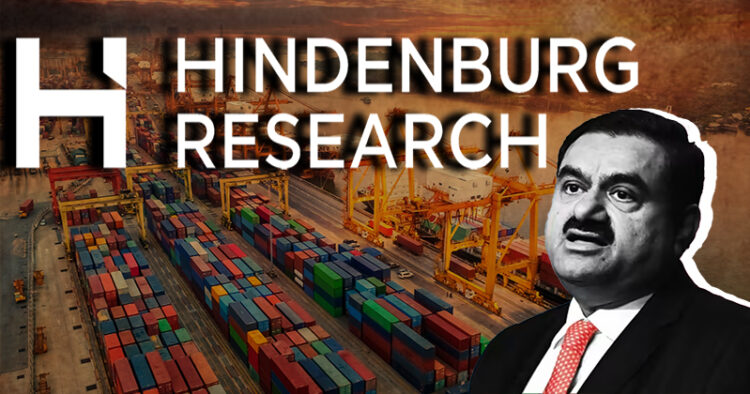

Founder of the Adani Group, Gautam Adnai lashed at the Hindenberg Report which had come out earlier this year in January, in which it maliciously tried to target the Adani group ahead of the FPO which the group was about to launch. While addressing the Adani Enterprises Annual General Meeting (AGM), Gautam Adani lambasted and dubbed the Hindenburg Research’s report as US-best short seller. Adani also mentioned that most of the allegations which were mentioned in the report were during the period of 2004-2015.

#WATCH | "…The report was a combination of targeted misinformation and discredited allegations. The majority of them dating from 2004 to 2015. They were all settled by authorities at that time. This report was a deliberate and malicious attempt aimed at damaging our… pic.twitter.com/yEH5r3Duff

— ANI (@ANI) July 18, 2023

Adani Returns Investors Money Despite a Fully Subscribed FPO

Gautam Adani, in his address said that the interests of the investors was paramount. Therefore , despite a fully subscribed FPO, they decided to keep the interest of the investor paramount and therefore returned their money. Adani Enterprises had filed a red herring prospectus with the markets regulator Securities and Exchange Board of India (SEBI) for the Rs 20,000 crore follow-on public offer (FPO), the largest ever in India.

Supreme Court’s Expert Committee Fails To Find Any Regulatory Failure in Adani Group

Post the fiasco created by the Hindenburg Research report against the Adani Group, the apex court that is the Supreme Court of India constituted a committee comprising a team of experts on March 2. The committee was headed by former apex court judge Justice AM Sapre. At the AGM, Adani said that the committee did not find any regulatory failure and in its report, the Supreme Court Committee mentioned, “that the mitigating measures undertaken by your company helped rebuild confidence.” It also mentioned that there were credible charges of targeted destabilisation of the Indian markets.

Gautam Adani reiterated his commitment towards protecting the interests of the people and added, “While SEBI is still to submit its report, we remain confident of our governance and disclosure standards. It is my commitment that we will continue to strive to keep improving these, every single day.”

No Credit Agency Cut Down the Ratings

Despite all possible attempts that were made to tarnish the image of the Adani group, none of the credit ratings whether in India or abroad downgraded the ratings of the Adani group. This clearly exposes the malafide intention with which the report was made.There were record-breaking international investments amid unscathed credit ratings

Adani Group’s Share Prices Increase

The share prices of the Adani group rose today, while Gautam adani was addressing the AGM. Its flagship company Adani enterprises share rose by almost 4 percent.

Gautam Adani Extolls India’s Growth Prospects

Hailing India’s growth, Gautam Adani said, “While economic cycles are getting increasingly hard to forecast, there is little doubt that, India – already the world’s 5th largest economy – will become the world’s 3rd largest economy well before 2030 and, thereafter, the world’s second largest economy by 2050.

“Following our independence, it took us 58 years to get to our first trillion dollars of GDP, 12 years to get to the next trillion and just 5 years for the third trillion. I anticipate that within the next decade, India will start adding a trillion dollars to its GDP every 18 months. This puts us on track to be a 25 to 30 trillion-dollar economy by 2050 and will drive India’s stock market capitalization to over 40 trillion dollars – approximately a10X expansion from current levels,” he said.

Comments