and lawmakers of errors in drafting, conflicting clauses, and cross-referencing discrepancies. The new draft was introduced by Finance Minister Nirmala Sitharaman on August 11, 2025, as a “clean, consolidated and modern tax code” that captures not just expert comments but also the “trust first, scrutinise later” approach of the government.

Tabling the bill, Finance Minister Nirmala Sitharaman said it embodies the government’s “trust first, scrutinise later” philosophy. She also read Verse 542 from the Thirukkural of Tamil poet and philosopher Thiruvalluvar: “Just as living beings live expecting rains, citizens live expecting good governance.”

“Nearly all the Select Committee’s suggestions have been accepted,” Sitharaman informed the House, adding that further changes proposed by taxpayers and industry associations had been made to reflect “the right legislative intent.”

The bill was cleared by voice vote, along with the Taxation Laws (Amendment) Bill, providing tax exemptions to subscribers of the Unified Pension Scheme.

From Budget Proposal to Statutory Reform

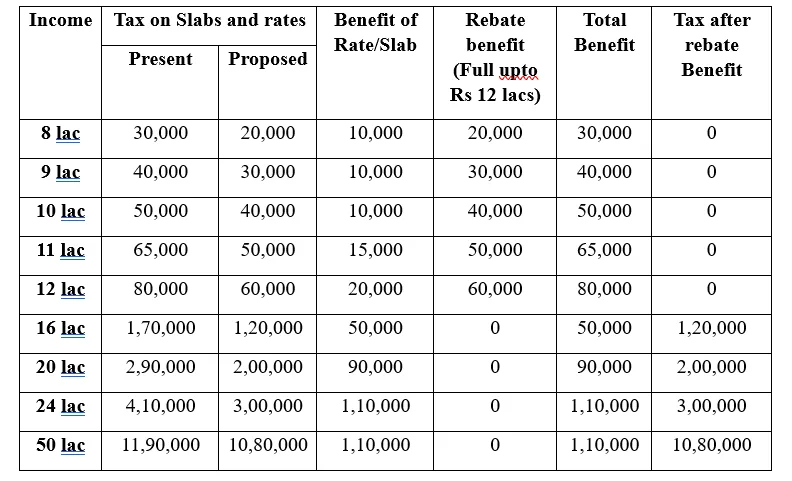

The Rs 12 lakh tax-exempt threshold, or Rs. 12.75 lakh for salaried individuals considering the Rs.75,000 standard deduction, was originally announced by Sitharaman in her Feb. 1 Union Budget address. Then it was proposed as a rate-and-rebate-based relief under the current Income Tax Act, 1961, to improve the middle class’s disposable income. The relief was provided by way of new slabs and increased rebates, with no tax incidence for those with incomes up to the limit.

In February, these reforms were in force under the provisions of the existing law and would have needed to be renewed each year through annual Finance Bills. The August bill, however, establishes them as a permanent part of the new code of law, providing more certainty for taxpayers.

Why the First Draft Was Withdrawn

The initial bill, introduced on February 13 and sent to the Select Committee, was touted as a landmark reform, the first total overhaul of the direct tax code in over 60 years. But once before lawmakers, tax specialists, and business organisations for review, more than 200 drafting problems were uncovered, from ambiguous definitions to contradictory cross-references.

The Select Committee, led by BJP MP Baijayant Panda, presented a 4,500-page report that suggested 285 detailed amendments to enhance clarity, minimise ambiguity, and harmonise provisions with prevailing legal and administrative frameworks. These comprised technical adjustments along with substantive updates in favour of taxpayers.

Sitharaman informed Parliament that the decision to withdraw and re-introduce the bill was made to prevent “confusion and misinterpretation,” so that the law as enacted would be clear, consistent, and future-proof.

Key Recommendations Brought in

Some of the most impactful changes incorporated from the Select Committee’s report are:

1) Tax refund flexibility: Refunds will still be available for late filers, ending a long-standing taxpayer complaint.

2) Dividend relief: Inter-corporate dividend deduction of Rs 80 million will be brought back.

3) NIL-TDS option: Advance NIL-TDS certificates can be procured by taxpayers who have no liability.

4) Vacant house tax relief: The offending clause charging notional rent on vacant houses has been deleted.

5) House property deduction clarity: The 30 percent general deduction will be arrived at after excluding municipal taxes; interest on rented houses will be allowed as deductions.

6) Simplified compliance norms: TDS on provident fund withdrawal, advance ruling charges, and penalty have been clarified.

7) MSME definition harmonisation: To align with the MSME Act for tax benefits.

8) Language and drafting enhancements: Outdated words eliminated, section numbering reduced, and contemporary language used.

9) Property classification clarification: Replaced the word “occupied” to prevent misclassification.

10) Expanded pension benefits: Commuted pension deductions now extend to non-employee individuals getting pensions from funds.

Structural Reforms in the New Act

Income-Tax (No. 2) Bill, 2025, is not just a rate change; it’s a total overhaul of India’s direct tax law. Main points:

1. Single “Tax Year” concept: Replaces the previous “Previous Year” and “Assessment Year” terminology, easing compliance for individuals and companies.

2. Less litigation: Redundant and conflicting provisions have been eliminated; a “trust first” philosophy to scrutiny.

3. Contemporary administration: Increased powers for the Central Board of Direct Taxes (CBDT) to make rules appropriate to the digital economy.

4. Rationalised structure: 536 sections and 16 schedules in a sequential, easy-to-follow order.

5. Digital compliance readiness: Features made for e-filing, e-assessment, and electronic maintenance of records.

These structural changes, along with the new tax slabs, are intended to establish a taxpayer-friendly ambience to facilitate compliance and protect revenue.

Political and Economic Implications

Though the bill went through the Lok Sabha unanimously, the way it was passed, without discussion, was severely criticised by the Opposition, which was holding demonstrations over issues unrelated to the bill. The argument was that the comprehensive nature of the bill warranted a full-fledged discussion.

Economists view the step as a part of a larger plan to spur investment and consumption by keeping more disposable income with the middle class. The Finance Ministry estimates that the combination of reduced rates, simplified provisions, and procedural clarity will enhance voluntary compliance and widen the tax base in the longer term.

A Long Road from 1961

Income Tax Act, 1961, passed in the initial years of economic planning of India, has expanded into a large and voluminous act within six decades, accompanied by layers of amendments, exceptions, and judicial interpretation. To most taxpayers, it had become a labyrinth of cross-references and technicalities.

Demands for a total overhaul had been mounting since the early 2000s, as several committees and task forces called for a simpler, purer code. The Lok Sabha approval of the 2025 bill is the culmination of that process.

Now, it’s the Upper House’s turn

The bill will be sent to the Rajya Sabha for consideration. With the government enjoying a majority in the upper house and having already included extensive parliamentary feedback, it is likely to be passed without much opposition. When enacted, the new law will take effect starting April 1, 2026, allowing taxpayers and the government time to adapt to the changes.

The Finance Ministry will initiate a countrywide awareness and training program for tax practitioners, enterprises, and individual taxpayers in the pre-implementation period. A new set of user-friendly guides and online calculators will also be developed to guide citizens about their obligations under the new regime.

The Spirit of “Nyaya” in the new bill

Sitharaman said the new bill on income tax will continue the spirit of ‘Nyaya’. The new regime will be easy to understand for taxpayers and tax administration, which will result in tax certainty and less litigation, she said.

Codification into a brand-new Income-Tax Act of the Rs.12 lakh tax-free threshold marks continuity and discontinuity: continuity of the government’s declared intent to bring relief to middle-class India, and discontinuity in the shape of a new, streamlined statute in place of an old law dating back to the 1960s.

Reforms are a means to achieve good governance for the people and economy: Finance Minister

As Sitharaman explained to the Lok Sabha, quoting the Thirukkural “Just as living beings live expecting rains, citizens live expecting good governance” Reforms are a means to achieve good governance for the people and economy. The government is wagering that a simpler, more equitable tax law will do both.

For taxpayers, the good news in a nutshell is that the relief promised in February’s budget is here to stay and it is now supported by the weight of an overhauled law which assures simplicity, fairness, and less litigation. For the economy, the expectation is that this reform would spur more consumption and investment and also simplify compliance in a world where everything is digital.

Comments